(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System and Wealthy and Wise®.)

|

Editor’s Note: Blog #112 involves a comprehensive financial plan in which a Private Retirement Plan funded with Indexed Universal Life is included as an alternative planning strategy in a do-it vs. don’t-do-it comparative analysis. Due to the new regulations for Indexed Universal Life, the policy reflects a reduced illustration rate of 6.85%. |

The Private Retirement Plan in this analysis involves a cash-rich life insurance policy used to accumulate funds prior to retirement from which secured participating loans are taken during retirement years. “Private” in this sense is used to make the distinction between this plan and a tax qualified plan such as an IRA, or 401(k), or profit sharing plan. There are no restrictions on the amount of funds paid into a Private Retirement Plan, and no approval or permission from the IRS is required for any aspect of it.

The following three features of the life insurance used in such plans are what make the results so unique:

- Cash values accrue without income tax;

- Cash values can be accessed without income tax using withdrawals to basis and/or loans;

- Death benefits are paid to beneficiaries without income tax. (This applies to the full death benefit, including any cash value component whether loans exist or not.)

Case Study

The purpose of this Case Study is to compare retirement planning for Tony and Jennifer Callahan with and without the use of a Private Retirement Plan, then substitute and compare term insurance as an alternative, and then introduce an innovation that increases spendable retirement cash flow considerably.

Tony and Jennifer are ages 45 and 40. He is a physician, and she is a CPA. Between them, their after tax income is $300,000.

The Callahans’ present plan is to duplicate their current after tax income of $300,000 beginning at retirement ages 65/60 and index it by 3.00% a year for an inflation offset. This will be reevaluated yearly and adjusted accordingly as their after tax income changes.

Their current net worth is a little over $2,000,000. Below are the details:

Click here for comments regarding yields and Monte Carlo simulations.

Strategy 1

Current Retirement Plan

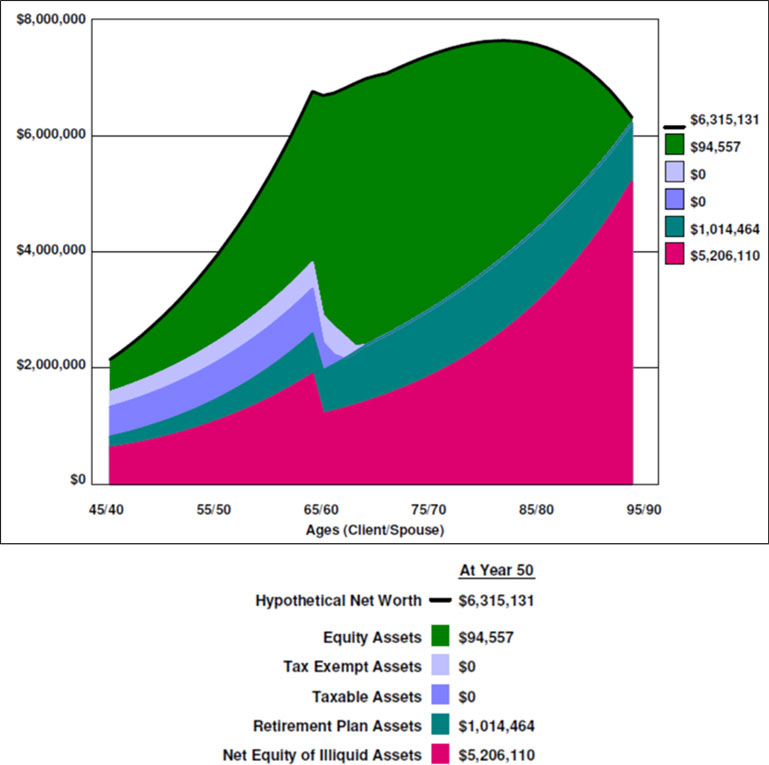

Based on the above assumptions, below is a Wealthy and Wise? graphic of Strategy 1, Tony and Jennifer’s illustrated net worth over the next 50 years. It includes the withdrawal of spendable, retirement cash flow of $300,000 a year starting at their ages 65/60 and increasing by 3.00% a year thereafter.

| Wealthy and Wise |

| Strategy 1 Net Worth |

| (After Providing Desired Cash Flow) |

That looks good, but let’s see if we can improve it.

