(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System

|

Summary of Part 1 and Part 2

As you will recall from Blog #127, Hawthorne Construction, Inc., has decided that part of a new benefit plan for Alex Demas will include a Leveraged Executive Bonus Plan funded with $2,875,000 of indexed universal life (IUL). The policy is max-funded with five level premiums of $100,000 financed with deductible bonuses by the company paid to Alex. Alex will pay the annual income tax on each bonus with funds from a bank loan secured by the cash value of the IUL.

We integrated data from the illustration in Blog #127 into an overall wealth evaluation using our Wealthy and Wise? System which developed some amazing results for Alex and his wife, Ana.

In Blog #128, we introduced an incentive feature called “Controlled Executive Bonus” where we added a condition to Alex’s bonus arrangement that the bonuses must be repaid if he voluntarily leaves the firm during the next 10 years.

A portion of the analysis in Blog #127 included the conversion of $500,000 in IRA assets into a Roth IRA. The conversion of an IRA to a Roth IRA is clearly superior for Alex and Ana compared to retaining the IRA as their long-range net worth is increased by almost $8 million. The income tax generated by the conversion is paid by a withdrawal for their liquid assets -- it is not an out-of-pocket cost. As a result, Alex and Ana consider the income tax an investment, not a cost.

Part of the analysis in Blog #127 includes the conversion of $500,000 in IRA assets to a Roth IRA. The income tax generated by the conversion is paid by a withdrawal for their liquid assets -- it is not an out-of-pocket cost. As a result, Alex and Ana consider the income tax to be an investment, not a cost, as it is the key to an increase in their long-range net worth of almost $8 million.

Note: Any future contribution to a retirement plan by Alex and/or Ana should likely be directed to a Roth IRA.

Part 3 of the Series

How about Inherited IRAs vs. Inherited Roth IRAs for heirs?

Alex and Ana’s daughter, Lexie, is currently age 15. Let’s assume she inherits the retirement plan in 50 years at her parents’ joint life expectancy of ages 89/89, which will be Lexie’s age 65.

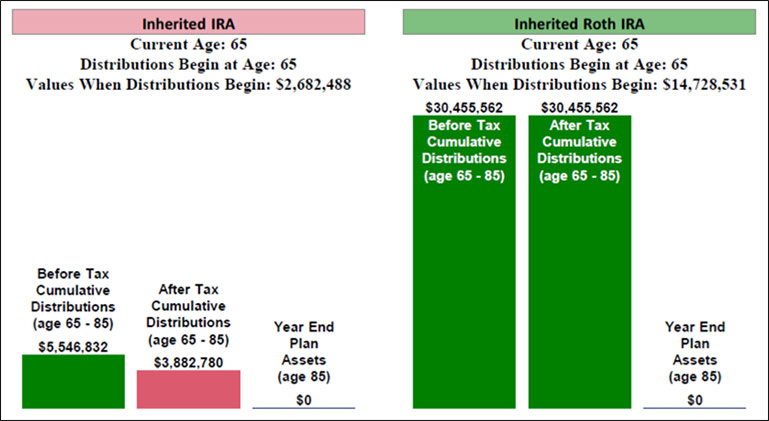

Below is the comparison of Lexie’s Inherited IRA vs. her Inherited Roth IRA.

| Inherited IRA vs. Inherited Roth IRA |

| Lexie Demas at age 65 |

| Assumed Yield 7.00% |

The reason for the discrepancy between the two options? By Alex and Ana’s joint life expectancy, the required minimum distributions (RMDs) from the IRA result in an initial value for Lexie’s Inherited IRA of $2,682,488 which produces after tax cash flow for her retirement of $3,882,780,171. The Roth, with no RMDs, develops an initial value for Lexie’s Inherited Roth IRA of $14,728,531 which produces after tax cash flow for her retirement of $30,455,562 -- 784% greater than the Inherited IRA. This alone is reason enough for Alex and Ana to convert the IRA to a Roth IRA.

If you are not including the giant impact on heirs of inheriting a Roth IRA in your presentations, you are missing out on a major benefit for your clients that they likely have never considered or been shown.

