Robert McNamara, age 45, is a very successful sports agent with a staff of 30. His business is a limited liability company (LLC), and he is the Managing Member.

One of Robert’s advisers recently commented, “It’s too bad you don’t have a profit sharing plan in your company. It’s a great way for you to put deductible money aside for retirement. Way more than, say, a 401(k) plan.”

Robert’s response, “I’ve looked into it, but I’d have to cover too many employees. They already have a 401(k) plan with a generous match.”

The adviser countered, “There is a way you can contribute to a personal Profit Sharing Plan, do it just for yourself, and the cash flow at retirement is tax free.”

“Can I do that? What’s the limit?”

“There is no limit.”

“Show me!”

Case Study

For comparison purposes, let’s pretend that Robert could install a Profit Sharing Plan just for himself funded with a company-paid, deductible, $250,000 contribution each year for five years. Since the business is an LLC, the deduction would flow to Robert saving him $100,000 of income tax in his 40% marginal income tax bracket. He would have the full $250,000 working on his behalf in the Profit Sharing Plan. (If Profit Sharing Plans could be constructed this way, those who own LLCs, LLPs, or S corporations would stampede to install them.)

Alternatively, assume the LLC distributes the same $250,000 of business profits to Robert each year for five years. In his personal, marginal income tax bracket of 40%, he pays income tax of $100,000 on the $250,000 and is left with $150,000 which he directs to $3,500,000 of Indexed Universal Life (“IUL”) set up as his personal retirement plan.

The key question is: Would Robert be better off with the company-paid, pretend Profit Sharing Plan funded with $250,000 or with the personally-owned IUL policy funded with $150,000? If the IUL proves to be the superior choice, there is no limit to the amount that can be contributed to it.

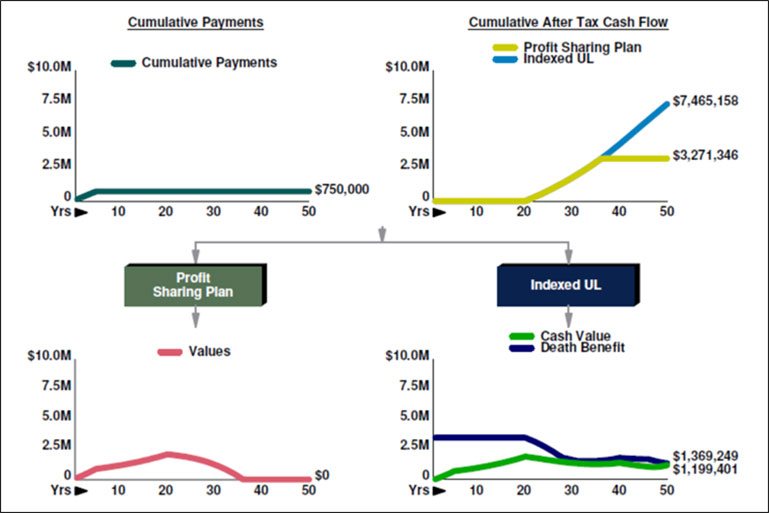

Below is a graphic comparing the IUL to this pretend Profit Sharing Plan from which we have scheduled withdrawals to produce the same after tax cash flow as the IUL. Unfortunately, the Profit Sharing Plan runs out of money in year 37 (Robert’s age 81) which is not the best timing for retirement cash flow to cease.

Click here to see the year-by-year values of the comparison.

There is simply no way that the values generated by this pretend Profit Sharing Plan can compete with the IUL. And remember -- in reality, this Profit Sharing Plan is not available for Robert, but the IUL is.

Additional Advantages

The IUL has four additional advantages:

- It provides a $3,500,000 life insurance death benefit;

- If the selected market index drops, there is no loss to the policy owner;

- There are no required minimum distributions;

- There is no 10% penalty tax associated for distributions prior to age 59?.

Conclusion

|

Unlike C corporations, there are very few benefit arrangements that provide leverage for principals of Limited Liability Companies, Limited Liability Partnerships, and S corporations. Due to the financial muscle of Indexed Universal Life (“IUL”), it outperforms a hypothetical profit sharing plan that discriminates totally in favor of the owner(s) of such entities.

I hope the analysis in this Blog increases your appreciation of IUL considerably as it is truly an unmatched financial instrument.

Note: See Blog #68 for a similar analysis involving IUL vs. a 401(k).

|

|

Whose Money Is It Anyway?

One of the more interesting aspects of this evaluation is that, during the accumulation years, the pretend Profit Sharing Plan shows more value than the Indexed UL. For example, just prior to retirement it has an illustrated value of $3,511,841 while the IUL contains only $1,924,052. Apples to apples comparison? It’s not comparable at all since, unlike the IUL, its values are subject to income tax when distributed.

So, whose money is it in the Profit Sharing Plan? Robert would likely have 100% of it listed on his financial statement. But it’s not 100% his; it’s 60% his and 40% the U.S. Government’s. Whose money is it in the IUL? It’s all Robert’s assuming he accesses it in a smart fashion by way of income tax free participating loans. Any residual values are paid to heirs via the income tax free death benefit of the life insurance.

Funding Based on Type of Business

- S corporation, LLC, LLP: The pretend Profit Sharing Plan is funded by the business with the deduction flowing to the principals. The IUL alternative is paid for with funds distributed by the business after taxes are paid.

- C corporation: The deductible pretend Profit Sharing Plan is funded by the employer. IUL is paid for with funds bonused by the business after taxes are paid. (See Part 2 next week for illustration details -- they are different for a C corporation.)

To follow the logic presented in this Blog, in each case, a comparison should be made to the hypothetical, business-funded, Profit Sharing Plan as though such an exclusionary plan is possible. That’s the point -- even if it were, IUL is a smarter alternative.

Compared to What?

You don’t need to compare the IUL to a Profit Sharing Plan to illustrate the power of this form of life insurance, but prospects and clients make better decisions when alternatives are considered. We call it Checkmate? Selling, and it drives almost everything we do at InsMark.

Prospecting

Imagine the response you would get if you ask the following question of individuals similar to Robert:

“If you could invest an unlimited amount into a deductible profit sharing plan just for yourself, how much could you contribute annually over the next five years?”

This question usually produces a favorable response. When that occurs, the Other Investments vs. Your Policy module in the InsMark Illustration System is a perfect choice to showcase the results of a pretend Profit Sharing Plan vs. IUL. (The illustration technique used in this Blog works best for S corporations, LLCs and LLPs; however, next week, I’ll show you how it can be illustrated for a C corporation.)

If you want to see the precise data entry I used for Robert’s Case Study, see below how to download the System Workbook file from the InsMark Illustration System I used to create the numbers for this Blog.

Incidentally, if you find business owners under, say, age 55, who are participating in a Profit Sharing Plan, recommend they drop out and allocate the after tax cost of their contribution to a cash-rich IUL policy.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing InsMark Systems

To license any of the InsMark Systems, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

Testimonials:

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer?, Financial Planner, Denver, CO

“InsMark’s Checkmate? Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

“InsMark provides incredible tools to give clients a visual of how they can optimize their wealth. It’s great for deciding which road to go down.”

Jim Heafner, MBA, CFP, Heafner Financial Solutions, Inc., Charlotte, NC

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.