(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise®.)

| A Guest Blog by Richard Abelar |

| InsMark Senior Software Engineer and |

| Wealthy and Wise Project Manager |

|

Note from Bob Ritter: Richard Abelar is a Senior Software Engineer at InsMark and is the individual primarily responsible for the coding and maintenance of our Wealthy and Wise? System. When Rich told me his story of how he used Wealthy and Wise to help a friend make an informed decision about a real estate matter, I asked him to turn it into a Guest Blog -- and here it is. |

How many times have you heard this question, particularly from your clients? Should I or Shouldn’t I? This question was recently posed to me by a longtime friend. She was considering purchasing a new home and was trying to determine if the purchase was a sound financial choice. Being a retired widow, she was quite concerned with liquid asset longevity as well as estate transfer.

The InsMark Wealthy and Wise? System is an extremely powerful tool capable of analyzing the most complicated financial planning scenarios. However, Wealthy and Wise is equally powerful when analyzing seemingly straight forward decisions such as a home purchase. Wealthy and Wise was the perfect tool to help answer my friend’s question.

Background

Carol Johnson is 79 years old and has been comfortably retired for many years. She has lived in her home for 50 years but is considering a new home in a safer neighborhood and closer to her children and grandchildren. Even after considering the advantages of a new home, the thought of making such a big financial commitment at this stage of her life was daunting. Carol and her husband lived conservatively and worked very hard for their retirement. She didn’t want to make a bad decision.

Carol’s current home is worth $320,000. She has about $507,000 in cash and investments, and $410,000 in an IRA. She collects $48,500 a year from a defined benefit retirement plan, and $15,625 from Social security, which together provides her an income with which she is comfortable. Being above the magical age of 70 ½, Carol is required to take minimum distribution from her IRA which she uses for family gifts and reinvestment cash flow.

Carol’s questions:

- Should I or Shouldn’t I purchase this home?

- If purchasing the home is a good idea, how should I go about it?

- Sell my current home?

- Keep it as rental property?

- Take a mortgage on the new house?

- Can I afford the payments?

- What about taxes and insurance?

So many questions!

Case Study

Scenario 1 ? Current Situation: We start off by doing the basic “Status Quo” illustration. This gives a picture of where Carol is now and what kind of net worth she is likely to have over her life expectancy assuming she remains in her current home. It also shows what her estate picture is when that inevitable day comes. In doing this analysis we used an inflation index of 2% on her income stream and a growth rate of 3% on her real estate assets, slightly out-pacing inflation. Growth rate assumptions on liquid assets are as follows: Tax Exempt Assets (2): 4% and 3%, Equity Assets: 6% with 0.5% dividend, and IRA: 5%. We assumed a stretch-out option for her IRA so the income tax will continue to be deferred at death. Carol is gifting a total $20,000 annually divided among her adult children.

Scenario 2 ? Simple Home Replacement: In this scenario we look at selling her existing home and purchasing the new home for cash at $515,000. Since Carol has been in her existing home for so long, she has a very low cost basis and will incur some capital gains tax on her home sale calculated by Wealthy and Wise. She needs an additional $203,000 in cash to complete the purchase of the new home. Her financial advisor has told her that she has access to these funds for a very modest tax consequence (also calculated by Wealthy and Wise).

Scenario 3 ? Keep Current Home as Rental Property and Purchase New Home: In this scenario, we look at renting her old home and purchasing the new home. Carol’s local real estate professional has advised her that she can get $1,400 or more per month for rent. Since she has access to $200,000 of liquid assets for little tax, we will use that for the down payment on the new house and take a standard amortized mortgage for $315,000 at 4.1% to complete the transaction.