Click here to review the Inherited IRA vs Inherited Roth IRA comparison from the InsMark Illustration System.

Source of the Inherited IRA and Inherited Roth IRA Calculations

Three calculators from the InsMark Illustration System (InsCalc tab) were used:

- Inherited IRA Calculator

- Inherited Roth IRA Calculator

- Comparison of Inherited IRAs

To establish the beginning values at Alex and Ana’s joint life expectancy at ages 89/89, we used the Defined Contribution Transfer Tax (Summary) report in Scenario 1 and the Roth Defined Contribution Transfer Tax (Summary) report in Scenario 3 in their Wealthy and Wise evaluation in Blog #127. (Those reports are the last ones shown in the Selected Report listing on the Report Selections tab list in those Scenarios.)

Derived from the Wealthy and Wise evaluation in Blog #127, we used the Defined Contribution Transfer Tax (Summary) report in Scenario 1 and the Roth Defined Contribution Transfer Tax (Summary) report in Scenario 3 to establish the beginning values of Lexie’s inherited retirement plan.

Click here to review those Wealthy and Wise reports. The value I used as the initial balance for Lexie’s Inherited IRA ($2,682,488) is at her parents’ ages 89/89 in Column (4) on Page 2. The value I used as the initial balance for Lexie’s Inherited Roth IRA ($14,728,531) is at her parents’ ages 89/89 in Column (4) on Page 4.

This data from the Wealthy and Wise reports was entered into each plan’s respective calculator (IRA Calculator and Roth IRA Calculator) on the InsCalc tab in the InsMark Illustration System (“IIS”). The results of each were then easily imported into the Comparison of Inherited IRAs Calculator in the same location which is source of the graphic image above. The IIS Workbook with all three calculators is available below.

Note: If you would like to review these two Wealthy and Wise evaluations in the context of Blog #127, go to the section entitled InsMark’s Digital Workbook Files and download it to your computer and then you may open it with Wealthy and Wise.

Conclusion

The benefits for Lexie Demas all stem from the power of the Leveraged Executive Bonus Plan featured in this three-part series of bank-funded income tax on the bonuses. Without the introduction of that plan’s benefits into the Wealthy and Wise analysis for her parents, none of the features described in Blogs #127, #128, and #129 would be present.

Here is a short summary of the three Blogs in the series:

Hawthorne Construction, Inc., deducts the bonuses paid to Alex resulting in an annual after tax cost of $65,000 a year for five years.

Alex is rewarded with an executive fringe benefit which, at no personal cost, provides:

- Pre-retirement, tax free death benefit of $2 million+ for his family;

- After tax retirement cash flow totaling $4.8 million;

- Residual policy cash value of $1.7 million.

- Residual policy death benefit of $1.8 million.

Hawthorne Construction, Inc., adds a Controlled Bonus feature to Alex’s benefit plan which provides it with near certainty of Alex’s employment for at least the next 10 years.

Blog #129:

A major result of the Roth conversion (outlined in Blog #127) results in a benefit to Alex and Ana’s daughter, Lexie, of an inheritance of an after tax income stream totaling over $30 million through her age 85. (The Inherited IRA and the Inherited Roth are both subject to RMDs. As a result, either inherited account is exhausted by Lexie’s age 85.)

Licensing InsMark Systems

To license the InsMark Illustration System, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer?, Financial Planner, Denver, CO

“InsMark is the Picasso of the financial services world ? their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer?, Overland Park, KS

“Standard bank financing illustrations produce much in the way of great data, but it takes the variations available in the InsMark Premium Financing System to really present compelling numbers; however, the integration of that data into InsMark’s comparative modules like Various Financial Alternatives and Wealthy and Wise is really what makes premium financing sizzle. The inherited IRA calculations add even more.”

Chris Jacob, CFP, SFI-Cadeau, InsMark Platinum Power Producer?, St. Louis, MO

“As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using bank loans to solve their financial needs. Because of this, I was able to close three large financed cases easier and faster than ever before. As always, InsMark has delivered again. I encourage all who use bank financing as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.”

William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer?

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP?, CAP?, RFC?, International Forum Member, InsMark Platinum Power Producer?, Encino, CA

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.