(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System

Assuming there are sufficient profits, almost all forward-thinking companies reward important key executives with special benefits, e.g., bonus plans, split dollar, salary continuation, stock options, etc.

If executives are valuable enough to be provided with a significant fringe benefit, they should also be covered with a business-owned key executive policy to indemnify the business against losses created by their death. There is a very efficient way to accomplish both issues.

Executive Trifecta®

“Trifecta” refers to a winning sequence of three and is typically associated with a pari-mutuel bet in horse racing that involves picking the exact order of which horses will finish first, second, and third in a given race.

We have given the name Executive Trifecta to the trifecta of benefits described in this Blog, and this plan can be illustrated in the InsMark Illustration System (located on the Executive Benefits tab).

Executive Trifecta is highly suitable for non-owner key executives of any business (profit-making or tax exempt), but it is also effective for principals of C Corporations, S Corporations, LLCs, LLPs, and Partnerships. It may surprise you that it works better for principals of an S Corporation and even better for principals of an LLC, LLP or Partnership. (More on this appears below.)

The Case Study that follows examines how Executive Trifecta can work for an important executive of an S Corporation who has no ownership interests in the company.

Case Study

Tony Jamison is Executive Vice President and General Manager of Town and Country Auto Group, Inc., a multi-brand, multi-city, new car dealership operating as an S Corporation. Tony is a classic rainmaker of corporate revenue for Town and Country Auto, and the company is vitally interested in providing him with an irresistible executive benefit that will ensure his employment for at least the next 10 years.

“Trifecta” refers to a winning sequence of three -- and Executive Trifecta delivers three, very powerful, sequential benefits. Here is how it works:

- Selected key executives are insured in favor of the employer;

- In pre-retirement years, a portion of each policy’s death benefit is allocated to provide survivor income benefits to the insured executive’s family;

- At a designated age, ownership of the life insurance policy is contractually transferred to the executive (as a deferred bonus) thereby creating a supplemental retirement asset.

Key Executive Coverage

With Executive Trifecta, the face amount of the life insurance policy is established using either of the following two options:

Option 1: The employer makes an arbitrary decision as to the amount, or;

Option 2: The software calculates the appropriate amount using employer estimates as to:

- The loss of revenue for the time it takes a replacement executive to match the performance of the current executive;

- The expected compensation differences between the current and replacement executive;

- Other replacement costs such as signing bonus, relocation package.

I used Option 1 in the following analysis in this Blog to establish coverage of $2,500,000 to be retained by Town and Country Auto Group (the Plan Sponsor) to indemnify it against the loss of Tony due to his death. (See Blog #44 for an example of Option 2 where the executive is a non-owner of a Limited Liability Company.)

Survivor Income Benefit

The software has a “smart solve” Survivor Income Benefit Calculator which establishes the amount of coverage needed to fund the Plan Sponsor’s payments to Tony’s family. In this Case Study, we illustrated a benefit of $300,000 a year for 10 years which included a 3.00% cost of living adjustment as hedge against inflation. The Survivor Income Benefit Calculator indicated that $1,753,806 of coverage is needed to fund the present value of the employer’s after tax cost of this survivor benefit. Tony’s family will receive income paid over 10 years totaling $3,439,164 should his death occur any time in the next 10 years.

This produces a policy death benefit of $4,253,806 -- the combination of the death benefit to be retained by the Plan Sponsor ($2,500,000) and the amount needed to fund the present value of the survivor income benefit ($1,753,806).

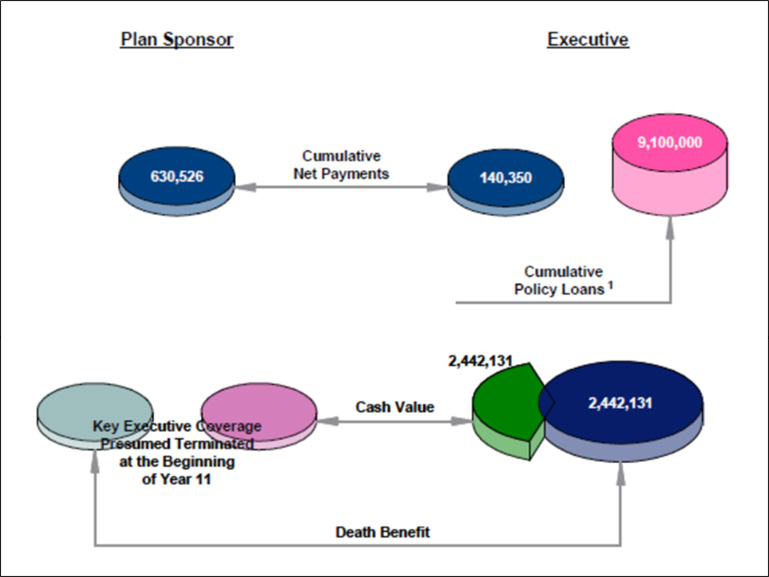

Policy Transfer - beginning of year 11

(Policy values are effectively the same as the end of year 10)

