(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the Premium Financing System and Wealthy and Wise®.)

|

|

Note from Bob: A trust-owned premium financing arrangement introduced in Blog #163 (Part 1 of this series) is the cause of much of the superb financial results in this Blog. If you haven’t yet read Blog #163 (Part 1 of 2), this Blog will likely make more sense if you do. |

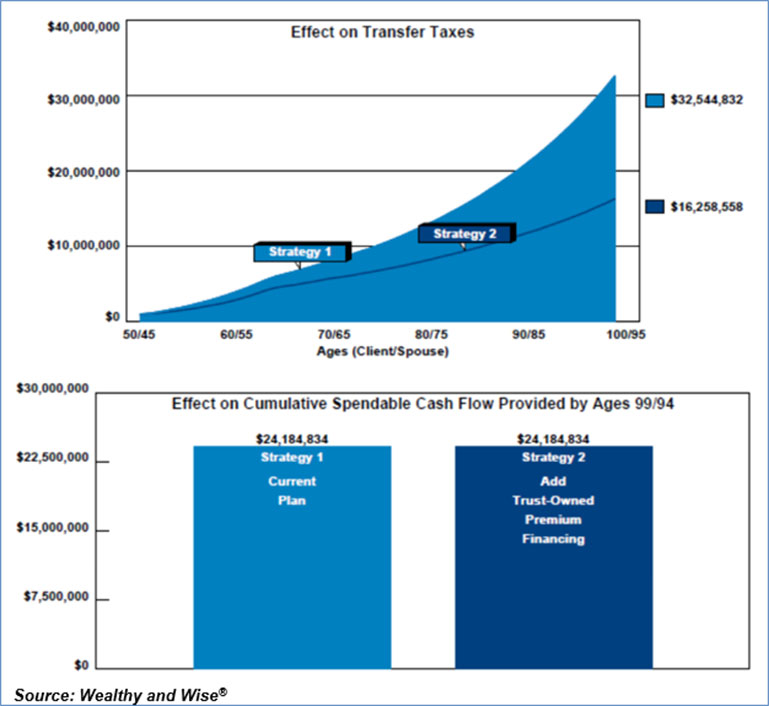

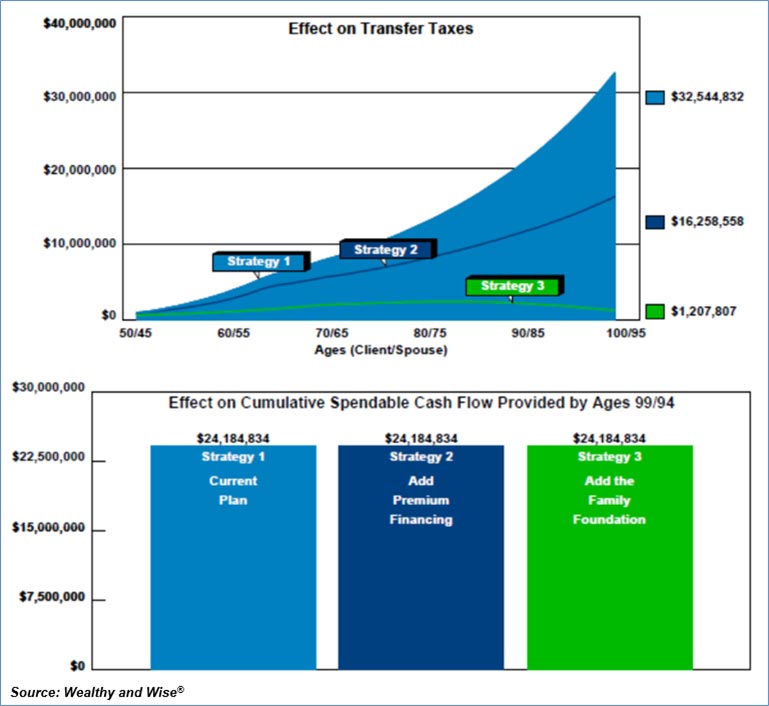

Following up on the recommendations for Arthur and Allison Baxter’s retirement and wealth analysis discussed in Blog #163, Blog #164 presents an enhancement that eliminates almost all of their multi-million estate transfer taxes. As you can see in Strategy 2 in the graphic below, the Baxters’ transfer taxes have been reduced by 50% in Blog #163 through the use of a trust-owned premium financing arrangement. Their spendable, retirement cash flow1 remains the same with either Strategy as all costs of the premium financing arrangement in the Wealthy and Wise analysis are funded from their assets, not from an out-of-pocket expense.