Strategy 2

Add Indexed Universal Life

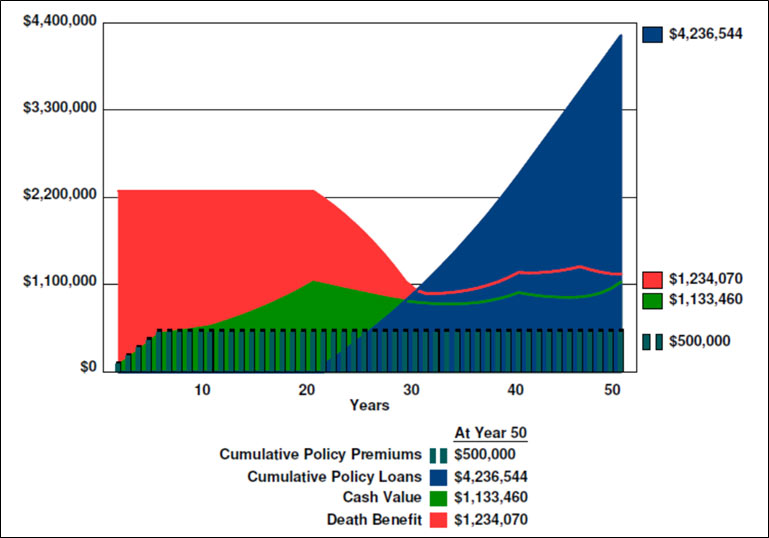

We’ll integrate a Private Retirement Plan into their analysis by funding it with a max-funded Indexed Universal Life (IUL) policy with $2,276,000 of level death benefit bearing five scheduled $100,000 premiums. Due to the new regulations affecting IUL, the policy is illustrated at 6.85%, and we’ll call this Strategy 2.

Below is a graphic of the policy’s illustrated performance:

| InsMark Illustration System |

| Illustration of Values |

Click here to review the IUL illustration associated with Strategy 2.

Normally, if you present the Callahans with an illustration like this, their reaction would likely be “Are you crazy? A $100,000 premium is a third of our current after tax income.” But here comes the magic of Wealthy and Wise because we can direct the program to integrate the policy into their overall asset base.

- The premiums will be paid by withdrawals from their current net worth;

- The policy values will add to their net worth;

- The policy loans will provide a large portion of their annual $300,000+ spendable retirement cash flow.

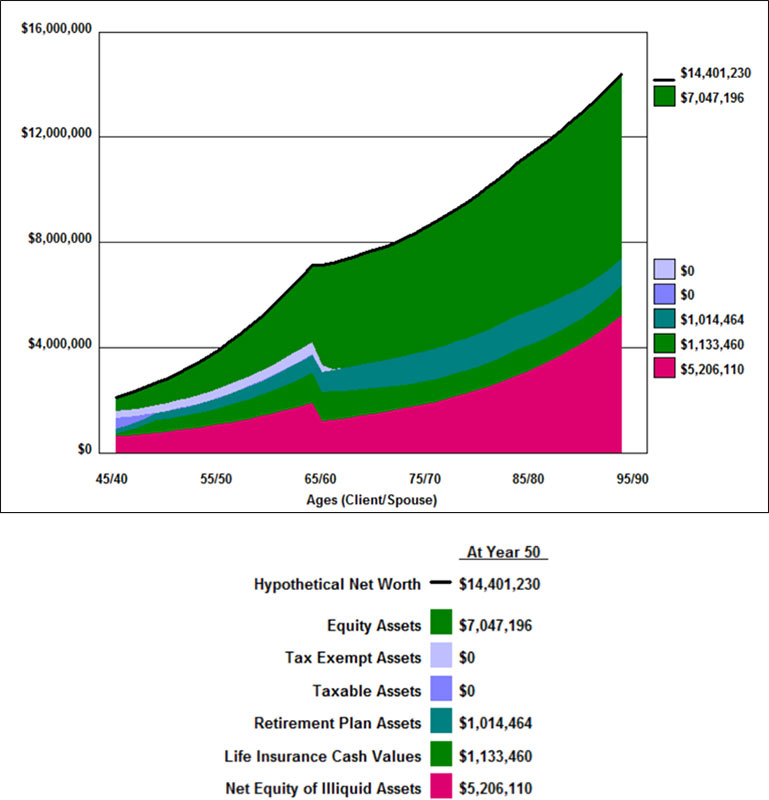

Below is the revision to Tony and Jennifer’s illustrated net worth over the next 50 years including the impact of the IUL.

