(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System)

|

If your clients ignore life insurance in their retirement planning, they are essentially saying, “I am not interested in maximizing my spendable retirement cash flow.” Read on for the proof!

In Blog #166 (Part 1 of 2), I compared an IRA to Indexed Universal Life (“IUL”) with a premium for the IUL equal to the after tax cost of the contribution to the IRA. The IUL was a significantly better choice. In this Blog, the comparison is a Roth IRA vs. IUL with a premium for the IUL equal to the contribution to the Roth IRA.

So you can more easily compare Blog #167 with Blog #166, Blog #167 repeats the format and much of the text of Blog #166.

Case Study

Erin Coppola is age 30. She is a self-employed, clinical psychologist and is planning to start a Roth IRA.

Erin is visiting with her financial adviser, “I can contribute $5,500, and it’s not deductible, right?”

“That’s correct, Erin. And when you reach age 50, that increases to $6,500.”

“How do I maximize the results at retirement?”

|

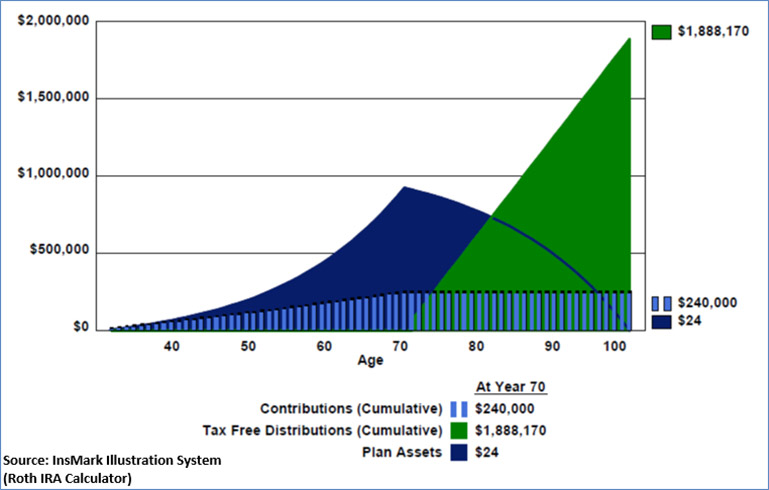

“You can contribute to it until you are age 70. After that you must start taking money out. In numbers I prepared for you, I scheduled the maximum contributions of $5,500 for 20 years increasing to $6,500 at age 50 – and I extended those contributions all the way to age 70. You don’t have to do that for all those years, but I wanted to show you the maximum possible results.” |

|

“What are the results?”

“You can start the cash flow any time after age 59 1/2, but starting at age 70 produces the greatest amount – $62,939 in annual spendable cash for the next 30 years for a total of $1,888,170.”

| Image 1 |

| Roth IRA Analysis |

Click here to review the year-by-year numbers.

$62,939 a year sounds pretty good,” comments Erin, “any alternatives?”

“Erin, there is a variation that could provide a better solution.”

“Tell me about it.”

“It’s life insurance.”

“I don’t need any life insurance.”

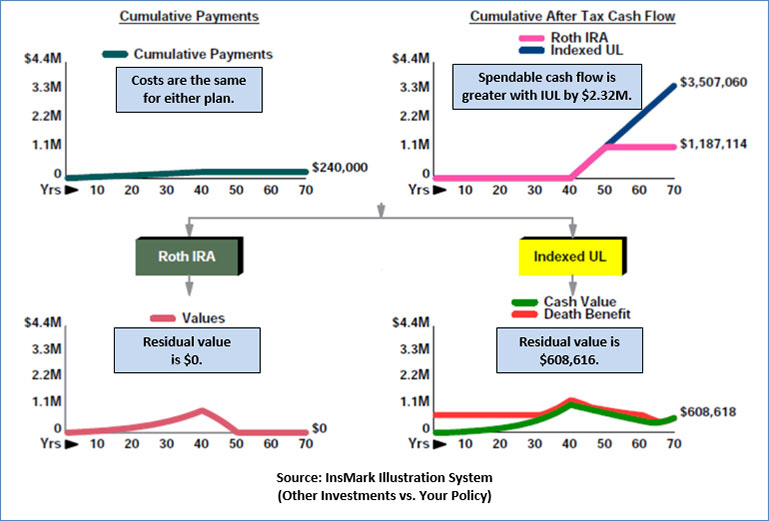

“You probably mean you don’t need the death benefit, and that may be true now. But you may change your mind about the rest of the policy’s benefits after I show you an illustration of Indexed Universal Life – which I’ll refer to as Indexed UL or IUL. The premium for the policy is set to the exact same cost as your Roth IRA contributions, so your out-of-pocket cost is the same for both the IRA and the IUL. You’ll see that the same spendable cash flow is produced by both the IUL and the Roth IRA.”

“The same $62,939, right?”

“Yes, the same $62,939.”

“Then what’s the difference?”

“Almost $5,500,000 in favor of the IUL.”

Review the comparison below:

| Image 2 |

| Roth IRA vs. Indexed Universal Life |

| (Identical Spendable Cash Flow) |

| For: Erin Coppola |

Click here to review the year-by-year numbers.

