(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System and Wealthy and Wise®)

Definition: The Hidden Partner is the United States Treasury which, through its income tax collection department, the Internal Revenue Service, confiscates a large percentage of the $24 trillion (and counting) in deductible retirement plans1.

1IRA, 401(k), 403(b), Keogh, Sec. 457, profit sharing plans, etc.

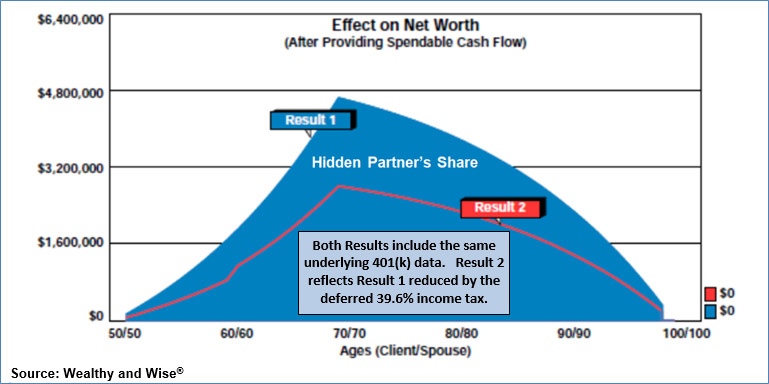

The following graphic from Blog #168 (Part 1 of 2) illustrates the Hidden Partner’s invasive claim on assets in Solo 401(k) accounts for Wayne and Lauren Rawlings, both age 50. They are in a marginal 39.6% income tax bracket.

| Image 1 |

| Hidden Partner's Effect on Net Worth |

As indicated by the text box inserted in the graphic, an optional new feature in Wealthy and Wise® allows you to reduce Result 2 by the portion of retirement assets representing income tax still due on Result 1. (We offer the same option with tax deferred annuities.) If you can’t withdraw a dollar without paying income tax in your top marginal bracket, that should be reflected in the account valuations. As you can see, the Hidden Partner has effectively placed an unavoidable lien on, in this case, a Solo 401(k).

So let’s integrate that asset grab into an overall wealth analysis to not only illustrate its impact but provide a way to avoid it.

Case Study (both doctors are in the same practice)

- Wayne Rawlings, MD: Orthopedic Surgeon, age 50

- Lauren Rawlings, MD: Anesthesiologist, age 50

- Marginal tax bracket: 39.6%

- Retirement age: 70

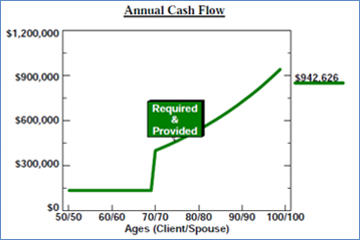

- Desired Spendable Cash Flow at Retirement: $400,000 (+ Cost of Living Adjustment: 3.00%)

- Plan: Solo 401(k) for each – assumed yield: 7.00% (1.00% mgt. fee)

- Contributions to Solo 401(k): $60,000 each ($54,000 plus $6,000 catch-up)

- Annual after tax cost of each Solo 401(k): $36,420

- Total after tax cost of both Solo 401(k)s: $72,480

- Illustrate for: 50 years

- Joint life expectancy: Age 90

| Current Net Worth |

| Wayne and Lauren Rawlings |

1The Medical Practice will be illustrated as sold at the Rawlings’ age 70 with the net proceeds invested in an equity account.

Note: The Rawlings believe the Social Security Trust Fund is unsustainable, and they do not expect to collect retirement benefits from this source.

Click here for comments regarding yields, sequence of returns, and Monte Carlo simulations.

Let’s see how their current retirement plan performs in producing their goal of $400,000 of spendable cash flow at retirement coupled with a 3.00% cost of living adjustment. Wayne and Lauren’s joint life expectancy is age 90, and they want to include an additional ten years in the analysis as a safety valve.

As discussed in Blog #168 (Part 1 of 2), it appears likely that significant increases in income taxes are inevitable due to Washington’s chronic inability to control spending. So the comparisons illustrated below start by showing the impact of current levels of income tax followed by comparisons assuming future increases in tax brackets to 60% and 75% as examples of the ultimate consequence of spendthrift governance.

