|

Editor’s Note: Blog #43 is the third in a series of Blogs involving several topics that are associated with the decision to sell a closely-held business, all of which provide opportunities for you to develop some serious business. If you have already read Blogs #41 and #42, you are up-to-speed on some of the issues presented so far for George and Marie Grove regarding the sale of their company. ?If you have not yet read them, we recommend you do so, and the links are below; however, if you prefer not to read them, this Blog is self-contained and should be useful to you without reviewing the prior Blogs. |

This Blog discusses an awesome variation of an Executive Bonus Plan for non-shareholder key executives. ?It is designed to reward such individuals handsomely while also providing a powerful new incentive for them to remain employed. We’ll apply the use of this concept to George and Marie Grove’s company, the firm we have featured in Blogs #41 and #42.

Tom Hamilton, age 40, is the Chief Marketing Officer of George and Marie’s company and is largely responsible for a substantial portion of the bottom line. ?His current annual compensation is $300,000. This week we’ll examine an irresistible set of golden handcuffs that can be provided to Tom so he remains employed during the next few critical years while plans firm up to sell the business.

Although George and Marie expect the business to be sold in five years, they don’t want the golden handcuffs associated with Tom’s executive benefit plan to be uncuffed until seven years have elapsed. ?The additional time is to encourage Tom to stay with the new owners for at least two years, a condition that enhances the value of George and Marie’s company to potential purchasers.

The Controlled Executive Bonus Plan

The key difference with this variation of executive bonus is that the business can require a repayment of the bonuses paid to Tom if his employment terminates during the next seven years for reasons other than death or disability.

Other than the bonus recovery provision, this plan for Tom is identical to the classic bonus arrangement where the employer provides a valued executive with a bonus to be used for the purchase of a personally-owned, investment-grade, life insurance policy.

There are two standard sub-sets of an Executive Bonus Plan: 1) single bonus of the premium where the executive pays the tax on the bonus (perhaps by a loan on the policy) and 2) a gross-up bonus, also known as a double bonus, where the bonus is sufficient to cover the premium on the policy and the tax on the bonus. ?We will illustrate the gross-up bonus and couple it with the controlled bonus feature.

How large should the bonus be? ?That depends, of course, on the current compensation of the executive, but it should be large enough to get some serious attention from the executive. ?In Tom’s case, if he is to be convinced to remain with the firm for the next seven years, we’ll need to make it substantial.

Let’s illustrate a $2,600,000 Indexed Universal Life policy with seven premiums of $60,000. Tom is in a 40% income tax bracket, so the company will have to bonus Tom $100,000 a year for seven years in order to cover the policy’s premium and the tax on the bonus. ?The company is a Limited Liability Company (a pass-through tax entity), so we will use George and Marie’s 40% personal tax bracket to determine the cost of the bonus. ?The company’s after tax cost is $60,000 a year for seven years, a total of $420,000.

If the plan is successful in keeping Tom with the company, the $420,000 will have been a good investment as the loss of sales to the company caused by his departure has been evaluated at roughly $1,400,000. (We’ll illustrate how this loss is mathematically calculated next week in Blog #44.) ?If the plan is not successful in retaining him, the company will recover whatever bonuses were paid -- a classic case of heads you win, tails you win, what do you have to lose?

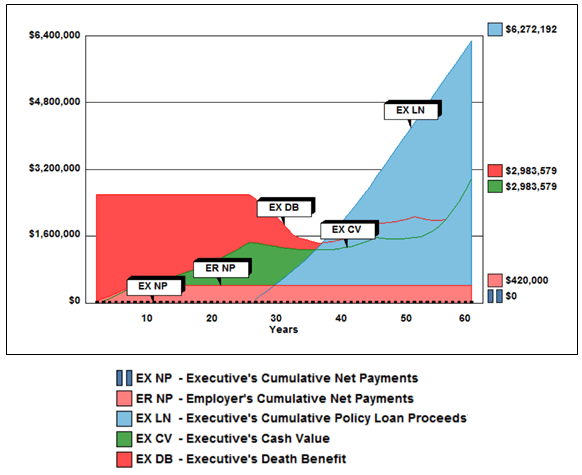

Below is a graphic of the results of the Controlled Executive Bonus Plan.

Notice that Tom is illustrated to receive over $6.2 million in tax free participating policy loans starting at age 65. ?We accomplished this by including a cost-of-living assumption (“COLA”) on the policy loans which start at $100,000 at age 65, gradually increase to $217,851 by age 85, remaining level thereafter.

