(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

|

|

Blog #193 begins a series of four Blogs featuring InsMark’s CheckMate® Logic as it relates to the purchase of a life insurance policy. Part 1 deals with procrastinating clients who seem to want the coverage but postpone purchasing it. Part 2 deals with clients who want to consider alternate funding (like equities.) Part 3 deals with clients who want to look at “buy term and invest the difference”. Part 4 deals with clients who want a comprehensive analysis to see the impact on their retirement plan of 1) acquiring the policy compared to 2) investing in an equity account compared to 3) buying term insurance and investing the difference. I will cover all four points in detail from the Main Platform at the 2020 InsMark Symposium in Las Vegas on February 28 – 29. I look forward to seeing you there. |

Part 1

This deals with a procrastinating client who wants the coverage but postpones purchasing it.

Case Study

Harvey Pierce, MD, is an internal medicine physician. He is age 45 and has determined Indexed Universal Life (IUL) can provide him with a superb retirement supplement.

His adviser is encouraging him to purchase the policy now. Suppose Dr. Pierce asks, “I am absolutely buried in medical paperwork; does it matter very much if I wait a couple of years to do it?”

This question can easily be answered using the Cost of Waiting module available on the Personal Insurance tab in the InsMark Illustration System.

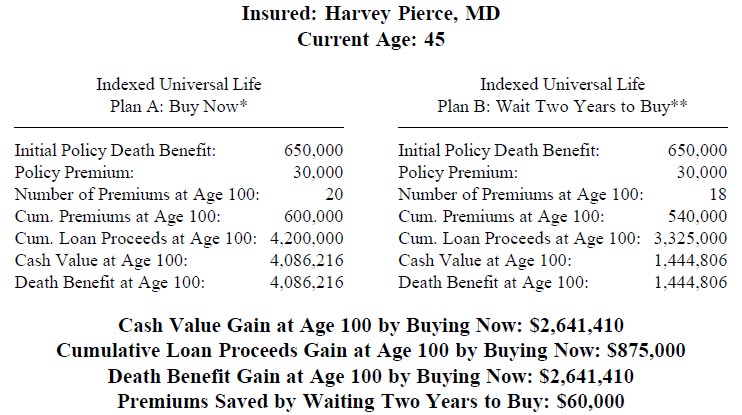

Compare the following two alternatives:

- $650,000 of increasing death benefit IUL issued at age 45 with 20 annual premiums of $30,000 and $120,000 of yearly policy loans from age 65 to 100.

- $650,000 of increasing death benefit IUL issued at age 47 with 18 annual premiums of $30,000 and $95,000 of yearly policy loans from age 65 to 100.

Here are the results:

| Image 1 |

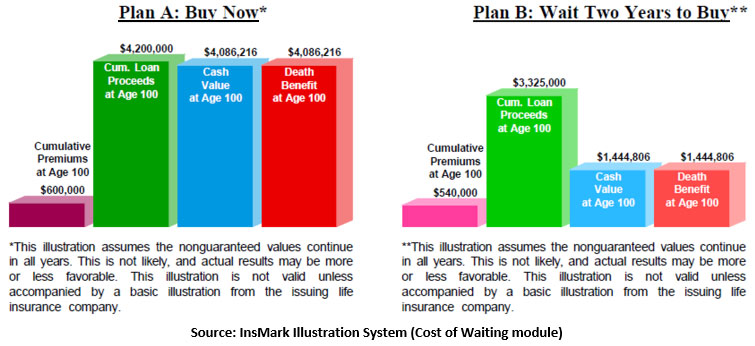

Below is a graphic that summarizes the results:

| Image 2 |

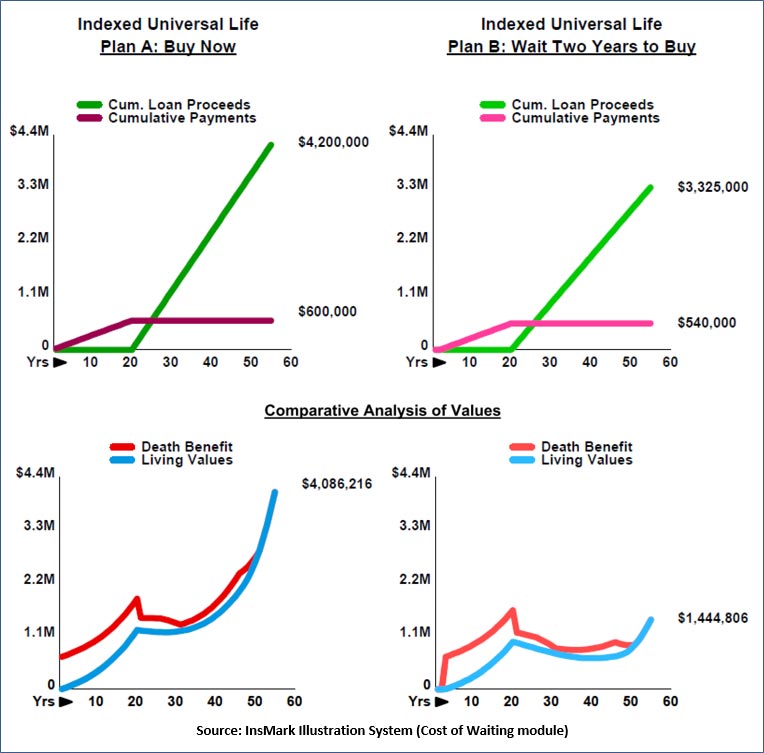

Click here to review the full illustration. As you will see on Page 5, Dr. Pierce would have to earn a pre-tax, equivalent rate of return of 16.30% on the two saved premiums to match the results of buying now.

Conclusion

The Cost of Waiting analysis shows that the attractiveness of a short-term delay in funding is offset by a significant decrease in cash value, death benefit, and retirement cash flow.

It makes little difference whether you are presenting a large or small amount of insurance -- Cost of Waiting is very useful in helping clients understand that acting now has very favorable financial consequences. It is a point that is difficult to quantify without the mathematical comparisons illustrated in this Blog, and trying to explain it conversationally is challenging.

There are other critical reasons why interested prospects might want to postpone purchasing life insurance. They are delaying the decision merely to avoid saying “no”. We will cover suggested responses to this often unstated objection in Parts 2, 3, and 4 of this Blog. Not just words – we’ll let the math speak for itself.

Licensing InsMark Systems

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or visit us online. Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward it to your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #193, click here for a guide to its content. It will be invaluable to you.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Platinum Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.® InsMark Platinum Power Producer®, Sipos Insurance Services, Freehold, NJ

“InsMark” and “CheckMate” are registered trademarks of InsMark, Inc.

Copyright © 2019 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

Important Note #3: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present and net cash values are so low that the income tax on the gain on surrender (calculated using gross cash values less basis) is more – often significantly more – than the net cash surrender value.

This lurking tax bomb can be present in all forms of whole life and universal life where policy loans of any type are utilized. It can be avoided, and you, the producer, are key to making sure your clients are aware of how to sidestep it.

A tax bomb can be avoided if the policy is neither surrendered nor allowed to lapse, since the policy death benefit wipes away the income tax liability. The foundation of this special treatment is IRC Section 101. This statute provides that the proceeds of life insurance maturing as a death claim are exempt from federal income tax. This applies to the full death benefit, including any cash value component whether loans exist or not.

Can your clients remember these facts years into the future? If they are incapacitated, will family members understand the issues? It is probably best to file a short note with the policy – something like this (although your compliance officer will likely have preferred language):

If/when you take policy loans on this policy, be sure to talk to your financial adviser before surrendering or lapsing the policy in order to anticipate unexpected tax consequences that may otherwise be avoided.

Some life insurance companies have concierge units that monitor loan status at the point of lapse or surrender, and you would be well-advised to select an insurance company with this capacity. To be effective regarding the tax bomb, such carriers need to be proactive in their client relationships, not merely reactive to client inquiries. I hope that ultimately the policyholder service division of all life insurance companies will bring this potential liability to the attention of those surrendering or lapsing policies, particularly those policies with 50% or more of the gross cash value subject to outstanding loans.