Comparison #1

39.6% Income Tax Bracket

Strategy 1a:

- No change in the net worth mix;

- Contributions of $60,000 are continued for each Solo 401(k).

Strategy 1b:

- New deposits of $60,000 to each Solo 401(k) are terminated;

- The after tax cost of both contributions is $72,480 ($36,240 each). The $500,000 Equity Account is liquidated over 20 years (to age 70) producing level after tax cash flow of $36,479. The $400,000 Indexed Annuity is liquidated over 20 years (to age 70) producing level after tax cash flow of $25,933. These three sums total $134,892 which pay the 20 annual premiums of $134,892 on an Indexed Survivor UL policy with a face amount of $3,504,964, increasing for 20 years; level thereafter. (Calculators in Wealthy and Wise easily produce the levelized distribution of both the Equity Account and the Indexed Annuity.)

- At age 70, annual level participating policy loans of $518,359 to age 100 are illustrated on the Indexed Survivor UL policy.

Click here to review the life insurance illustration.

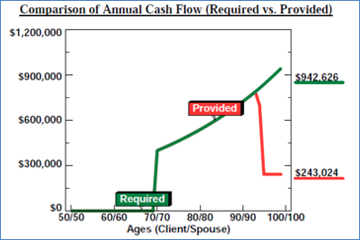

Below is the spendable, retirement cash flow comparison of Strategy 1a vs. Strategy 1b.

| Image 2 |

| Cash Flow Comparison |

Strategy 1a (Current Plan)

vs.

Strategy 1b (Indexed Survivor UL Plan)

Cash Flow Results for Strategy 1a

Strategy 1a fails to complete the cash flow goal.

Cash Flow Results for Strategy 1b

Strategy 1b completes the cash flow goal.

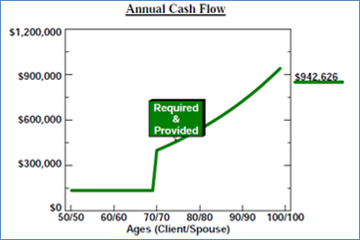

| Image 3 |

| Overall Results for Strategy 1a vs. Strategy 1b |

Long-range, Strategy 1b has over $11 million more in net worth and over $3 million more in spendable, retirement cash flow all with no increase in out-of-pocket, funding costs. The additional net worth could easily accommodate a significant increase in spendable cash flow or, perhaps, a serious gifting program for children or favorite charities.

Round 1 goes to the life insurance alternative.

Comparison #2

39.6% Income Tax Bracket (Years 1 – 20)

60% Income Tax Bracket (Years 21 – 50)