In our example, we scheduled the transfer of the policy to the executive at the beginning of year 11 at which time all policy values (accumulation values of $877,189 and death benefits of $4,253,806) become personally owned by Tony. He owes income tax on the $877,189 which, in his 40% income tax bracket, costs him $350,875. This is offset by a bonus from the Plan Sponsor of $350,875 requiring an out-of-pocket cost to Tony of $140,350 (40% of $350,875).

Note: This is just one of many bonus options. For example, a gross-up bonus (also known as a “double bonus”) could be used to offset all Tony’s costs for the transfer.

Below is the financial summary of what Town and Country Auto Group is providing Tony in exchange for his loyal employment over the next 10 years:

- Almost $3,500,000 of survivor income benefits for his family if he dies anytime during the next 10 years;

- Beginning in year 11, a personal life insurance policy with no further premiums due with a face amount of $4,253,806 and current cash values approaching $1,000,000;

- After tax retirement cash flow of $260,000 a year that totals more than $9,000,000;

- Long-range residual cash value of almost $2,500,000.

Tony’s cost for all this is $140,350 of income tax in year 11, and that tax could easily be funded by Tony using a participating loan on the policy after the transfer.

This transaction is a contractually guaranteed option to acquire a seasoned IUL policy, and I suspect you now understand why I sub-titled this Blog:

| IUL - An Alternative to Stock Options |

For a variety of reasons, many family-owned companies are unwilling to use classic stock options - not the least of which is a reluctance to deal with non-family, minority stockholders once the options are exercised.

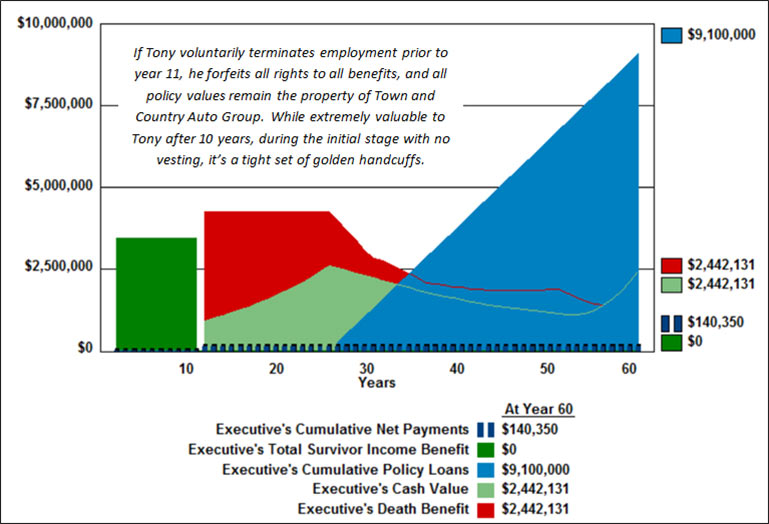

Below is a graphic of the plan’s costs and benefits from Tony’s age 40 to 100:

| Image 1 |

| Summary of Costs and Benefits |

Details of the Plan

Click here to review Tony’s numbers on Page 1. Note on Page 3 that he would need to earn a pre-tax rate of return in excess of 30.00% on his $140,350 cost in year 11 in order to match his results of the plan (and this ignores the value of the survivor income benefits in years 1-10 as well as the policy death benefit for his survivors thereafter).

Below is a graphic of Tony’s results:

| Image 2 |

| Trend Lines of Tony’s Costs and Benefits |

Click here to review the costs and values for Town and Country Auto Group. Over 10 years, it costs this Plan Sponsor $700,000 in policy premiums offset by substantial cash values. (At the end of 10 years cash values total $857,031, a gain of $157,031 over premiums paid.) At the beginning of year 11, these values are transferred to Tony resulting in a small after tax gain to the Auto Group. (See the Details of the Tax Consequences report down a few lines.)

Click here to review the funding for the survivor income benefits. There is no additional cost to Town and Country Auto Group to provide this benefit as $1,753,806 of the policy death benefit is reserved for this purpose (see year 1, Column 3). $1,753,806 is the present value at 6.00% of the after tax cost of providing the stream of survivor benefits shown in Column 1.