Click here to view the Controlled Executive Bonus Plan illustration¹. The Flow Chart of the transaction is on Page 2. The plan costs and benefits are illustrated on Pages 3 - 5, and you can review Tom’s repayment obligations on Page 7. His plan calls for a 100% repayment of the bonuses paid during the first seven years of the plan. It isn’t until year 8 that all cash values are freely his property.

¹ The source of the illustration and the graphic is the Executive Security Plan module on the Executive Benefits tab in the InsMark Illustration System. The Controlled Bonus prompt is located on the Plan details tab only when the following items are selected for Type of Business on the same tab: C Corporation, S Corporation (non-shareholder), LLC (non-member), Partnership (non-partner), Sole Proprietorship (non-owner), and Tax Exempt Organization.

The difference to Tom between Year 7 and 8, for example, is substantial. ?If Tom quits in year 7, he owes his employer $700,000 with illustrated cash value of $418,145 to help pay it, a shortfall of $281,855. ?In Year 8, Tom owes no repayment and has full ownership of the illustrated cash value of $448,015, a swing of $729,870 in his favor in just one year. ?Good enough to keep him on the management team? ?One would think so.

There are several other ways the repayment of the bonus could be scheduled. Click here for another example. Click here for a more generous example. You will likely think of several other alternatives.

Click here to review some questions that George and Marie and their advisers might ask about the Controlled Executive Bonus Plan.

?Evaluation Resource

We were able to develop Tom’s plan for George and Marie’s only because we were alerted to his value as we reviewed the results of their company’s appraisal by the InsMark Business Valuator (powered by BizEquity). ?This evaluation resource can be of significant use with your business clients as demonstrated in this Blog #43 as well as #42, and #41. ?Click here if you would like to view our webinar on the InsMark Business Valuator. ?Click here if you would like to visit the InsMark Business Valuator website.

Alternatives

There are other executive benefits that George and Marie could consider:

COLI-funded Salary Continuation: ?This is probably not a good idea for a closely-held company expected to be sold in five years.

Loan-Based Split Dollar: ?This plan takes longer to season than seven years.

Executive Trifecta®: ?We’ll discuss this one next week in Blog #44.

Final Thought

Would Tom be better of investing the $60,000 after tax results of the seven bonuses in, say, an equity account? ?Check the graphic below to see the?comparison between an equity account and the life insurance. (The equity account runs out of gas in year 40.)

Click here to review the full illustration. ?It is generated by the Other Investments vs. Your Policy module in the InsMark Illustration System.

Documentation

The documentation for the Controlled Executive Bonus Plan is different than a typical Executive Bonus Plan. Version 21.0 (and higher) of InsMark’s Documents On A Disk™ has complete specimen plan documents for this plan in the Executive Bonus Plan category located in the Key Employee Benefit Plans section. If you use this concept, you will need these documents. Included are the plan implementation documents as well as a flow chart of the process and a layman’s explanation highlighting the features of the concept.

The documentation for the Controlled Executive Bonus Plan is different than a typical Executive Bonus Plan. Version 21.0 (and higher) of InsMark’s Documents On A Disk™ has complete specimen plan documents for this plan in the Executive Bonus Plan category located in the Key Employee Benefit Plans section. If you use this concept, you will need these documents. Included are the plan implementation documents as well as a flow chart of the process and a layman’s explanation highlighting the features of the concept.

The specimen plan documentation includes a Restrictive Endorsement Agreement which prohibits Tom from accessing policy values prior to retirement without the permission of his employer. If the parties agree, this Endorsement can be modified by counsel. ?For example, it might be written to apply only during the bonus repayment term, i.e., seven years in this Case Study.

Click here to watch a short video of the Controlled Executive Bonus concept and its documentation.

If you are licensed -- or become licensed -- for the InsMark Illustration System and would like to review the data input we used for both the Controlled Executive Bonus Plan and the comparison to an Equity Account, please email us at bob@insmarkblog.com, and we will get the Case Data file (Workbook) right out to you. Be sure to ask for the Workbook associated with Blog #43: Golden Handcuffs for Tom Hamilton.

To license the InsMark Illustration System and/or Documents On A Disk, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or 925-543-0513.

Testimonials:

"As a top national brokerage firm representing many insurance companies, the InsMark Illustration System has everything we need in an advanced marketing presentation system."

Gary M. Baker, President/CEO, Bloom-Baker/Asensus of New England, Boston, MA

"I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark."

Sam Keck, Financial Planner, Denver, CO

Important Notice

The information in this Blog is presented for educational purposes only. ?In all cases, the approval of the participants’ legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.