(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this Blog were created using InsMark’s Wealthy and Wise® and the InsMark Loan-Based Split Dollar System)

|

Good as bank-funded premium financing is, self-funded premium financing is often a sound alternative, particularly where there are sufficient liquid assets to support the premium loans needed.

In Blog #126, we examined a client with net worth of $13,600,000, all but $4,000,000 of which was tied up in rapidly appreciating real estate. A considerable amount of trust-owned life insurance was needed. The premiums illustrated ($1,937,112 a year for five years) were substantial enough that the client was uncomfortable using liquid assets to fund them. It was a perfect case for bank-funded premium financing.

In Blog #159, there are sufficient liquid assets to fund the desired premiums for a grantor trust-owned policy. Due to this liquidity, Loan-Based Private Split Dollar (“LB-PSD”) is an irresistible companion to anchor these five components of an impressive wealth planning strategy:

- Desired retirement cash flow;

- Solid net worth;

- Reduced death taxes;

- Increased wealth to heirs;

- Substantial charitable bequest.

Click here for illustration details of the survivor indexed universal life policy used in the LB-PSD illustration.

Click here to review the LB-PSD illustration which is one of the modules in the InsMark Loan-Based Split Dollar System. The policy is presumed owned by an intentionally defective grantor trust.

Case Study

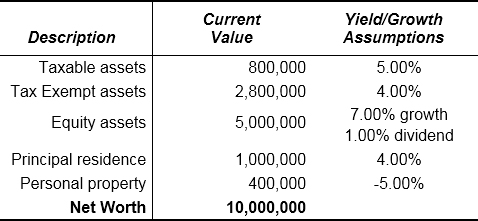

Tom and Donna Anthony are ages 55 and 50. Their current net worth is summarized below:

| Net Worth | ||

| Tom and Donna Anthony | ||

|

|

Tom and Donna want $400,000 in after tax, retirement cash flow indexed at 3.00% beginning at their ages 65/60. They also want to establish a $10 million Charitable Foundation at their death to fund breast cancer research in memory of Donna’s mother who passed away recently. (This planned bequest will not restrict their access to any of their assets as it occurs only at their death based on terms of their Wills.) Let’s see if we can accomplish their two goals (retirement cash flow and charitable bequest) without too much damage to their net worth or the wealth passing to their three children.

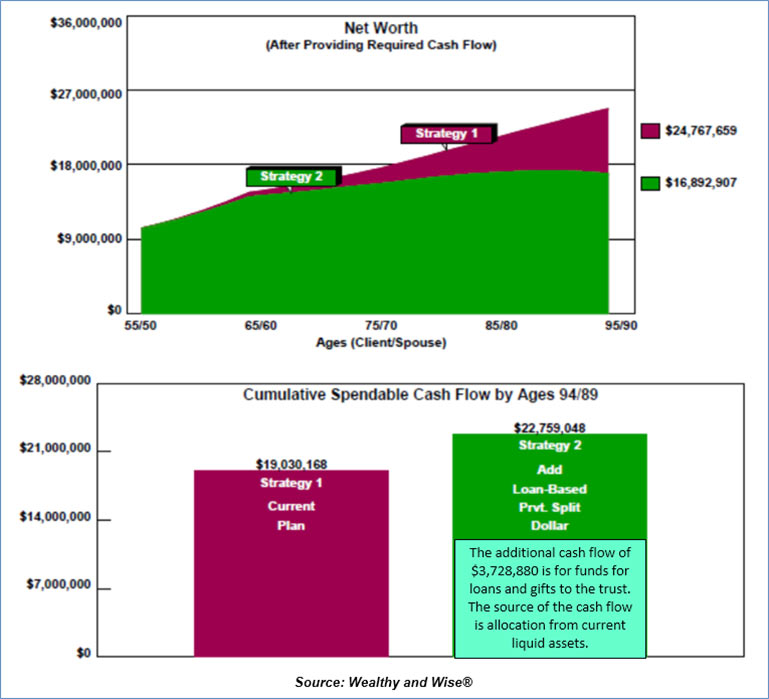

Wealthy and Wise® was used for the estate planning analysis which included the values developed by LB-PSD. After accounting for the cash flow drain of their desired retirement income and loans and gifts to a grantor trust to support the LB-PSD, their net worth is projected to increase from $10 million to almost $17 million by the time they reach 95/90 (two years past their joint life expectancy). The following graphic summarizes those results:

| Image 1 |

| Comparison of Alternatives at Ages 95/90 |

Total wealth distributed increases by over 157% (from $24,767,659 to $39,052,776).

Wealth to heirs increases by over 125% (from $21,124,834 to $26,429,430).