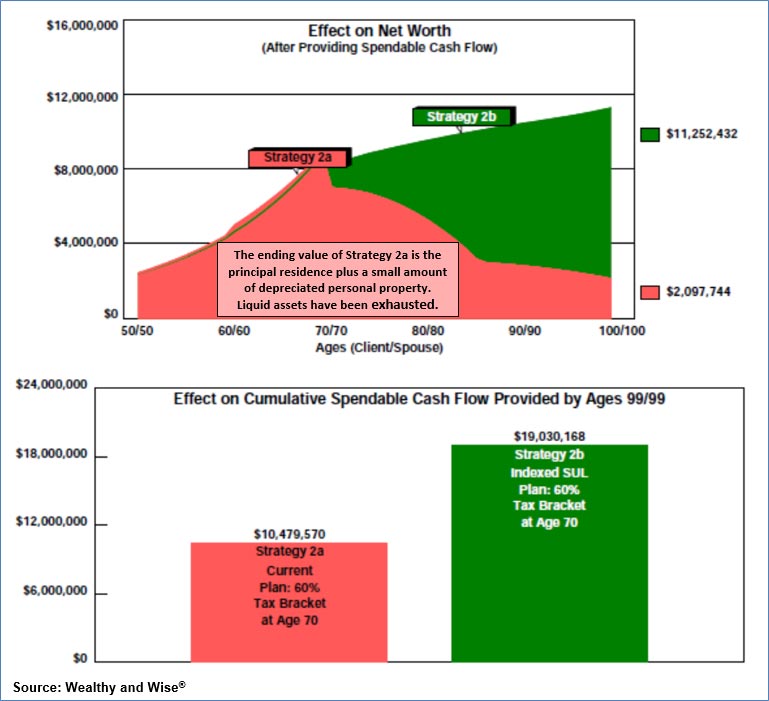

Strategy 2a and Strategy 2b are identical to Strategy 1a and Strategy 1b with one exception: Wayne and Lauren’s income tax bracket reflects an increase to 60% at age 70.

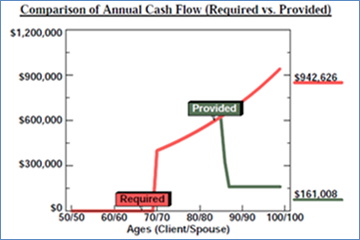

Below is the spendable, retirement cash flow comparison of Strategy 2a vs. Strategy 2b.

| Image 4 |

| Cash Flow Comparison |

Strategy 2a (Current Plan)

vs.

Strategy 2b (Indexed Survivor UL Plan)

Cash Flow Results for Strategy 2a

Strategy 2a falls further behind the cash flow goal.

Cash Flow Results for Strategy 2b

Strategy 2b (unchanged) completes the goal.

| Image 5 |

| Overall Results for Strategy 2a vs. Strategy 2b |

Long-range, Strategy 2b has $9 million+ more net worth and $8.5+ million more spendable, retirement cash flow. The additional net worth could easily accommodate a significant increase in spendable cash flow or, perhaps, a serious gifting program for children or favorite charities.

Round 2 goes to the life insurance alternative.

Comparison #3

39.6% Income Tax Bracket (Years 1 – 20)

75% Income Tax Bracket (Years 21 – 50)

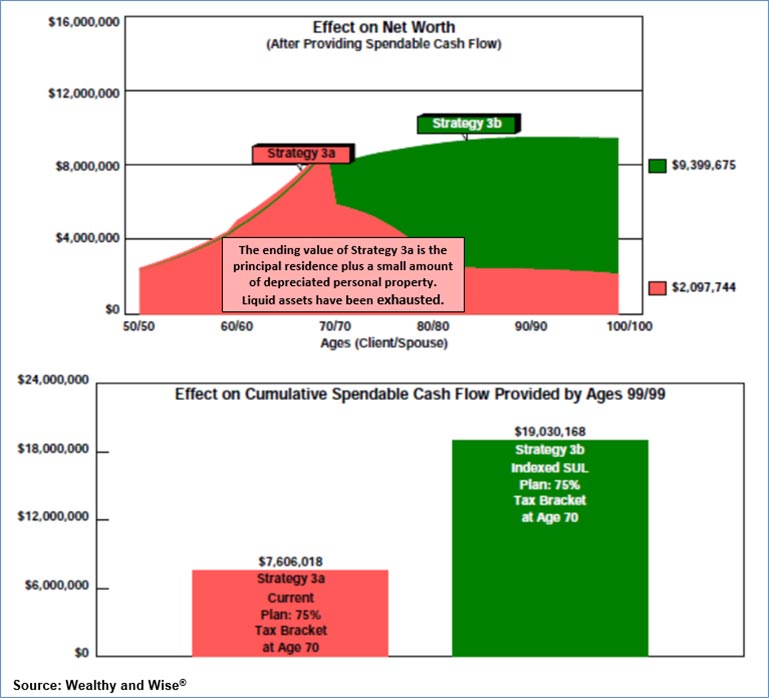

Strategy 3a and Strategy 3b are identical to Strategy 2a and Strategy 2b with one exception: Wayne and Lauren’s income tax bracket reflects an increase to 75% at age 70.

Below is the spendable, retirement cash flow comparison of Strategy 3a and Strategy 3b.

| Image 6 |

| Cash Flow Comparison |

Strategy 3a (Current Plan)

vs.

Strategy 3b (Indexed Survivor UL Plan)

Cash Flow Results for Strategy 3a

Strategy 3a falls further behind the cash flow goal.

