There are lots of calculators available online. ?I have an app for the online version of the hp12c which gives me very quick answers on a variety of financial issues. ?Good as it is, what is missing are the year-by-year development of the numbers and user-friendly reports. ?This is a shortfall of almost all online calculators.

So we decided to build some calculators with those features . . .

In this Blog, I’ll demonstrate three of them, but first let me list them all for you:

InsMark Calculators

- Taxable Accounts

- Tax Exempt Accounts

- Hypothetical Portfolio

- Tax Deferred Accounts

- Equity Accounts

- IRA Calculators

- Roth IRA

- Comparison of IRAs

- Inherited IRA

- Inherited Roth IRA

- Comparison of Inherited IRAs

- Single Premium Immediate Annuity

- Social Security Benefits

- Defined Contribution Retirement Plans

- Mortgage Payments

- Life Expectancy

- Multiple Accounts

- Retirement Income Summary

- FIFO Withdrawal/Dividend/Loan

These calculators are all available on the InsCalc tab in the InsMark Illustration System. ?They are valuable as stand-alone calculators, although we designed them to feed data to our Retirement Needs Analysis and Survivor Needs Analysis modules in the InsMark Illustration System.

Taxable Accounts Calculator

Among other assets, Susan Ridgeway, age 45, has $100,000 in a taxable account she expects will earn 4.00%. ?She is in a 30% tax bracket and wonders how much cash flow can be expected starting at age 65 lasting through her life expectancy.

We first checked the Life Expectancy Calculator to determine Susan’s life expectancy to be age 83. We then used the Taxable Accounts Calculator to calculate easily that her current $100,000 could produce $11,590 a year in after tax cash flow starting at age 65 and continuing through age 83.

If Susan were a client of yours, she might like to have these calculations in a graphic and a ledger-style format so she (or her CPA) can audit the numbers rather than simply trusting the accuracy of the internal formulas.

Below is the graphic of the results from Susan’s taxable account:

Click here to review the year-by-year performance of Susan’s taxable account broken into two InsMark-style ledgers: pre-retirement and retirement. ?For presentations, it beats a one-and-done calculator, doesn’t it?

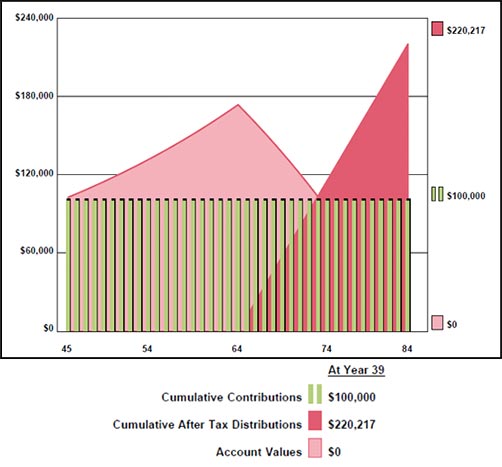

Equity Account Calculator

You may believe Susan should be in another investment rather than a taxable account, and an equity account could well be a reasonable alternative. ?We used hypothetical assumptions of 6.00% growth and 1.50% dividend to illustrate after tax cash flow of $28,468 starting at age 65 and continuing through age 83. ?This is a pretty complex calculation, but it is easily done with this calculator.

Below is the graphic of the results from Susan’s hypothetical equity account:

Click here to review the year-by-year performance of Susan’s hypothetical equity account.

Single Premium Immediate Annuity (“SPIA”) Calculator

Aaron and Connie Bigelow are ages 75 and 70. ?They are interested in acquiring a Joint and Survivor Single Premium Immediate Annuity (10-year period certain) with a lump sum payment of $600,000. ?The Bigelows are in a 28% income tax bracket. ?I use the following website for quotes for the SPIA: https://www.immediateannuities.com/, and it determined that the monthly income for the Bigelows would be $3,333 from a competitive carrier (annualized as $39,996 in the illustration).

Below is the graphic of the results from the Bigelow’s SPIA illustration:

-Single-Premium-Immediate-Annuity-Calculator-502x495.jpg)

Click here to review the year-by-year performance of the Bigelow’s illustration from our Single Premium Immediate Annuity Calculator.

Conclusion

Sometimes you just need a good calculator . . .?and when you do, we have several that can be a good partner for you.

Note: Our Wealthy and Wise® System includes the logic all of our calculators integrated within the solves. So does our Retirement Needs Analysis and Survivor Needs Analysis in the InsMark Illustration System.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or 925-543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

"InsMark helps us help our clients understand their money and their choices. I am always learning something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone ? just by pushing InsMark buttons on the computer. How great is that?!"

Kay Corbin, CLU, ChFC, InsMark Power Producer, Phoenix, AZ

“InsMark has created without question the best suite of software for our industry that has ever existed.”

Simon Singer, CFP?, CAP?, RFC?, InsMark Power Producer, The Advisor Consulting Group, Encino, CA