Can Indexed Universal Life (IUL) compete with an equity account? In some ways, it’s an apples vs. oranges comparison in view of the equity account’s potential for gain in excess of the participation cap of the IUL. On the other hand, the downside protection against loss of IUL gives it a competitive advantage, and for some clients, this is an overwhelming plus.

Let’s just compare them using the same interest rate, say, 7.50%. We’ll also credit the equity account with a 1.00% dividend since IUL typically excludes dividends from the crediting rate of the selected index. (Some companies may offer this feature, but I am unaware of any.) As you will see, the IUL outperforms the equity account by a wide margin.

The reason for this is the significant difference in the items that retard the growth of the equity account vs. those that impact the IUL.

Equity Account Limitations:

- Management fees;

- Income tax on dividends;

- Income tax on realized short term gains;

- Capital gains tax on realized long-term gains;

- Turnover: Income tax and/or capital gains tax.

Indexed Universal Life Limitations:

- Haircut on the index used;

- No credit for a dividend;

- Mortality charges.

Case Study

Tom and Anne Murray are both age 45. Among other assets, they have an equity account currently valued at $250,000 with a cost basis of $200,000. They are interested in acquiring more life insurance on Tom’s life for the protection of their three children and are evaluating IUL as an appropriate policy.

Tom and Anne intend to use the equity account to supplement their retirement income. Their adviser suggests using the equity account as a source of premiums for the IUL and accessing the IUL cash value to enhance retirement cash flow. They want to examine this strategy.

To establish the premium pattern for the IUL, we used a calculator in our Wealthy and Wise? System to determine the level amount of after tax cash flow that could flow from the $250,000 equity account. We directed the calculator to deplete the account over five years taking into account the limitations noted above. (With so many moving parts to the equity account, this calculator is a valuable tool should you want to duplicate the logic of this Blog.)

Wealthy and Wise Equity Calculator Prompt

This calculator is located on the Equity Account sub-tab located on the Liquid Assets tab. See the Equity Assets (Details) report for the year-by-year calculations. Similar calculators are available for all Liquid Assets.

This calculator is located on the Equity Account sub-tab located on the Liquid Assets tab. See the Equity Assets (Details) report for the year-by-year calculations. Similar calculators are available for all Liquid Assets.

The calculator determined the equity account could produce $53,304 a year for five years (after tax) which we will use to fund the IUL. Starting at age 65, they will begin accessing cash flow from the IUL.

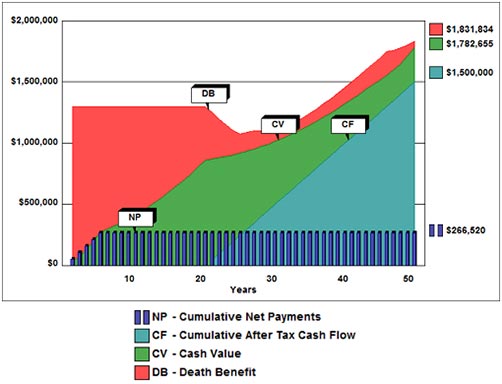

Below is a graphic of the IUL results over 50 years (Source: Illustration of Values module in the InsMark Illustration System):

Click here to review the entire IUL illustration. Pay particular attention to Pages 2 and 3 where after tax retirement cash flow of $50,000 a year is illustrated (withdrawals to basis; loans thereafter). Note also that a substantial amount of death benefit is available in all years, a feature not associated with the equity account.

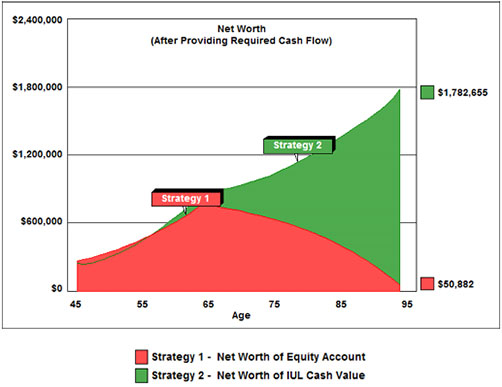

The next step is to compare the IUL with continuing the equity account with the identical after tax cash flow of $50,000 a year from each Strategy starting at their age 65. For this, I used Wealthy and Wise, and below are the graphics from that System showing the comparisons of net worth and death benefit.

Net Worth Comparison

(After Providing $50,000 a Year in After Tax Retirement

Cash Flow from Both the Equity Account and the IUL)

Death Benefit Comparison

(After Providing $50,000 a Year in After Tax Retirement Cash Flow from Both the Equity Account and the IUL)

Equity rescue?? You bet it is!

Click here to review the Wealthy and Wise reports.

A Wealthy and Wise case typically requires input of all a client?s financial information. This is not the case with an Equity Rescue Plan (or an Annuity Rescue Plan as described in Blog #10). Both can be illustrated with minimal data input. An ancillary benefit is that it gives you a platform to discuss other planning opportunities with what is likely to be a very impressed client.

Conclusion

A well-designed Equity Rescue Plan can produce very dramatic results. Click here for a testimonial from one of our licensees.

For a license to use and InsMark System, contact Julie Nayeri at InsMark at julien@insmark.com or (888) InsMark (467-6275). Institutional inquiries should be made to David A. Grant, Senior Vice President ? Sales at (925) 543-0513 or dag@insmark.com.

If you are licensed for the InsMark Illustration System and Wealthy and Wise and would like to review the menu prompts we used for this analysis, please send us an email, and we will get the Case Data files (Workbooks) right out to you. (For the InsMark Illustration System file, be sure to ask for "Blog #21 - IUL".? For the Wealthy and Wise file, be sure to ask for "Blog #21 - Comparison".)