(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark® Illustration System)

|

Depth charges launched by the NAIC* in AG 49 and AG 49A gave illustrations for Indexed Universal Life (IUL) a real beating. Fortunately, they did not sink them.

Depth charges launched by the NAIC* in AG 49 and AG 49A gave illustrations for Indexed Universal Life (IUL) a real beating. Fortunately, they did not sink them.

*National Association of Insurance Commissioners

As shown in the “Compared to What?” analysis featured in this Blog, even with the latest restrictions, InsMark’s IUL illustrations can be created that provide you with devastatingly effective presentations.

The more I study the details of IUL, the more they are irresistible. The opportunity to couple valuable death benefits with cash values credited with interest rates equivalent to a high percentage of a selected Index is, of course, one of the policy’s key lynchpins.

Provided the policy is not a modified endowment contract (MEC), the icing on the cake is the opportunity to access cash values through participating loans. Traditionally, the rule for accessing spendable cash flow has been to use tax-free withdrawals up to cost basis (basis being the sum of premiums paid) and switching to tax-free policy loans once cost basis has been exhausted.

The participating policy loan is a real game-changer for IUL. It dictates loans from the get-go as the preferred way of accessing cash values for, say, tax-free retirement cash flow. Such loans provide a significant opportunity for interest rate arbitrage, a strategy typically associated with foreign currency transactions and not historically available with loan activity on life insurance policies.

It only works well if the loan interest rate charged by the issuing insurance company is guaranteed for the policy's life. Assume you can borrow against accruing cash values at a guaranteed rate of, say, 4%, and the cash values securing the loan still participate in the selected Index (guaranteed never to be lower than 0%). In that case, you then have the following benefits of 21st-century life insurance:

- Policy cash values accrue free of income tax;

- Cash values securing policy loans continue to participate in tax-free accumulation pegged to the Index selected, including a guarantee that the credited rate cannot go negative;

- Policy loans are free of income tax if the policy is neither surrendered nor lapsed;

- Policy death benefits wipe away any deferred income tax liability whether policy loans exist or not.

There is nothing in the financial world quite like this package of benefits.

Case Study

Harvey Pierce, MD, age 45, is a highly successful vascular surgeon. He is considering acquiring $1,500,000 of Indexed Universal Life with scheduled premiums of $65,000 for 20 years.

Let's address “Compared to What?”. No financial product is good or bad in the abstract. Real value is determined by comparison to reasonable alternatives.

I illustrated the IUL with a credited rate of 6.00% compared to an alternative of a hypothetical equity account growing at 7.50% coupled with a dividend of 1.00%.

The equity account has yield erosion due to:

- Management fees;

- Dividend and capital gains taxes;

- Capital gains income tax due to portfolio turnover;

- Taxation as funds are withdrawn for cash flow.

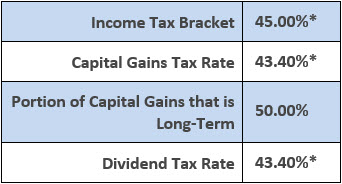

Tax assumptions for the equity account are:

*Biden’s proposed rates for a high earner including a provision for state income taxes.

IUL has charges for commissions, mortality, and other policy expenses, the sum of which are significantly lower than those for the equity account. The illustration that follows the graphic below also lists and compares all equity and IUL charges.