1$400,000 annually from ages 65/60 to 100/95 indexed at 3.00% as an inflation offset.

| Image 1 |

| Transfer Taxes |

| (Image 8 from Blog #163) |

Transfer Taxes

|

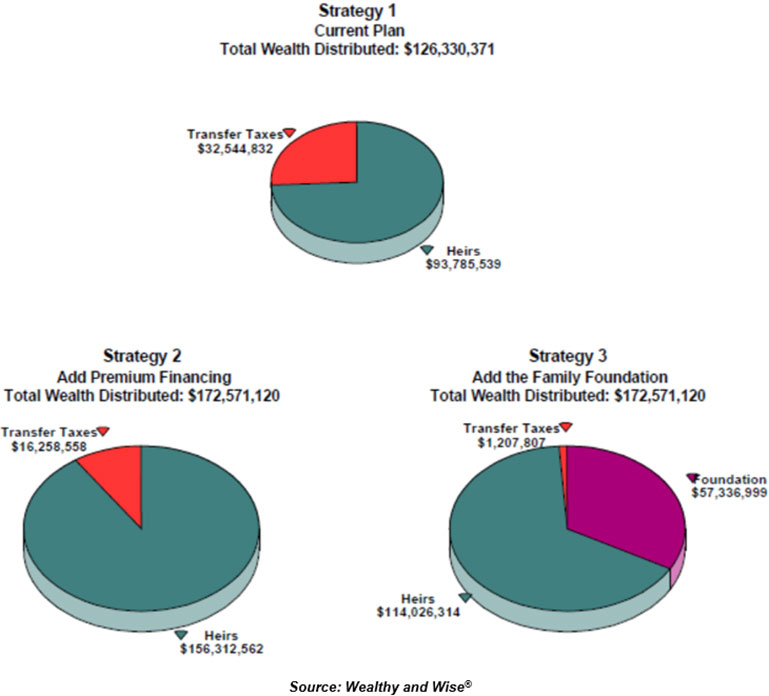

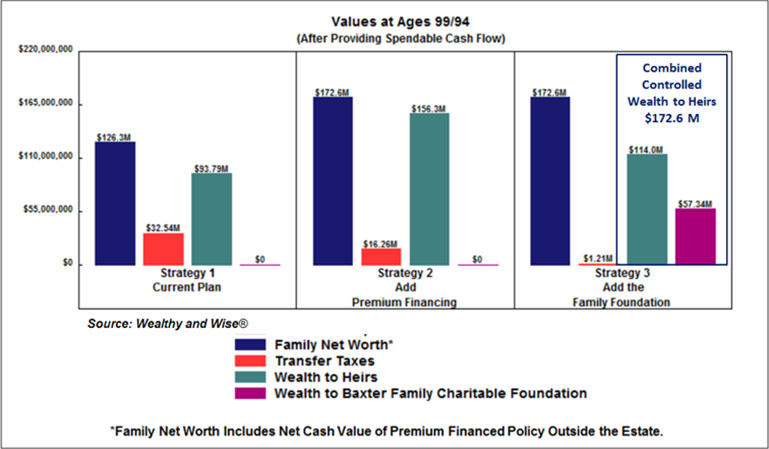

Like the Family Net Worth concept described in Blog #163, the solution to most of the Baxters’ remaining $16 million transfer tax problem can be eliminated through a concept called Controlled Wealth to Heirs where, in this example, one of the Baxters’ assets (the family S corporation currently valued at $5 million) will be directed by a provision in their Wills to the Baxter Family Charitable Foundation managed by heirs. The balance of the estate will be left to heirs in a dynasty trust. |

|

Note: The assumptions used in both Blog #163 and Blog #164 are that the S corporation has annual growth of 5.00% coupled with a dividend yield of 5.00%. The dividend provides current cash flow for the Baxters until their retirement after which it will be retained by the corporation to increase compensation to family members employed by the firm.

