(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise®)

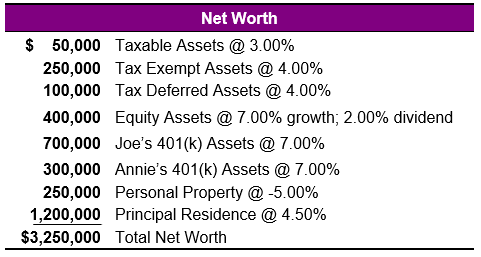

Joe and Annie Jordan, both age 60, learned in Blog #197 that their current 401(k) values of $1,000,000 could produce after-tax, retirement cash flow of $80,192 from age 70 to 95 – including a yearly 2.00% COLA (cost of living adjustment).

It’s not nearly enough because they want annual, spendable cash flow during retirement of $15,000 a month ($180,000 annualized) with a 2.00% COLA.

They expect to collect Social Security retirement benefits, so they want that integrated into the analysis.

The next step involves gathering information regarding the individual components of their current net worth and measuring if their liquid assets can support their desired retirement cash flow goal.

Case Study

Below is a summary of their current net worth.

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

Strategy 1: Using their current liquid assets, we were able to meet their retirement cash flow goal while retaining a significant level of net worth in the process. Below are graphics of the cash flow and net worth at age 95:

| Image 1 |

| Strategy 1: Use Liquid Assets |

| Annual Cash Flow Including a 2.00% COLA |

| Results by Age 95 |

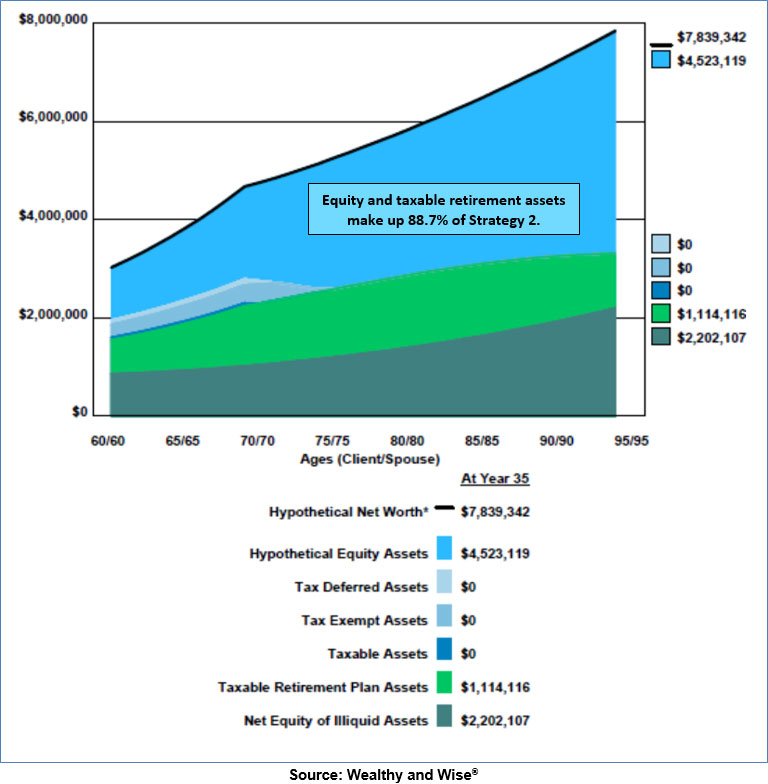

Long-range net worth looks positive, considering Joe and Annie’s cash flow requirements. That is until you examine the components of their long-range net worth.

| Image 2 |

| Strategy 1: Use Liquid Assets |

| Details of Net Worth at Age 95 |

95.97% of their long-range net worth in illiquid assets? That is way too much illiquidity, as there are not sufficient liquid funds for even one more year of retirement cash flow – which, due to the COLA, has increased from $180,000 to $352,922. Click here to see the effect of the COLA on cash flow in Column (1) and the value of that cash flow in today’s dollars in Column (3), assuming 2.00% hypothetical inflation in all years.

Solutions to improve liquidity? There are several; here are three likely candidates:

- Reverse mortgage;1

- Roth conversion;

- Indexed universal life (IUL).

| 1 | Click here for comments regarding illustrating a reverse mortgage in InsMark’s Wealthy and Wise®, our wealth planning system. You should accompany any illustration of a reverse mortgage included in a client-based analysis with specific details of the actual reverse mortgage data from an authorized source. Joe and Annie are both age 60, which means they will have to use a non-FHA mortgage to activate a reverse mortgage before age 62 1/2. They could wait two years to obtain a traditional, home equity conversion mortgage (HECM), but they may want to take advantage of the option now as the earlier the transaction is done, the better. |