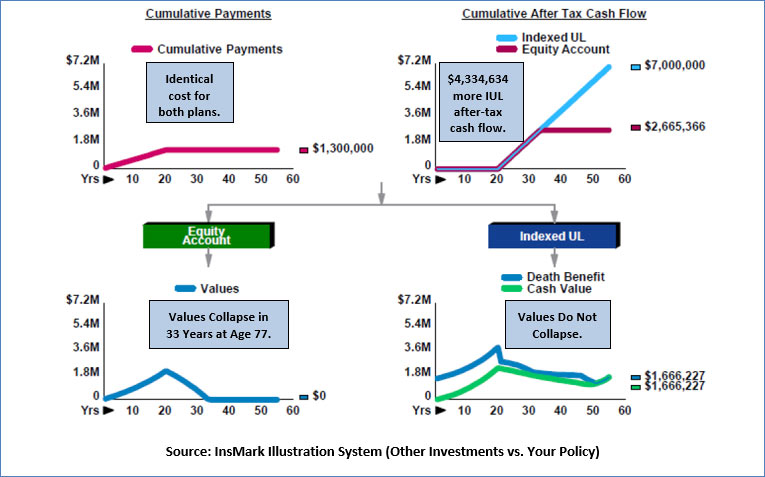

Below is a graphic of our “Compared to What?” analysis using InsMark’s unique CheckMate® Selling logic. There is no income tax associated with this IUL illustration so long as the policy is neither surrendered nor lapsed.

| Male, Age 45 |

| IUL vs. Equity Account |

| Deposit to Both Plans: $65,000 for 20 years |

| Equity Account Illustrated at 7.50% Growth plus 1.00% Dividend |

| IUL illustrated at 6.00% |

Click here for the year-by-year illustration. As shown on Page 4, the equity account needs a yield of 13.09% (including the dividend) to match the life insurance results. That is 709 basis points greater than the IUL’s 6.00%.

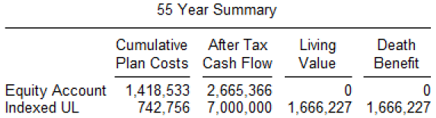

As you can see on Pages 5 and 6, the sum of the charges to the IUL is significantly lower than those of the equity account. Below is the startling Summary that appears at the bottom of Page 6:

Page 7 shows a graphic of the comparison of plan costs.

Caution: You must manage the amount of loans to ensure the policy contains sufficient residual (un-borrowed) cash value to prevent a lapse of the policy. Such a lapse will trigger income taxation of all policy loans above cost basis.

Whole Life

Whole Life cannot compete with Dr. Pierce’s IUL for several reasons, not the least of which is that Whole Life has no features where all withdrawals of cash values can be cast as participating loans with interest rate arbitrage opportunities.

Whole Life is a highly desirable product for conservative buyers. Those desiring better performance should consider IUL. Unfortunately, AG 49A requires an understatement of the illustrated values of IUL that has little bearing on even conservative results of actual in-force policies. If the goal was to make IUL less attractive, it succeeded. A more creative goal might have been more disclosure of the reality of IUL.

Conclusion

Even with the restrictions of AG 49A, InsMark illustrations can be created that provide you with extraordinarily effective presentations.

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries — contact David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

Creating Similar Presentations

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

The video below can also acquaint you with the general subject of downloading and using InsMark’s Digital Workbook Files.

Digital Workbook File for Blog #211

InsMark Illustration System

Assuming you have our InsMark Illustration System, you can download the same Digital Workbook File below I used to prepare the Case Study for this Blog. It shows the precise menu prompts to use to reproduce a similar illustration.

Digital Workbook File For This Blog

or

Download all workbook files for all blogs

|

Before downloading and reviewing any files, be sure you have installed the most current updates to your InsMark Systems. Do this using InsMark Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you see this message on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook file to your PC’s appropriate directory where your InsMark System(s) reside. |

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“InsMark’s referral resource, Brian Manderscheid from LifePro, has been a gem to work with! He helps us use InsMark with every one of our cases. The genius factor is InsMark’s commitment to “Compared to What.”

Glenn Main, InsMark Platinum Power Producer®, McMurray, PA

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, and InsMark Power Producer, Overland Park, KS

“InsMark”, the InsMark logo, and “CheckMate” are registered trademarks of InsMark, Inc.

© Copyright 2021 InsMark, Inc.

All Rights Reserved

Important Note #1: The hypothetical values associated with this Blog assume the non-guaranteed values shown continue in all years. This result is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, you must secure the approval of a client’s legal and tax advisers regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.