Below is a comparative evaluation of the long-range results of the charitable bequest of the S corporation:

| Image 2 |

| Comparison of Alternatives at Ages 100/95 |

Compare the long-range wealth controlled by heirs:

2Trust ($114,026,314) + Foundation Controlled ($57,336,999)

To accept this logic, [some of] the heirs must be part of the management structure of the Foundation.

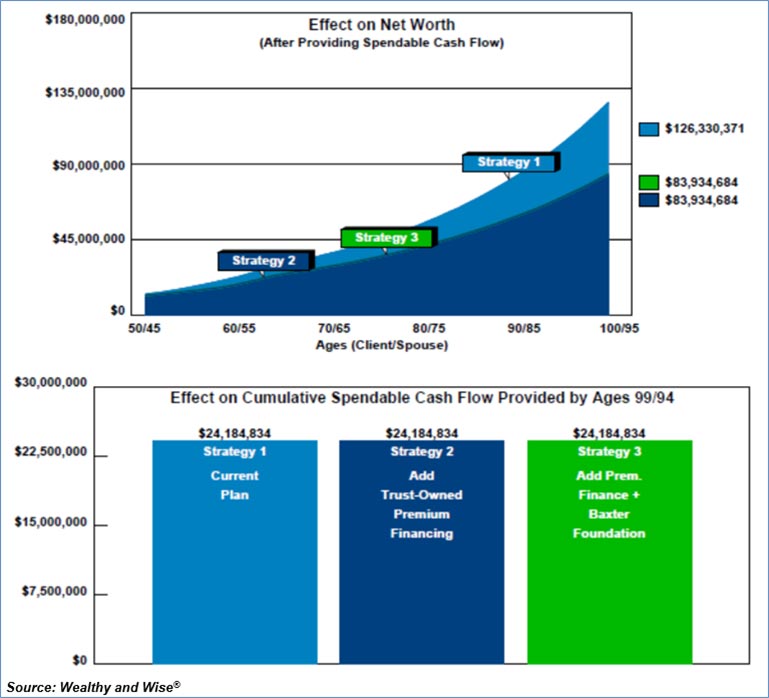

Let’s go through the important graphics for all three Strategies starting with net worth:

| Image 3 |

| Net Worth Comparison |

The net worth of Strategy 3 is identical to Strategy 2 since the Charitable Foundation occurs only at death as a Will bequest. Prior to that, the S corporation asset that is expected to fund the Foundation is freely available to the Baxters. In reality, it is a “change your mind” bequest should the Baxters’ at some point no longer wish to make the bequest.

Next comes the impact of using the Family Net Worth concept. (Family Net Worth is a concept explained and illustrated in detail in Blog #163.)