Cash Flow Results for Strategy 3b

Strategy 3b (unchanged) completes the goal.

| Image 7 |

| Overall Results for Strategy 3a vs. Strategy 3b |

Long-range, Strategy 3b has $7.3+ million more net worth and almost $11.5 million more spendable, retirement cash flow. The additional net worth could easily accommodate an increase in spendable cash flow or, perhaps, a serious gifting program for children or favorite charities.

Round 3 goes to the life insurance alternative.

Click here to review the entire Wealthy and Wise evaluation for Strategy 3a vs. Strategy 3b. I did not include all the comparisons as it is an overwhelming number of pages. For those licensed for Wealthy and Wise, the entire digital workbook file is available below. For those not licensed for Wealthy and Wise who would like to review the case-specific digital workbook file used for this Blog #169, we will be pleased to provide you with a complimentary 30-day installation for the software along with the digital workbook file. Contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) for details. (This offer applies to any digital workbook file discussed in any of my Blogs.)

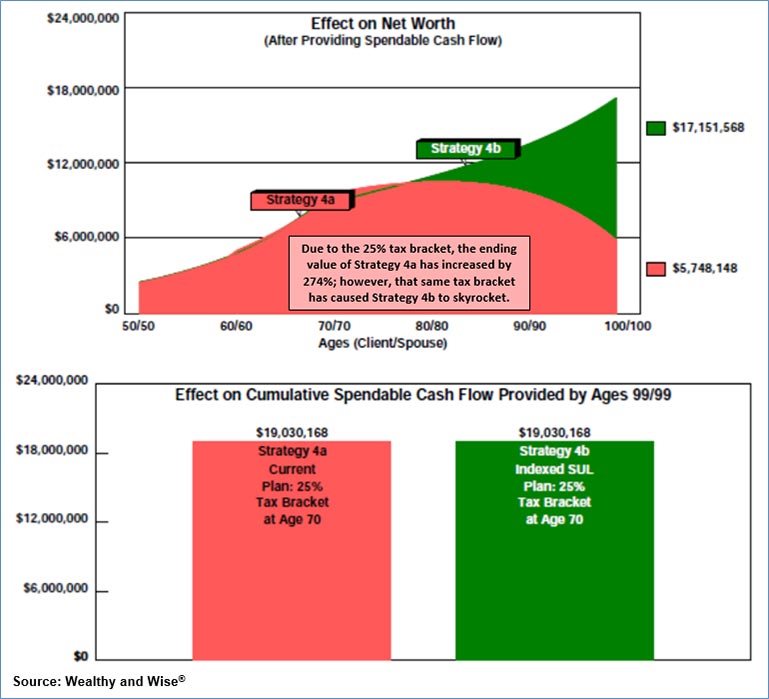

Comparison #4

39.6% Income Tax Bracket (Years 1 – 20)

25% Income Tax Bracket (Years 21 – 50)

Strategy 4a and Strategy 4b are identical to Strategy 3a and Strategy 3b with one exception: Wayne and Lauren’s income tax bracket reflects a decrease to 25% at age 70. I consider this to be seriously unlikely in view of the spending habits of our politicians, but I did want to include it for those who think it should be part of this analysis.

Below is the spendable, retirement cash flow comparison of Strategy 4a and Strategy 4b.

| Image 8 |

| Cash Flow Comparison |

Strategy 4a (Current Plan)

vs.

Strategy 4b (Indexed Survivor UL Plan)

Cash Flow Results for Strategy 4a

Strategy 4a completes the cash flow goal.

Cash Flow Results for Strategy 4b

Strategy 4b (unchanged) completes the goal.

| Image 9 |

| Overall Results for Strategy 4a vs. Strategy 4b |

Long-range, Strategy 4b has $11.4 million more net worth with identical, spendable, retirement cash flow. The additional net worth could easily accommodate an increase in spendable cash flow or, perhaps, a serious gifting program for children or favorite charities.

Round 4 goes to the life insurance alternative.