| Wealthy and Wise |

| Net Worth Strategy 2 |

| (After Providing Desired Cash Flow) |

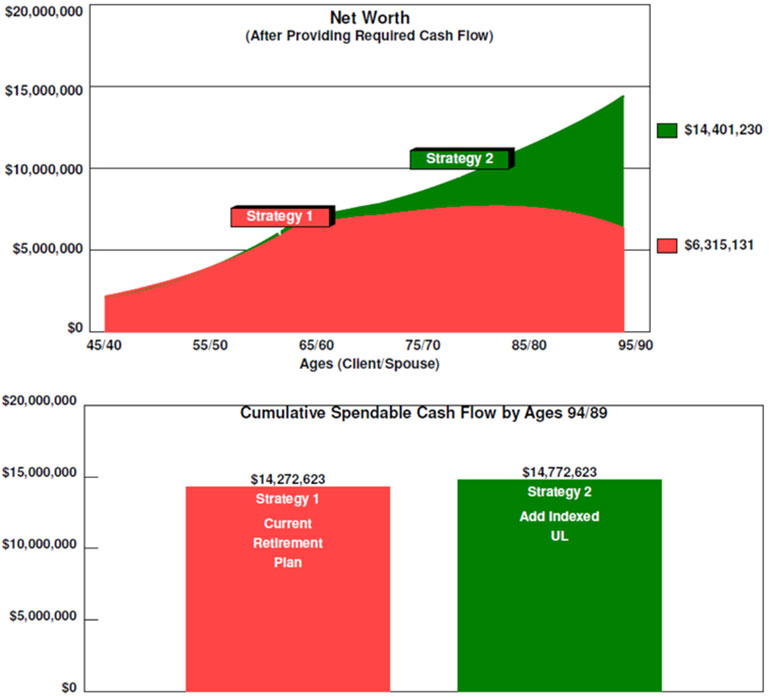

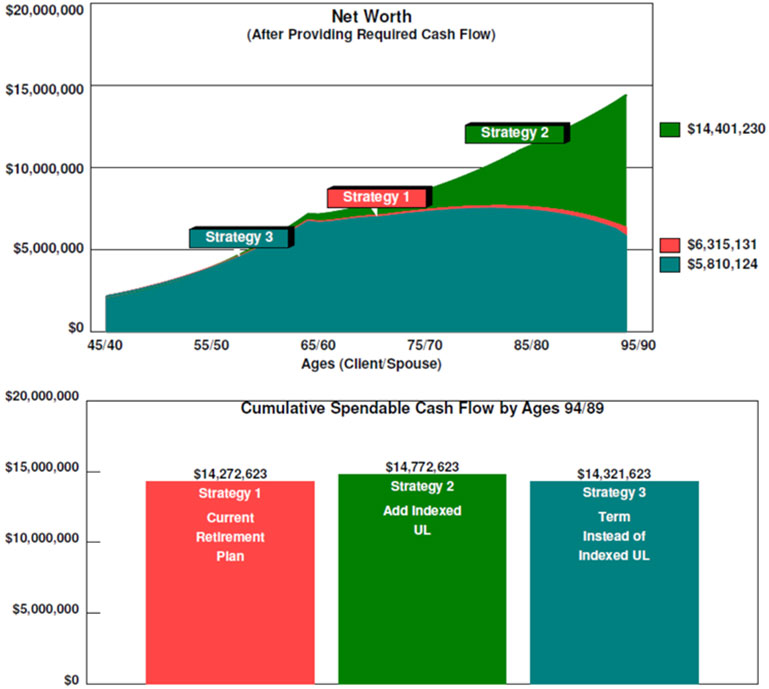

Below is a Wealthy and Wise graphic comparing the two strategies.

| Wealthy and Wise |

| Strategy 1 vs. Strategy 2 |

|

Strategy 2 shows a long-range increase in net worth in excess of $8,000,000. The additional net worth is caused in large part by the substantial policy loans from the IUL which significantly reduces the amount of principal needed from other assets. Be sure you understand that the only difference between Strategy 1 and Strategy 2 is the inclusion of IUL in Strategy 2. In all other respects, they both use the same data. |

|

In the lower half of the graphic, you can see that both strategies produce $14,000,000+ in spendable retirement cash flow. $9,000,000 of that is $300,000 a year times 30 retirement years (ages 65/60 through ages 95/90). The balance is the result of the 3.00% indexing. Strategy 2 shows $500,000 more cumulative spendable cash flow than Strategy 1 as the system is accounting for the five $100,000 IUL premiums added to desired cash flow. Remember -- this technique involves an asset transfer for the IUL premiums so Wealthy and Wise is accounting for the funds needed for those five premiums.

I rarely use words like “astonishing” in my Blog, but I will this time -- Strategy 2 has produced an astonishing result. Note that this result has the IUL illustrated at a lower interest rate (6.85%) as required by the new IUL regulations.