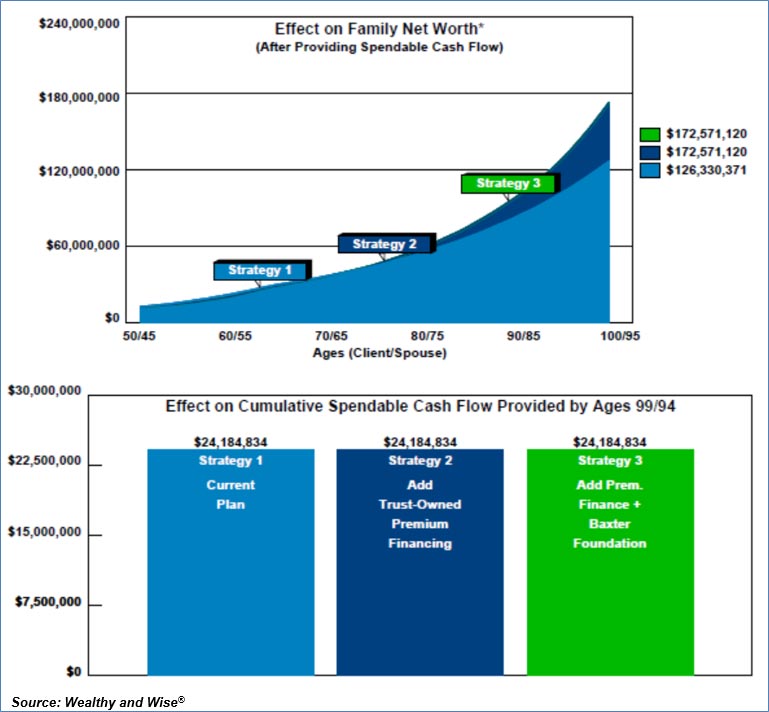

| Image 4 |

| Family Net Worth Comparison |

As you can see in the next graphic involving Transfer Taxes, the charitable component of Strategy 3 further reduces estate transfer taxes. The remaining death taxes are the income taxes on retirement plan assets.

Note: Wealthy and Wise can be directed to add the retirement plan assets to the Charitable Foundation bequest thus eliminating the income tax at death on those funds as well. In order not to complicate this Blog further, I did not include this feature in the analysis, so let’s assume the Baxters accept the $1.2 million of transfer tax in Strategy 3 as a terrific long-range reduction from the $32 million of Strategy 1 and the $16 million of Strategy 2.

| Image 5 |

| Transfer Taxes |

Wealth to the Baxter Family Charitable Foundation is significant. It also adds indirectly to wealth to heirs due to the control features of a family-involved Foundation.

| Image 6 |

| Wealth to Baxter Family Charitable Foundation |

The long-range effect of the bequest to the Charitable Foundation in Strategy 3 produces a reduction in wealth to heirs of $42 million from Strategy 2 (although it is $20 million more than Strategy 1, their current plan).

| Image 7 |

| Wealth to Heirs Comparison |

| Image 8 |

| Summary Analysis of the Alternatives |

All this has been accomplished with no additional out-of-pocket cost for the Baxters as all requirements for retirement cash flow and gifts to the trust have been funded by asset allocation producing what is known as a cash flow neutral analysis.

Click here to view the 96-page Wealthy and Wise evaluation. This includes a third section titled Details of the Bequest to the Foundation in which I included only the reports that deal with this aspect of the case

|

That is still a lot of reports; however, with a Wealthy and Wise presentation, I recommend that you have all the reports for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you never know which report you’ll need to have handy to answer the inevitable question, “Where did this number come from?” Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt which I used for this Blog ? located on the bottom right of the Main Workbook Window: |

|

Conclusion

It makes little difference which estate planning technique is used (trust-owned premium financing, trust-owned private split dollar, GRAT, SCIN, private annuity, LLC, family limited partnership, etc.) for the concept of Family Net Worth to be an effective new tool for your comparative evaluations.

It is difficult to present any of these alternatives as an effective family planning device for your clients without integrating the data within a “do it vs. don’t do it” Wealthy and Wise analysis. The stand-alone numbers of each option need an overall family wealth context to make the most sense ? and the greatest impression on your clients and their advisers.

There is also a potential new benefit to the bequest of the Baxters’ S corporation to their Foundation. In the future, if capital gains taxes becomes due at death (thanks to our tax-obsessed politicians and bureaucrats in Washington), the Foundation approach could save millions in capital gains taxes (tens of millions in later years) on the projected value of the S corporation in this Case Study if the plan is to leave it to heirs.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Before importing either downloaded file into the appropriate InsMark System, be certain to update your InsMark Premium Financing System to Version 4.0 and your Wealthy and Wise System to Version 13.0. Do this using Live Update available under Help on the main menu bar of either System or this icon on the main menu bar in either System:

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark Systems. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook(s) for Blog #164, click here for a guide to the content.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“Standard premium financing illustrations produce much in the way of great data, but it takes the InsMark Premium Financing System to really present compelling numbers; however, the integration of that data into InsMark’s comparative modules like Various Financial Alternatives and Wealthy and Wise is really what makes premium financing sizzle.”

Chris Jacob, CFP, SFI-Cadeau, St. Louis, MO, InsMark Platinum Power Producer®

“As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using a “Financed Premium” concept to solve their financial needs. Because of this, I was able to close three large financed premium cases easier and faster than ever before. As always, InsMark has delivered again. I encourage all who use Premium Finance as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.”

William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer®

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Life insurance illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

“Family Net Worth” is a trademark of InsMark, Inc.