Transfer taxes reduce by over 35% (from $3,642,825 to $2,382,865).

Wealth to Charity goes from $0 to $10,240,481.

Net Worth

You are likely wondering what their net worth would be if they leave their current plan as is and forget about the new strategy. See the graphic below for the comparison.

| Image 2 |

| Net Worth Comparison |

Strategy 2 produces a one-third decrease in net worth caused by the increase in cash flow for loans and gifts needed to support the LB-PSD. That’s a lot of damage. Let’s see what we can do to improve it.

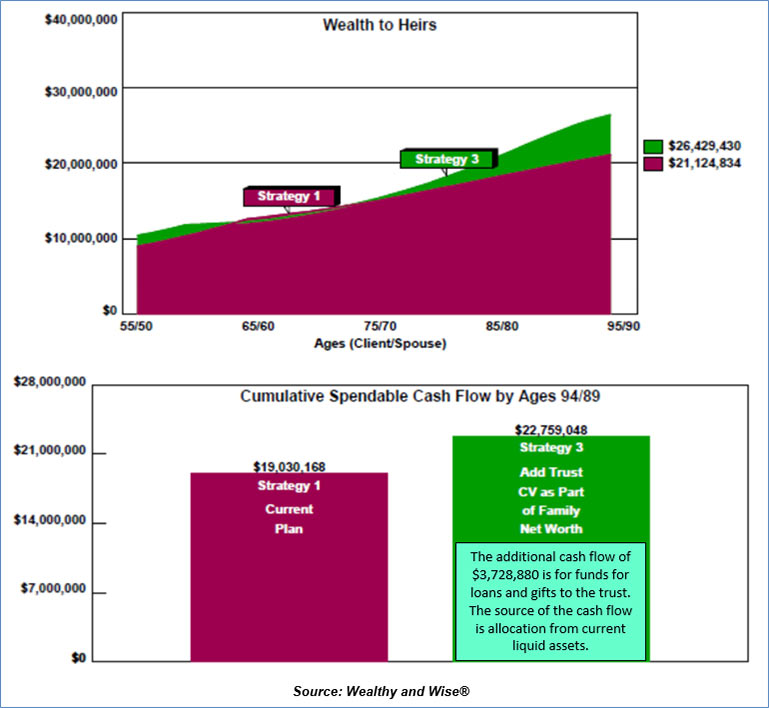

The “Forgotten Money?”

Have we overlooked anything? What about the cash value of the policy in the trust (net of the outstanding loan to the grantor)? So far, the trust’s net cash value has not appeared as a component of net worth; however, it is clearly part of the family’s wealth prior to the deaths of Tom and Donna.

| Image 3 |

| Trust’s 40 Year Analysis |

Using policy loans as a source of funds for the trust, many commentators believe the trust can loan money to Tom and Donna using what is known as a Wrap Trust, a term that has been copyrighted by James G. Blase, JD, LLM, of St. Louis, Missouri, as the Wealth, Retirement, and Asset Protection (WRAP) Trust.

Click here to read a report on the subject of Wrap Trusts that also includes an unusual use of limited powerholders to provide possible grantor access to funds in the trust.

Below is a reflection of Tom and Donna’s net worth in which the cash value of the trust’s policy is included in a category called “Family Net Worth”. This is not double counting of cash values since only the policy death benefit appears in the reports and graphics for wealth to heirs. Adding these values to Family Net Worth has no bearing on the wealth to heirs since, on the death of the second-to-die insured, this aspect of Family Net Worth disappears and is replaced by the tax free life insurance death benefit.