Click here to confirm “Details of the Tax Consequences” to both the Plan Sponsor and Tony that are associated with the transfer of the policy at the beginning of year 11 (reflecting end of year 10 values). The income tax savings of $280,000 to the Plan Sponsor caused by the transfer of the policy to Tony are reduced by the $210,526 after tax cost of the bonus paid to Tony to assist with his tax cost of the transfer resulting in a gain of $69,474 which reduces the Plan Sponsor’s funding to $630,526 ($700,000 minus $69,474). Click here to review those calculations.

It is unusual for me to show you pieces of the overall illustration one at a time. I have done so because Executive Trifecta can appear very complex the first time you look at it, and I wanted to give you a preliminary heads-up before you review it in its entirety.

Click here to review all the reports associated with this benefit plan. Executive Trifecta has a composite feature where costs and benefits for several executives can be illustrated. While you generally would not produce a composite for just one executive, I included the composite with this case because the summary numbers on illustration Pages 2, 3, 4, and 5 are so powerful - and probably welcome as this simplifies the moving parts of this benefit plan.

The detailed illustrations for Tony’s plan begin on illustration Page 10. A Flow chart of the Executive Trifecta process is on illustration Page 11. It may look complicated, but study it carefully as it will help guide you through the reports that follow.

A Benefit Summary -- sort of a road map -- appears on illustration Page 12 where highlights of each feature are listed along with the name of the specific report that illustrates each one. Special thanks to Kerry Walker, InsMark Platinum Power Producer, for not only suggesting the Benefit Summary but also helping us design it.

Conclusion

Is the plan worthwhile for Tony? This is easy -- absolutely yes!

Is the plan worthwhile for Town and Country Auto Group? Assuming Tony’s high value to the company over the next ten years -- absolutely yes!

What if Tony is not interested in participating in the plan? Some serious management information will have been discovered as Tony may be considering alternate employment. Any advance notice of it - or even a suspicion of it - is a valuable management tool.

Repeat the Benefit Plan in Year 11?

What happens after ten years? All Tony’s benefits are vested after ten years, so after that he can depart without penalty. Can the Auto Group convince him to stay longer? They likely can by duplicating the benefit plan over the following ten years!

Advantages of Executive Trifecta over Loan-Based Split Dollar:

- No Applicable Federal Rates apply;

- No compliance with split dollar regulations required;

- No liability for the executive in the early years of the policy due to surrender charges;

- No IRS issues with bonuses;

- The plan is suitable for executives of a public business (i.e., no conflict with Sarbanes-Oxley as is the case with Loan-Based Split Dollar).

Business Types

|

The tax details are different depending on whether the executive is an owner or non-owner -- as well as whether the firm is a C Corporation, S Corporation, LLC, or Partnership. The Sample Illustrations section for Executive Trifecta in the InsMark Illustration System contains illustrations for all these business entities. You will be amazed at the efficiency of plans for owner-executives of S Corporation, LLCs, and Partnerships. The transfer tax costs are significantly reduced for owners of S Corporations and are totally eliminated for owners of LLCs and Partnerships. Executive Trifecta is one of the few benefit plans for pass-through entities with more leverage for owners than non-owners. (We can also illustrate plans for executives of tax exempt organizations.) |

|

Click here for Tax Notes detailing the income tax consequences of any of the referenced business types.

Click here for a comprehensive PowerPoint presentation with examples of all variations of Executive Trifecta for different business types and their executives.

Documentation

InsMark’s Cloud-Based Documents On A Disk™ has specimen documents for implementing Executive Trifecta located in both the Business Owner Benefit Plans and Key Employee Benefit Plans section of documents. (Note: This link will take you to the DOD promo site. If you are licensed for DOD, go to www.insmark.com and select My InsMark from the home page for access to the full version of DOD.)

InsMark’s Cloud-Based Documents On A Disk™ has specimen documents for implementing Executive Trifecta located in both the Business Owner Benefit Plans and Key Employee Benefit Plans section of documents. (Note: This link will take you to the DOD promo site. If you are licensed for DOD, go to www.insmark.com and select My InsMark from the home page for access to the full version of DOD.)

Licensing InsMark Systems

To license the InsMark Illustration System, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President - Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“My experience with InsMark’s Executive Trifecta is career changing. Showing this idea to a business owner is a win-win-win! The business owner wins by protecting and retaining one of his most valuable assets (a key executive). The executive wins by being recognized and rewarded for efforts, results, and loyalty. The financial professional wins by gaining the confidence and business of a new client. This concept can revolutionize a financial services career.”

Kerry L. Walker CLU, ChFC, InsMark Platinum Power Producer®, The Walker Firm, Inc., Aurora, CO

“InsMark is the Picasso of the financial services world — their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer®, Overland Park, KS

Important Note #1: The hypothetical values associated with this Blog assume the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.