(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System)

|

“Buy term and invest the difference” continues to be the siren song of the uniformed — folks like Dave Ramsey and Suze Orman. I have written several Blogs on the inefficiency of term insurance. Click here to access an inside page of the Blog Index to review them when you have some time for study.

But for now, I want to explore a new way to counter the Permanent vs. Term argument.

Case Study 1a

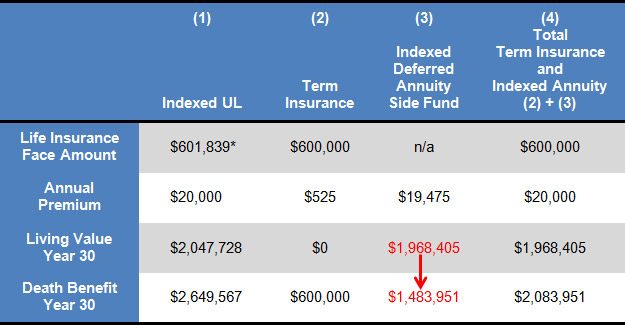

Tom Robinson is age 35. He has decided that Indexed Universal Life (“IUL”) is the policy for him and is considering $600,000 in face amount with premiums of $20,000 a year until his expected retirement at age 65. Values are illustrated at 7.00%

Tom is in a combined federal and state marginal income tax bracket of 35.00%, and I have prepared a comparison to 30-year term with a face amount of $600,000 coupled with a side fund of an indexed tax deferred account (like an Indexed Annuity) yielding the same 7.00% as the IUL.

The term premium is among the lowest I could find on the web -- $525 for $600,000 of 30-year level term.

*The smallest face amount that produces a non-MEC

(increasing death benefit for 30 years; level thereafter)

Red arrow = income tax shrinkage.

Here is the tax calculation for the Indexed Annuity:

- $1,968,405 = value at end of year 30

- $ 584,250 = 30 x $19,475 (cost basis)

- $1,384,155 = gain in the contract (a – b)

- $ 484,454 = income tax at 35.00%

- $1,483,951 = net proceeds (a – d)

Note: Unless the income tax bracket tops out at 35.00% in 30 years, the income tax on the gain in the Indexed Annuity side fund would be considerably higher due to the $1,384,155 gain in the contract being taxed all in one year. But let’s be positive and hope for a future top tax bracket of 35.00%. (The IUL fortunately does not have to deal with this risk.)

Now comes the new illustration strategy – a tax free participating loan of $1,483,951 is scheduled on the IUL at the beginning of year 31 that is sufficient to empty the Indexed Annuity when $1,483,951 is withdrawn from it. The annuity is effectively surrendered while the life policy continues on – with the most extraordinary results.

Real Wealth Involves Sustainable Cash Flow

The transaction leaves sufficient value in the IUL that, starting the next year, it can support tax free annual loans of $100,000 for supplemental retirement cash flow through Tom’s age 95 (and continuing should he live longer). This produces cumulative retirement cash flow of $2,900,000 for a total of $4,383,951 including the $1,483,951 realized at retirement. In addition, the IUL has residual cash value remaining at the end of the analysis of $1,336,676. The Indexed Annuity is depleted at Tom’s age 65.

So -- as Tom’s 30-year term insurance expires, he arrives at retirement with IUL producing tax free capital of the identical amount of after tax capital contained in the annuity side fund ($1,483,951). The IUL also generates $2,900,000 in further retirement cash flow plus residual value of $1,336,676 at the end of the analysis. The IUL is the clear “winner” – it’s not even close.

Here is a snapshot of the summary on the bottom right of Page 3 of 12 of the illustration available below:

Below is a graphic of the results:

Term Insurance and an Indexed Annuity @ 7.00%

vs.

Indexed Universal Life @ 7.00%

Image 1

Click here to review this comparative illustration from the InsMark Illustration System produced by the Permanent vs. Term module on the Personal Insurance tab.

