(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using InsMark Illustration System

|

Strategy 1: Stretch IRA

Strategy 2: Charitable IRA

Strategy 3: Roth Conversion

In Part 1 of this series (Blog #133), we compared Stretch IRA vs. Charitable IRA vs. Roth IRA for Harry and Angela Dorsey who are ages 55 and 50, respectively. Their current net worth is a little over $5 million of which $800,000 is in Harry’s IRA. They plan to retire in ten years and want $150,000 a year in after tax cash flow indexed at 3.00% as inflation offset.

Stretch IRA: This involves naming heirs as the final beneficiary of the IRA.

Charitable IRA: This involves naming a charitable organization as the final beneficiary of the IRA and replacing its value for heirs with $1.5 million of indexed survivor universal life coverage bearing a $25,000 annual premium and paid by withdrawals from their liquid assets.

Roth IRA: This involves converting the IRA to a Roth IRA with the income tax caused by the conversion paid by withdrawals from their liquid assets.

The purpose of this Blog is to compare the effect of leaving their daughter, Caroline Dorsey Baker, currently age 25, either the Stretch IRA or the Roth IRA. (The difference in favor of the Roth is substantial.)

Note: If you did not read Blog #133 (Part 1 of 2), this would be a good time to review it as the details in it are important as well a sequential preview to your understanding of this Blog. The life insurance sale associated with Blog #133 is even more of a slam-dunk when coupled with the information in this Blog.

Case Study

Harry and Angela’s daughter, Caroline, is currently age 25. Let’s assume she will inherit either retirement plan in 38 years at her parents’ joint life expectancy of ages 92/87, which will be Caroline’s age 63.

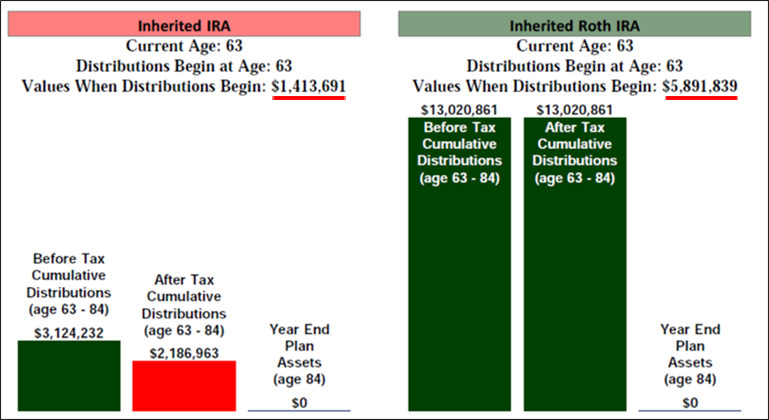

Below is the comparison of Caroline’s Inherited IRA vs. her Inherited Roth IRA (both inherited versions have required minimum distributions).

| Image 1 |

| Inherited IRA vs. Inherited Roth IRA |

| Caroline Dorsey Baker at age 63 |

| Assumed Yield 7.00% |

The Inherited Roth IRA provides Caroline with 595% greater after tax cash flow for her retirement than the Inherited IRA. Once shown the difference, most parents with sufficient liquid assets to fund the income tax on the Roth Conversion are eager to convert an IRA to a Roth.

If you are not including the giant impact on heirs of inheriting a Roth IRA in your presentations, you are missing out on a major benefit for your clients that they likely have never considered or been shown.

Why is there such a discrepancy between the two options?

By Harry and Angela’s joint life expectancy of ages 92/87, the required minimum distributions from their IRA have reduced its value to $1,413,691. When inherited by Caroline, it produces cumulative after tax cash flow for her retirement of $2,186,963 from her age 63 to 84 at which point required minimum distributions have exhausted the Inherited IRA.

Conversely, by her parent’s joint life expectancy, the Roth, with no required minimum distributions, has developed an initial value for Caroline’s Inherited Roth IRA of $5,891,839 which produces cumulative after tax cash flow for her retirement of $13,020,861 from her age 63 to 84 at which point required minimum distributions have exhausted the Inherited Roth IRA.

Click here to review all the illustrations and graphics from the Inherited IRA vs. Inherited Roth IRA comparison calculated using the InsMark Illustration System.