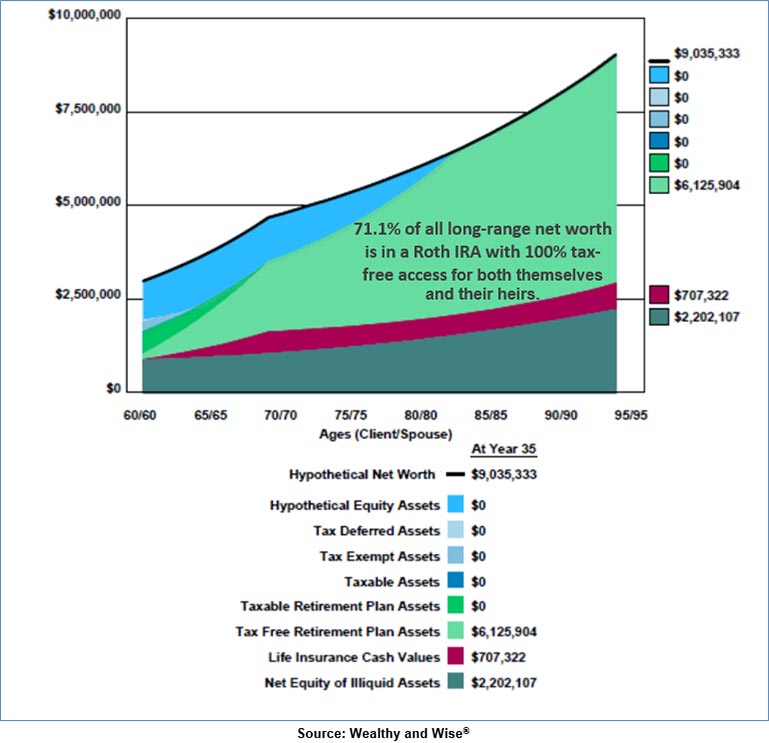

Strategy 2: Let’s look first at a reverse mortgage. After studying some age-sensitive alternatives, we selected Joe and Annie’s current age 60 to secure $600,000 in loaned funds for investment in their equity account.

| Image 3 |

| Strategy 1: Use Liquid Assets |

| vs. |

| Strategy 2: Add Reverse Mortgage |

Reinvesting proceeds from the reverse mortgage into the equity account increases long-range net worth by almost $2,000,000, most of it in liquid assets.

| Image 4 |

| Strategy 2: Add Reverse Mortgage |

| Details of Revised Net Worth in Image 3 |

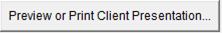

Strategy 3: Add a Roth IRA conversion and Indexed IUL – each one adds about $600,000 to long-range net worth. Liquid assets are directed to pay for both the income tax on the Roth conversion and the premiums for IUL.

| Image 5 |

| Strategy 1: Use Liquid Assets |

| vs. |

| Strategy 2: Add Reverse Mortgage |

| vs. |

| Strategy 3: Add Roth Conversion and Indexed UL |

There is another factor that may outweigh even those good results. Check out the graphic below to see the further significance of Strategy 3.

| Image 6 |

| Strategy 3: Add Reverse Mortgage + Roth IRA + Indexed UL |

| Details of Revised Net Worth at Age 95 |

Click here to view the 32 pages of reports for Joe and Annie featuring the details of Strategy 3. Wealthy and Wise licensees who want to view the reports for Strategies 1 and 2 should download the digital Workbook file below.

The Wealthy and Wise reports were created using the following prompt available at the bottom right of the Main Workbook Window of Wealthy and Wise:

Conclusion

Having the majority of liquid assets in a Roth IRA can result in extraordinary planning flexibility, both for Joe and Annie and their heirs.

I don’t think this comparison can be duplicated anywhere other than Wealthy and Wise, InsMark’s cash flow, net worth, and wealth planning system. Not only does it produce exceptional results, but it also exemplifies the remarkable function of InsMark’s unique Good Logic vs. Bad Logic®2 algorithm where prioritization of access to assets maximizes cash flow, net worth, and wealth to heirs. Click here to view a screen show on this subject.

| 2 | The same money, just accessed differently. There will be much more on this technique at the InsMark Symposium on February 28-29, 2020. |

Licensing InsMark Systems

To license the Wealthy and Wise, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or visit us online. Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

The InsMark Illustration System produced the IUL illustration.

InsMark’s Digital Workbook Files

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward it to your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #198, click here for a user guide to its content.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale.” In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner, and the Wealthy and Wise software has helped me supplement my LEAP skills and increase my commissions. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer®, New York, NY

“Wealthy and Wise allows us to reflect practically ANY planning scenario we have encountered with clients. The ability to flow data easily into the program (without being so granular as to be unwieldy) is, in my opinion, one of the core strengths of Wealthy and Wise. Modeling alternate planning scenarios and being able to present the results in both graphical and numerical formats is certainly welcome, and I can’t imagine doing cash flow and estate growth projections without Wealthy and Wise.”

Mark A. Trewitt, CLU, ChFC, CAP, CFP, AEP, InsMark Platinum Power Producer®, Plano, TX

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“InsMark”, “Wealthy and Wise” and “Good Logic vs. Bad Logic”

are registered trademarks of InsMark, Inc.

Copyright © 2019 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical life insurance illustrations and alternative investments referred to in this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations of life insurance are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.