Click here to review a report summarizing the year-by-year cash flow and net worth numbers for Strategies 1 and 2.

Click here for all the reports associated with Strategy 1 and Strategy 2. I included all possible reports, 89 pages in total. Pages 1 through 6 are the key comparison summaries; the balance of the reports show how the significant increase in net worth is accomplished.

That is a large number of reports; however, with a Wealthy and Wise evaluation, I recommend that you have all the reports for a given case with you when you are visiting with a client or client’s attorney or CPA. Wealthy and Wise backs up every number shown, and you never know which report you’ll need to answer the inevitable question, “Where did this number come from?” That’s why I provided all of them to you in this Blog so you can familiarize yourself with them; however, you can accomplish the same thing if your presentation involves a computer as you can access the relevant reports via the Report menu.

Experienced Wealthy and Wise licensees usually select a few key illustrations for the main report and put the balance in an Appendix. Even more elaborate report organization can be accomplished (Table of Contents, Section pages, etc.) through use of this prompt at the bottom right of the Main Workbook Window. (I used it to prepare the reports for Strategy 1 vs. Strategy 2 available above.)

Strategy 3

Substitute Term Insurance

Somewhere, someone like Suze Orman will surely say, “Yeah, but you could do even better if the Callahans bought term insurance and invested the difference.” As the saying goes, “some people know the price of everything and the value of nothing.” Let’s dispel that term insurance myth right now as it relates to 21st century cash value life insurance.

Somewhere, someone like Suze Orman will surely say, “Yeah, but you could do even better if the Callahans bought term insurance and invested the difference.” As the saying goes, “some people know the price of everything and the value of nothing.” Let’s dispel that term insurance myth right now as it relates to 21st century cash value life insurance.

Below is a Wealthy and Wise graphic where we created Strategy 3 (Term Insurance Instead of Indexed UL) by replacing the $2,276,000 IUL on Tony with $2,276,000 of 20-year level term insurance. The 20-year term policy has a level annual premium of $2,450.

| Wealthy and Wise |

| Strategy 1 vs. Strategy 2 vs. Strategy 3 |

It’s not even close. Strategy 3 results in a $8.6 million long-range decrease in net worth compared to Strategy 2 due solely to the use of term insurance instead of IUL.

Click here to review just four of the reports from Strategy 3 that show the year-by-year differences that result when term insurance is substituted for the IUL. If you are licensed -- or become licensed -- for Version 12.0 (or higher) of Wealthy and Wise and want to review all the reports for Strategy 3, request the Wealthy and Wise Workbook file from us available below.

Click here to review a report summarizing the year-by-year cash flow and net worth numbers for Strategies 1, 2, and 3.

Strategy 4

More Cash Flow

The Callahans might well ask, “Since the IUL produces so much more net worth, can some of it be used to provide additional cash flow during retirement?” Wealthy and Wise has a calculator that can compute this automatically subject to the available liquid assets and/or liquidation of illiquid assets.

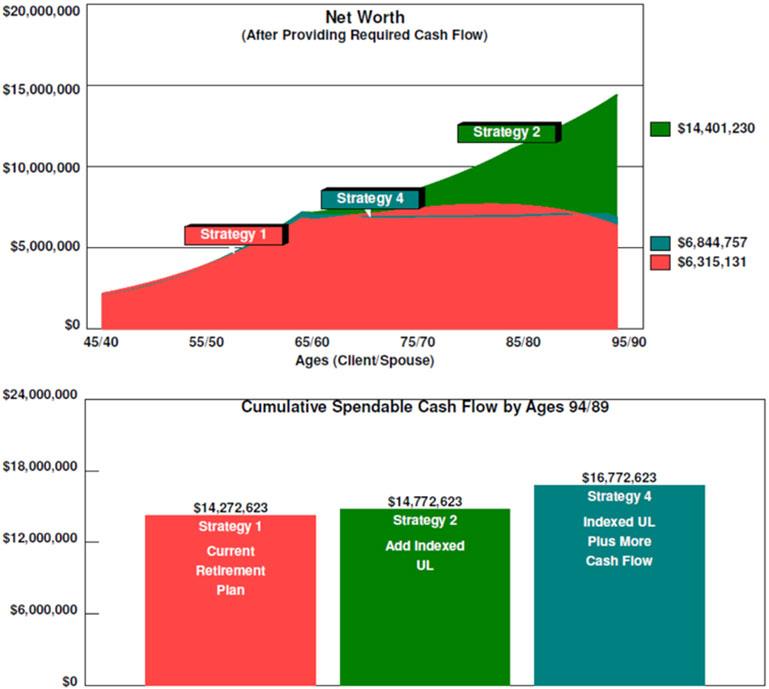

Below is a Wealthy and Wise graphic where we created Strategy 4 (Indexed UL Plus More Cash Flow) where additional spendable cash flow of $100,000 a year is scheduled from age 65/60 to 85/80. (This was an arbitrary selection on my part as the calculator can produce a variety of answers based on the selection of amount, indexing, duration, etc.)