What about the difference in cash flow for her parents during their retirement years? Doesn’t ending up with much more in the Roth IRA means Caroline’s parents are short-changing their own retirement? No – in the Roth analysis in Wealthy and Wise in Blog #133, both scenarios (IRA and Roth IRA) provide the identical level of after tax retirement cash flow -- $150,000 a year indexed at 3.00% as an inflation offset.

In Wealthy and Wise, except for occasional cases where cash flow is not a consideration, required cash flow is the dominant consideration for all scenarios. When cash flow from an IRA’s required minimum distributions disappears because the IRA has been converted to a Roth which has no distribution requirements, Wealthy and Wise provides the missing cash flow from another asset based on the user’s prioritization1 of assets. It could come from or another liquid asset or even the Roth itself. If there is no other liquid asset available, the program advises you of it.

1Note to InsMark’s Wealthy and Wise licensees and prospective licensees: It is critical for sound retirement planning to prioritize which assets to access for cash flow and in what order. To do so, activate the following selection on the “Prioritize the Use of Assets” sub-tab located on the Illustration Details tab (after you have entered desired cash flow, expected cash flow, retirement plans, and liquid assets).

Click here to see an 8-minute video, the first 4 minutes of which highlights the logic of the Maximize Net Worth selection. The last four minutes discusses gifts to a trust for the purchase of life insurance trust and a Roth conversion.

Source of the Inherited IRA and Inherited Roth IRA Calculations

Three calculators from the InsMark Illustration System (InsCalc tab) were used to produce the Image 1 graphic above:

- Inherited IRA Calculator

- Inherited Roth IRA Calculator

- Comparison of Inherited IRAs Calculator

Once your data entry is complete for both Inherited Calculators, the results can be easily imported into the Comparison of Inherited IRAs Calculator (follow the prompts on the first screen).

To establish the initial inherited value for each calculator at Harry and Angela’s joint life expectancy at ages 92/87, click the following reports from the Wealthy and Wise? evaluation in Blog #133 (Part 1 of 2).

In the Wealthy and Wise system associated with Blog #133 (Part 1 of 2), both reports are the last ones shown in the “Selected reports” listing on the Report Selections tab in the first and third Scenarios. The digital Workbook file from Wealthy and Wise Blog #133 (Part 1 of 2) showing complete data input is available below.

This data from year 38 in each of the Wealthy and Wise reports for the parents noted above was entered into Caroline’s Inherited IRA Calculator and Inherited Roth IRA Calculator located on the InsCalc tab in the InsMark Illustration System. Don’t forget, Caroline is assumed to be age 63 at this point (current age 25 + 38 years). The results from each of her calculators were then easily imported into the Comparison of Inherited IRAs Calculator (InsCalc tab) which is source of Image 1 above. The digital Workbook file from the InsMark Illustration System showing complete data input for each of the three calculators is available below.

Note: To prepare reports similar to the ones featured in this Blog, you will need access to both the InsMark Illustration System and Wealthy and Wise.

Video of the Logic

To study videos of these IRA/Roth IRA concepts (or if you have staff that could benefit from viewing them), click on the 12-minute video below which highlights all the features of Stretch IRA vs. Charitable IRA vs. Roth Conversion. Included in the second half of that video is a comparison of an Inherited Roth vs. an Inherited Roth IRA. The video deals with slightly different case data; however, the principles involved are identical to those discussed in Blog #133 (Part 1 of 2) and Blog #134 (Part 2 of 2).

| Three Smart IRA Strategies |

| Steve Savant, Syndicated Financial Columnist |

| Don Prehn, Senior Adviser to InsMark |

Licensing InsMark Systems

To license the InsMark Illustration System and/or Wealthy and Wise, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President – Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer?, Grafton, WI

“InsMark provides incredible tools to give clients a visual of how they can optimize their wealth. It’s great for deciding which road to go down.”

Jim Heafner, MBA, CFP, Heafner Financial Solutions, Inc., Charlotte, NC

"InsMark has important marketing information for every one of the producers in my firm — from the newly licensed to the veteran producer."

Gary Curry, President and CEO, ORBA Insurance Services Inc., InsMark Platinum Power Producer?, Gold River, CA

Important Note #1: The hypothetical IRA and Roth IRA values associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable.

Important Note #2: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.