| Image 4 |

| Family Net Worth Comparison |

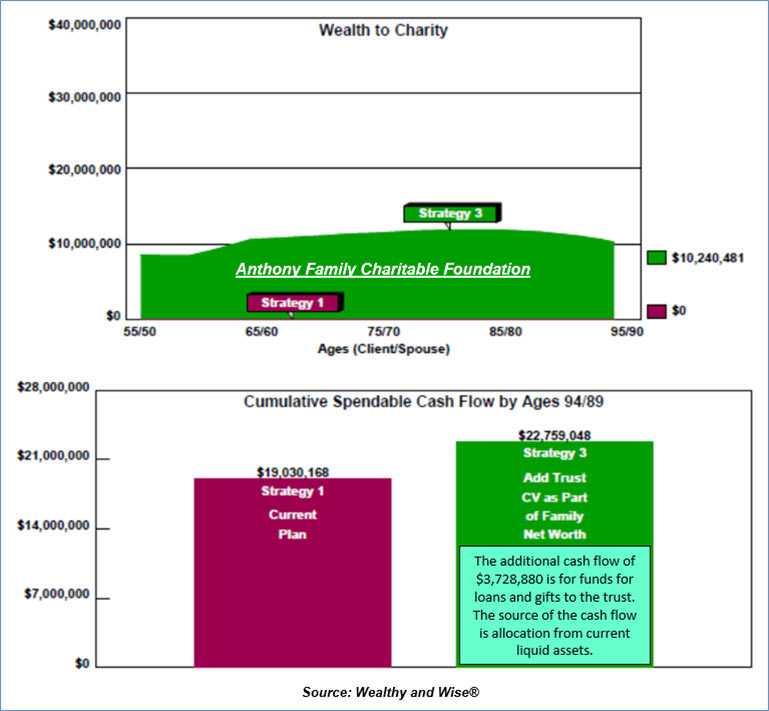

Long-range Family Net Worth in Strategy 3 now exceeds Family Net Worth in Strategy 1 by almost $4.3 million, an increase of 17.3%. As you can see below, Wealth to Heirs has also been increased considerably.

| Image 5 |

| Wealth to Heirs Comparison |

And finally, last but not least, the Anthony Family Charitable Foundation is scheduled to emerge at Tom and Donna’s death.

All this has been accomplished with no additional out-of-pocket cost for Tom and Donna as all cash flow requirements have been funded by asset allocation producing what is known as a Cash Flow Neutral evaluation.

Click here to view the 70-page Wealthy and Wise evaluation.

That’s a lot of reports; however, with a Wealthy and Wise presentation, I recommend that you have all the reports for a given analysis with you when you are visiting with a client or client’s attorney or CPA. The system backs up every number shown, and you never know which report you’ll need to have handy to answer the inevitable question, “Where did this number come from?”

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in supplemental sections or an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of the following prompt which I used for this Blog — located on the bottom right of the Main Workbook Window:

Conclusion

It would be difficult to present LB-PSD as an effective tool for Tom and Donna without integrating its data within a “do it vs. don’t do it” Wealthy and Wise evaluation as the stand-alone numbers of LB-PSD need an overall wealth context to make the most sense. This is true of almost any premium financing arrangement as well as executive benefit plans (as discussed in Blog #158: Integrating Executive Benefit Plans with Retirement Planning).

Some Details

Wealthy and Wise has special receptors that recognize data from our LB-PSD illustrations. Click here to learn how to export data from LB-PSD to Wealthy and Wise.

It is important to use loans – not gifts – from the grantor to fund the trust as gifts are limited by the lifetime gift exemption and available annual exclusions. Loans are not bound by such rules.

The trust associated with LB-PSD is an irrevocable grantor trust. Gifts are made to the trust to cover the cost of the loan interest due to the grantor; however, the grantor owes no income tax on the interest payments received from the trust. Under grantor trust rules, the trust and the grantor are a single income tax entity, and income tax consequences on transactions between them are ignored. (IRC Secs. 671 and 675, IRS Reg. 1.671-2(c), and Rev. Rul. 85-13.)

Can LB-PSD can be funded with a one-time premium? Yes, but that will produce a modified endowment contract (“MEC”) – usually not the best course of action. It can be funded with a one-time loan and avoid MEC status by using our Premium Reserve Account (“PRA”) logic that gradually feeds out premiums that avoid producing a MEC. In Blog #161 (scheduled for May 8), I will illustrate that technique using Tom and Donna’s data.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

If you obtain the digital workbook for Blog #159, click here for a guide to its content.

Special plan documentation is required to support Loan-Based Private Split Dollar. InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) contains a comprehensive set of specimen documents for it in the Wealth Transfer Plans section of documents. Look for Loan Regime Private Collateral Assignment Split Dollar in the Private Split Dollar Plans section of documents. If you are not licensed for DOD and would like more information, go to www.documentsonadisk.com. If you are licensed for DOD, you can access the document sets by signing in at www.insmark.com.

Special plan documentation is required to support Loan-Based Private Split Dollar. InsMark’s Cloud-Based Documents On A Disk™ (“DOD”) contains a comprehensive set of specimen documents for it in the Wealth Transfer Plans section of documents. Look for Loan Regime Private Collateral Assignment Split Dollar in the Private Split Dollar Plans section of documents. If you are not licensed for DOD and would like more information, go to www.documentsonadisk.com. If you are licensed for DOD, you can access the document sets by signing in at www.insmark.com.

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President — Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP®, CAP®, RFC®, Past President International Forum, InsMark Platinum Power Producer®, Encino, CA

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D’Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer®, New York City, NY

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer®, Minneapolis, MN

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.

“Documents On A Disk” is a trademark of InsMark, Inc.