| Wealthy and Wise |

| Strategy 1 vs. Strategy 2 vs. Strategy 4 |

With Strategy 4, total retirement cash flow is increased by $2 million by reducing long-range net worth to $6.8 million, slightly in excess of Strategy 1. Use for the funds could be additional cash flow, gifts to children or a trust on their behalf, premiums for disability income or long-term care policies, charitable gifts, etc.

Click here to review a report summarizing the year-by-year cash flow and net worth numbers for Strategies 1, 2, and 4.

Click here for a few questions and answers about this case that may be useful including how you can calculate additional cash flow using Wealthy and Wise.

Final Thought #1

I know that many of my readers are comfortable selling the retirement cash flow features of IUL using a stand-alone illustration that is not integrated with a client’s other assets. Clients typically consider the premiums to be an expense for such plans. Changing to a Wealthy and Wise analysis creates a new learning curve because your presentation changes to an asset transfer. Believe this: the wealthier a client, the easier it is to convince him or her of the power of integrating IUL into their portfolio of assets with this type of analysis. With allocations from current assets as the source of the IUL premiums as shown in this Blog, it becomes a case of “comparing assets and cash flow if you do it -- with what happens when you don’t.” That is a completely different presentation, and it can have compelling results for you.

The payoff? You will develop much higher average compensation per case and a client locked into your planning expertise, not just as an IUL policyholder. Tended carefully, you will likely have this client for life.

If you are an experienced user with Wealthy and Wise, putting a case together like this will be relatively straightforward. (See below to obtain the electronic Workbook I used to prepare the data for all the Strategies in this Blog.)

That’s the good news. The bad news for some is that you have to gather all of your client’s financial data for this type of analysis. Many of my readers are used to doing this. For those of you who are not so comfortable with it, how do you feel about asking a prospective client to reveal details of financial data? Clearly, you have to earn a prospective client’s trust to do that. My suggestion for the best way to gain that confidence is to share examples of how this concept works for others -- this Blog, for example, or the Wealthy and Wise reports associated with it.

Note: A Fact Finder is available in Wealthy and Wise to guide you in your data gathering (see Tools on the main menu bar). Many of our licensees tell me they think the Fact Finder is best filled out with the client(s) present and involved in the process.

At first glance the Fact Finder may look intimidating, but on most pages, you will be entering data in only a few of the listed categories. To acquaint yourself with it, try filling one out for your own situation.

If you are new to Wealthy and Wise, I suggest using one of our Referral Resources (see below) to help you with your first few cases. Their help can be invaluable.

Final Thought #2

The following paragraph appeared earlier in this Blog, and I want to draw your attention to a different aspect of it -- particularly the last sentence:

The Callahans’ present plan is to duplicate their current after tax income of $300,000 beginning at retirement ages 65/60 and index it by 3.00% a year for an inflation offset. This will be reevaluated yearly and adjusted accordingly as their after tax income changes.

As their income increases, Tony and Jennifer will likely want to increase the projected amount of spendable, retirement cash flow at retirement, and here is the point: They will need you to bring their plan up-to-date every year, and this means you not only have opportunities for additional planning strategies, you also have the opportunity to charge an annual monitoring fee for each review. This is easier to negotiate if you charge a fee for the initial study. Look what you can accomplish for clients like the Callahans who are likely to be stunned by the results of the analysis. Isn’t this worth a good-sized fee?

Blog #98 includes a monitoring fee in a Wealthy and Wise analysis. The fees? are coupled with a premium financing case, but the logic involved fits any planning case. Review Blog #98 for the ease in which monitoring fees can be included in an evaluation. Blog #97 is also a good resource if you are contemplating charging monitoring fees.

Note: Before charging monitoring fees, be sure to check state/federal broker dealer and insurance company compliance.

Licensing

To license Wealthy and Wise and/or the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials:

"I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner, and the Wealthy and Wise software has helped me supplement my LEAP skills and increase my commissions. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it."

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Power Producer

"As I’ve said to anyone that will listen, Wealthy and Wise is the best piece of software in the industry.”

Simon Singer, International Forum Member, InsMark Power Producer, Encino, CA

"If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.