Results at Life Expectancy

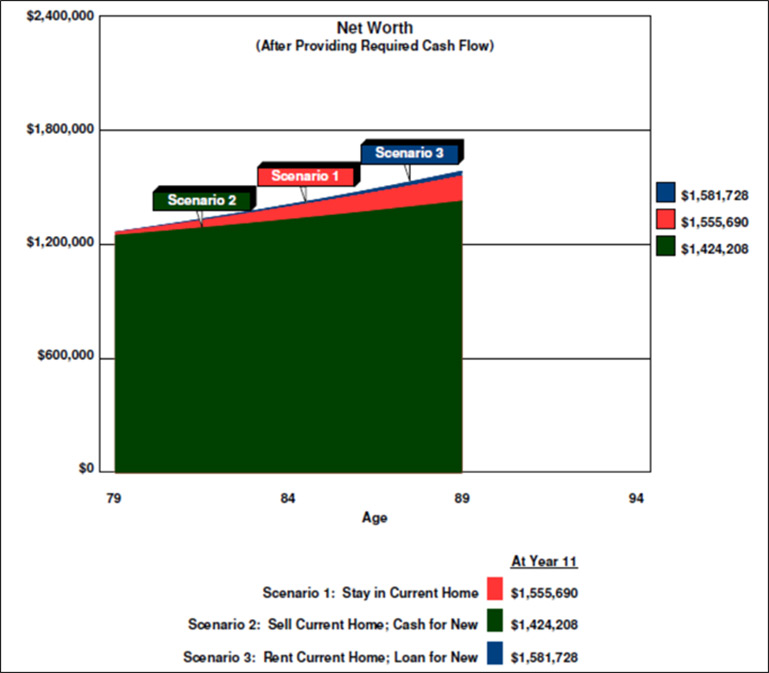

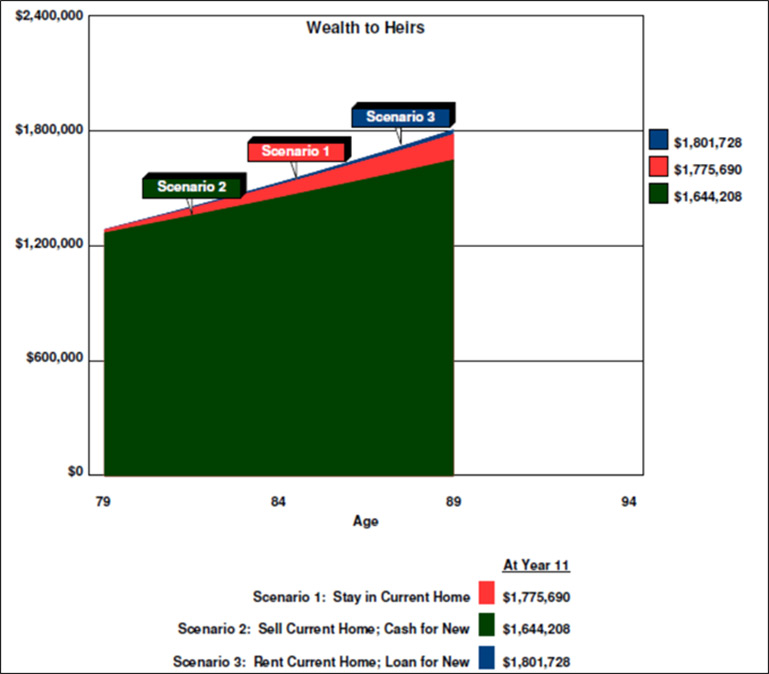

Scenario 1 reveals that if Carol remains in her current home until her life expectancy of 89, her net worth grows to $1,555,690 and her total estate transferred to heirs is $1,775,690.

Scenario 2, complete home replacement, is her worst choice, decreasing her net worth and wealth to heirs by over $130,000.

Scenario 3, keeping the old home as rental property and taking on the mortgage for the new home results in a very small increase in net worth and wealth to heirs.

See the two graphics below showing a comparison of these three options:

