(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System)

|

Editor’s Note: This week, we released Jazz, Version 17.0 of the InsMark Illustration System, to all licensees. Click here if you would like to learn more about the new features of “Jazz” (plus some real jazz from InsMark’s CEO’s Dixieland band.) Chris Jacob, CFP, a long-time licensee from St. Louis had this to say about the new Jazz release: “I have been using InsMark since it was a C:> prompt back in the early 1980s. The new Jazz release is the most exciting upgrade to the system I’ve seen in 28 years! With unlimited options for customization, you can now be as creative as you want when producing illustrations. I downloaded it last night, and used it successfully with my first appointment this morning.” |

The real cost of life insurance is what you could do with the money if you didn’t buy the life insurance.

One of my Blog readers wrote in recently asking me which InsMark module I would recommend for a simple explanation of the economics of a cash value life insurance policy. ?He wanted to know how best to emphasize the value of the death benefit. I suggested Dollars of Benefits for Pennies of Cost located on the Personal Insurance tab in the InsMark Illustration System.

Based on the following prompt, there are two key ways to utilize this module:

Case Studies

The four examples that follow are for a male, age 40. ?They all illustrate the increasing death benefit option. ?(Level death benefit plans can also be effectively illustrated with this module.)

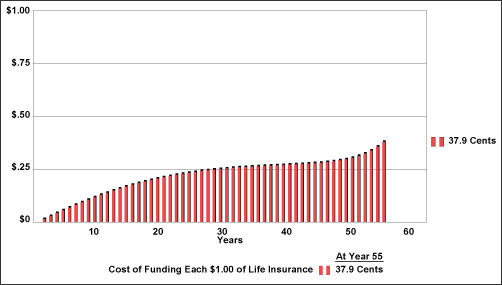

Case Study #1a (no foregone interest): ?Below is a graphic of the cost per dollar of a $500,000 Universal Life policy illustrated at 5.00% with level annual premiums of $7,200 illustrated keeping the policy in force until at least age 95. ?No foregone interest is included.

Click here to view the full illustration.

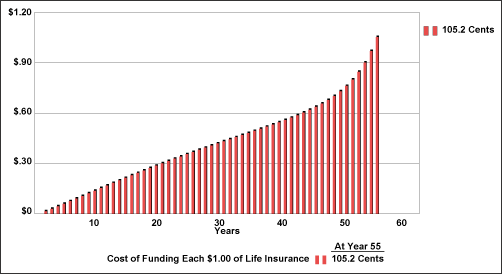

Case Study #1b (foregone interest of 5.00%): Below is a graphic of the cost per dollar for the same Universal Life data illustrated at 5.00% but with foregone interest assumed at 5.00%. (The $1.00 line is crossed only in the last year illustrated. ?In other words, there are 54 years of costs of less than $1.00 for each $1.00 of death benefit.)

Click here to view the full illustration.

Case Study #2a (no foregone interest): Below is a graphic of the cost per dollar of a $500,000 Indexed Universal Life policy illustrated at 7.50%. Premiums are illustrated at the maximum non-MEC of $20,853 a year until age 65, and tax free, participating, policy loans are illustrated thereafter. No foregone interest is included. ?What is revealed in the last portion of the graph is the astonishing power of participating policy loans. The results are startlingly in favor of the acquiring the policy.

Click here to view the full illustration.

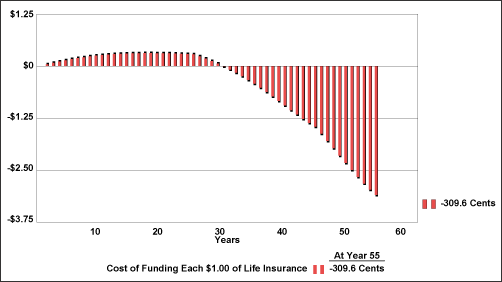

Case Study #2b (foregone interest of 7.50%): Below is a graphic of the cost per dollar for the same Indexed Universal Life data illustrated at 7.50% but with foregone interest assumed at 7.50%.

You would think the 7.50% use of money assumption would cause Case Study 2b to be inferior to 2a, but the opposite is true due the strength of participating policy loans. ?They are so significant that the use of money works in the favor of the life insurance when applied to negative cumulative payments. ?On the illustration report, this first occurs in year 30 in Column (4) on Page 2.

Click here to view the full illustration.

Note: I ran Case Study 2b at foregone interest of 8.00%, 9.00%, 10.00%, 11.00%, and 12.00%, and the final year of each one resulted in a negative cost for each dollar of life insurance.

As you can see, Dollars of Benefits for Pennies of Cost is a pretty impressive way to illustrate the value of a life insurance policy, particularly one where you are illustrating participating loans. I recommend you seriously consider using this module.

A tip of the hat to Ben Feldman, one of the leading stars from the pantheon of life insurance greats. ?It was Ben who coined the phrase “dollars of benefits for pennies of cost”. ?I think he would have liked what we have done with the concept.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or 925-543-0513.

InsMark Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark?s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

Testimonials

“The InsMark Illustration System is one of the best sales tools I’ve ever seen for financial professionals to show their clients the benefits of cash value life insurance.”

Rick Biggert, CLU, President, Retirement Solutions, Tulsa, OK

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Lindsay, CLU, AEP, ChFC, Pasadena, CA