The key illustration pages are Pages 2 and 3 of 12. Equally important are the four pages that follow which detail the Indexed Annuity’s values. Bear down on these four pages to be sure you follow the tax implications of the transaction.

As you can see on Page 8 of 12, the indexed annuity would have to earn 10.35% to match the results of the IUL (335 basis points more than the IUL at 7.00% – almost half again as much).

The graphics starting on Page 9 of 12 are particularly informative.

Case Study 1b

If Tom were to retain the $1,483,951 in the IUL at age 65, his annual after tax retirement cash flow could increase to $204,044 through his age 95 (and continuing should he live longer), a rather amazing result. This would, of course, mean the deferred annuity could also produce after tax cash flow if it is not surrendered, but only an after tax amount of $204,044 for eight years, then $180,082 for one year, at which point it would be depleted.

Here is a snapshot of the summaries of Case Studies 1a and 1b:

Click here to review this comparative illustration from the InsMark Illustration System produced by the Permanent vs. Term module on the Personal Insurance tab.

Conclusion

Hey, Dave Ramsey and Suze Orman, what do you think of us now?

|

Buy term and invest the difference? As usual, cost bears no relationship to value. Clearly, term insurance has its place for those with small budgets or covering short-term needs, but not as a participant in alternatives to cash value life insurance. |

|

The next time you run into a prospect that raises the “invest the difference” argument, ask this question: “Do you dislike cash value life insurance so much that you’ll sacrifice yield just to avoid it?”

This almost always generates this response, “What do you mean?”

Respond with, “I need fifteen minutes to show you. When can we do that?”

Try asking it this way with a hostile attorney or CPA who indicates a preference for term, “Do you dislike cash value life insurance so much that you’ll recommend your clients sacrifice yield just to avoid it?” Be prepared, it will annoy them.

Sales suggestion: Always bring a comparison to term and invest the difference with you to any interview – even if you think you won’t need it. You may not need it, but is it ever valuable if you do. You never know when this issue will surface. Imagine an interview where your prospect (or his attorney or CPA who happens to be present) brings this up just as you are ready to close the sale. The comparative analysis requires a demonstration of the math involved, and it is difficult to do it without the proof of the numbers. So have several of them with you.

Click here for some information about preparing this illustration that will be helpful if you want to duplicate as I have shown. (Downloading the digital workbook file for Blog #146 below will also be helpful as you can see the precise keystrokes I used in the InsMark Illustration System to prepare the illustration.)

More on the Subject

In Blog #147: New Logic for Permanent vs. Term (Part 2), I’ll examine buy term and invest the difference with the “difference” in an equity account with growth at 7.00% plus a 2.00% dividend, the latter being the missing component of the typical index associated with IUL. (It’s the price paid for no downside below a 0.00% yield with IUL.)

I’ll also discuss the impact of what happens to this analysis in a future world of increased taxes. Although the election of Donald Trump likely delays this from happening, I think it is ultimately inevitable in view of the expected growth of the federal deficit due to unfunded entitlements and the lurking menace of major increases in interest rates on federal debt.

In Blog #148: New Logic for Permanent vs. Term (Part 3), I’ll examine permanent vs. term in the context of a comprehensive Wealthy and Wise® evaluation comparing retirement cash flow, net worth, and wealth to heirs.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

New Zip File Downloaders

Watch the video.

Experienced Zip File Downloaders Download the zip file, open it, and double click the Workbook file name to open it in your InsMark System.

If you obtain the digital workbook for Blog #146, click here for a Guide to each of the illustrations.

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing InsMark Systems

To license any of the InsMark software products, visit our Product Center online or contact Julie Nayeri at Julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

For help on how to use InsMark software, go to The Quickest Way To Learn InsMark.

Testimonials

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer®, Grafton, WI

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer®, Top of the Table, International Forum, Pasadena, CA

“InsMark’s Checkmate® Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.

“InsMark” and “Wealthy and Wise” are registered trademarks of InsMark, Inc.