Image 1

Image 2

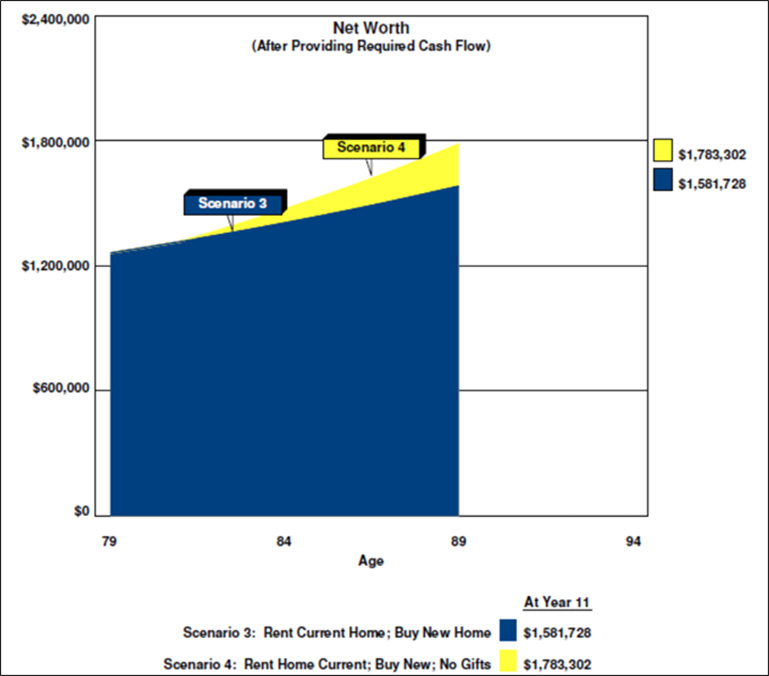

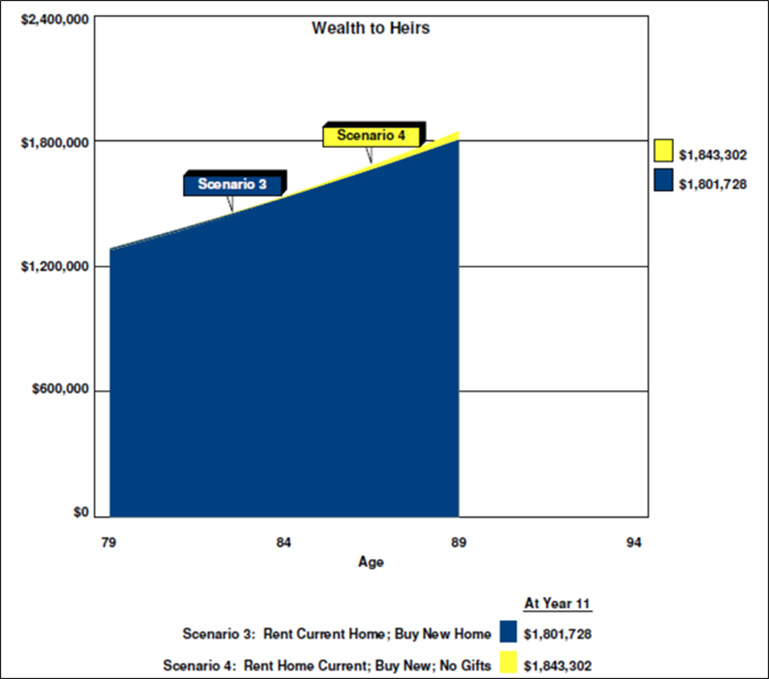

Our analysis can be further expanded to include a safety net -- just in case. Carol’s original thought was to suspend her family gifting and use that money to pay her mortgage payment. Our analysis so far keeps those gifts intact and illustrates that she can afford both. However, if Carol becomes concerned after a few years we can show her the effect of suspending those gifts at a later time. Scenario 4 suspends the gifts after 3 years. This strategy results in an increase in net worth with virtually the same wealth to heirs. The details can be seen in the graphs below:

Image 3

Image 4

Conclusion

Carol has the information she needs to make a sound financial decision. She is now comfortable that she can enjoy a new home in a nice area, closer to her family with very little financial worries. If she becomes concerned about her situation in the future, she has an additional safety net of suspending her family gifts to increase her income and help satisfy her new home commitment. Carol can now move forward with her plan.

One thing she won’t be dragging with her when she moves is that nagging question: Should I or Shouldn’t I?

Note: Should Carol live past her life expectancy of 11 years, her net worth and wealth to heirs continue to grow on a similar path as shown in the above images including providing her with the needed retirement cash flow.

Licensing InsMark Systems

To license Wealthy and Wise, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone -- just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer?, Phoenix, AZ

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer?, Minneapolis, MN

Important Note: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.