Final Thoughts

I think the most significant takeaway is that the client’s overall financial plan is improved with Indexed Survivor UL even when we assume a very low, income tax bracket. Specifically, even an unrealistic decrease in tax rates to 25% shows that the addition of life insurance results in substantial increase in the client’s long term wealth. When you compare the even greater benefits of life insurance at higher tax rates, 21st century life insurance appears to be an irresistible funding option.

What is your perspective on long-range, income tax rates? Mine is that much higher tax rates are inevitable. Click here to review the history of the top income tax rates. How high could they go – who knows? But they once were at 94%.

Cash value life insurance has been maligned for many, many years by folks like Suze Orman and Dave Ramsey as a less than desirable financial tool. They are – and have been – just plain wrong!

The Bill Boersma quote I frequently include could never be more appropriate:

“I can only wonder if another asset with the same qualities would be implemented more frequently if it wasn’t called life insurance.”

Using an indexed life insurance policy typically means (a) more net worth and wealth to heirs and/or (b) more spendable cash flow. Any client that eliminates cash value life insurance as a funding resource for retirement cash flow is effectively saying, “I don’t mind inefficient retirement planning.”

The reason I used the survivor variation is because, if I used a single life policy on, say, Wayne, and he died unexpectedly, let’s say at age 85, the power of the arbitrage produced by accumulated participating loans on his policy would die with him. Lauren would receive a policy death benefit, but it would not be nearly enough to sustain the same after cash flow from the policy had Wayne not died. (The reverse is true if Lauren were the insured.) By using a survivor policy, if one death occurs, the policy continues its arbitrage effectiveness producing significant levels of after tax policy participating loans. A survivor policy is usually the most effective way to accomplish this although often a case can be made for insuring both spouses with their own policy. That said, there are other reasons to use separate policies – particularly where one spouse needs more coverage than the other and, of course, in almost all business insurance situations.

InsMark illustrations can also assist you with some aspects of your DOL compliance since, when appropriate, the calculations show that you are acting in the client’s best interest in recommending cash value life insurance as a supplemental, retirement savings alternative.

Below are additional advantages when life insurance is used:

- There are no federally mandated limits to premiums for life insurance, and once this is understood, many clients will increase their funding for the life insurance;

- A waiver of premium can be attached to life insurance in the event of disability;

- Tax free cash flow from the life insurance (withdrawals to basis; loans thereafter) can be accessed prior to age 59 1/2 with no premature distribution tax;

- Life insurance also provides a significant death benefit ($3,504,964 of second-to-die coverage for Wayne and Lauren).

- Many policies allow for advance of death benefits to fund long term care costs.

There is one way in which government-sponsored, retirement plans have an advantage over the cash value life insurance alternatives. In most cases, government plan assets are creditor proof. See the attached state-by-state listing1 of creditor-proof opportunities from Duggan Bertsch, a Chicago law firm that specializes in a wide range of wealth planning. The list includes the states that protect cash values of life insurance from creditors.

1InsMark makes no guarantee or warranty of the list’s accuracy. Contact Duggan Bertsch directly with fee-based requests for additional information.

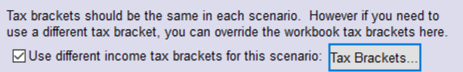

Technical Design Note: If you are using unique tax brackets for different scenarios in Wealthy and Wise, you need to override the master tax bracket selections you initially make in Client Data. To produce different tax brackets for a given scenario, use this selection found in the center of the Preliminary Data tab:

Files For This Blog

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Before downloading and reviewing any files, be certain you have installed the most current update to your Wealthy and Wise System. Do this using Live Update available under Help on the main menu bar of the System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #169, click here for a guide to the content. It will be invaluable to you.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Again, for those not licensed for Wealthy and Wise who would like to review the case-specific digital workbook file used for this Blog #169, we will be pleased to provide you with a complimentary 30-day installation for the software along with the applicable, digital workbook file. Contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) for details. (This offer applies to any digital workbook file discussed in any of my Blogs.)

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“Bob Ritter’s blogs make me look like a genius! My CPA takes the info, then studies for a week before he says he ‘gets’ it.”

Stewart King, Wealthy and Wise licensee, Bayboro, NC

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.