Erin remarks, “That means I could have even more spendable money from the IUL.”

“Exactly. Let’s take a look at how much more.”

| Image 3 |

| Roth IRA vs. Indexed Universal Life |

| (Maximum Spendable Cash Flow from the IUL) |

| For: Erin Coppola |

The IUL produces $116,902 in annual spendable cash flow for 30 years starting at age 70. That’s a 295.43% increase in spendable cash flow with no corresponding increase in funding costs. The Roth IRA, endeavoring to match that spendable number, is depleted after just ten years.

Click here to review the year-by-year numbers.

Table 1 below summarizes the results of the IRA vs. IUL examined in Blog #166 (Part 1 of 2) compared to the results of the Roth IRA vs. IUL analyzed in this Blog #167 (Part 2 of 2). There are no valid reasons why Erin should choose either the IRA or the Roth IRA.

| Table 1 |

| Comparison of Erin’s Options |

| IRA vs. IUL |

| Roth IRA vs. IUL |

Note: Some of you may wonder why I didn’t use IUL with high early cash values. With most IUL carriers, high early cash values mean reduced cash values later which reduces the amount of loans that can be made for retirement cash flow. If you find a carrier where this does not occur, by all means use high early cash values if that is your – or your client’s – preference.

Conclusion

I am again reminded of Bill Boersma’s classic comment in his article in the December 2014 issue of Trusts & Estates in which he discusses life insurance as an asset class: “I can only wonder if another asset with the same qualities would be implemented more frequently if it wasn’t called life insurance.”

Using IUL can mean either more net worth or more spendable cash flow with no increase in contributions. Any client that eliminates cash value life insurance as a funding resource for retirement cash flow is effectively saying, “I don’t mind putting my retirement cash flow at risk.”

If you can produce these results for a $5,500 / $6,500 Roth IRA contribution, imagine what you can develop from a comparison to an $18,000 contribution to a Solo Roth 401(k) – you’ll see an example of this below.

Every case can be backed up by our illustration logic that compares continuing contributions to the retirement plan to redirecting those contributions to life insurance premiums leaving current balances in the retirement plan untouched – although if you are careful with your design regarding DOL compliance, you can likely convert these funds as well.

InsMark illustrations can assist you with some aspects of your DOL compliance since the calculations show you are acting in the client’s best interest in recommending cash value life insurance as a supplemental, retirement savings alternative.

Below are additional advantages when life insurance is used:

- There are no federally mandated limits to premiums for life insurance, and once this is understood, many clients will increase their funding for the life insurance (more on this below);

- A waiver of premium can be attached to life insurance in the event of disability;

- Tax free cash flow from the life insurance (withdrawals to basis and/or loans) can be accessed prior to age 59 1/2 with no premature distribution tax;

- Life insurance also provides a significant death benefit (in excess of $700,000 for Erin). Many millennials in single households like Erin don’t have a current need for life insurance death benefits. A useful option may be a temporary revocable charitable beneficiary for all or part of the IUL death benefit. Click here for more information about how to accomplish this.

Older Ages

You may be wondering how this concept works at older ages. The concept discussed in this Blog works for ages well into the 50s. Want some proof? Below is an example for Erin’s older sister, Ashley Coppola, age 45, a highly-paid, motivational coach for senior executives.

Ashley’s comment after viewing Erin’s numbers, “I wish I had started at Erin’s age.”

|

Ashley’s wish doesn’t require a genie popping out of a bottle to reproduce Erin’s results for herself. She is self-employed and is eligible to start a Solo Roth 401(k) with non-deductible contributions which can be as high as $18,000 for someone her age. |

|

And guess what? As you can see below, like Erin, Ashley will be far better off with an IUL alternative bearing the same $18,000 in annual premiums.

| Image 4 |

| Solo Roth 401(k) vs. Indexed Universal Life |

| For: Ashley Coppola, Age 45 |

-vs-Indexed-Universal-Life-769x532.jpg)

|

Ashley’s IUL produces $116,382 in annual spendable cash flow (almost identical to Erin’s $116,902) for 30 years starting at age 70 and totaling $3,491,460. The Solo Roth 401(k), endeavoring to match that level of spendable cash flow, is depleted in 12 years after producing only $1,393,383. |

|

Click here to review the year-by-year numbers.

Note: Ashley’s self-employed sister, Erin (a clinical psychologist), is also eligible for an $18,000 Solo Roth 401(k). If she’s up to it, she can increase her annual, spendable, retirement cash flow to almost $400,000 by using IUL. I included that final analysis as Proposal 4. Solo Roth 401(k) vs. IUL-30 in the Digital Workbook File available below.

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Files For This Blog

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Before downloading any files, be certain you have updated your InsMark Illustration System to Version 17.0 if you haven’t already done so. Update using Live Update available under Help on the main menu bar of either System or this icon on the main menu bar:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #167, click here for a guide to the content. It will be invaluable to you.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer®, Financial Planner, Denver, CO

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS

“InsMark’s Checkmate® Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner when policy loans are present. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” is registered trademarks of InsMark, Inc.