(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the Premium Financing System and Wealthy and Wise®.)

Alex and Ana Demas are both age 40. He is the executive vice president of Hawthorne Construction, Inc., a family-based company. Alex is not currently a shareholder in the firm. Ana is a CPA.

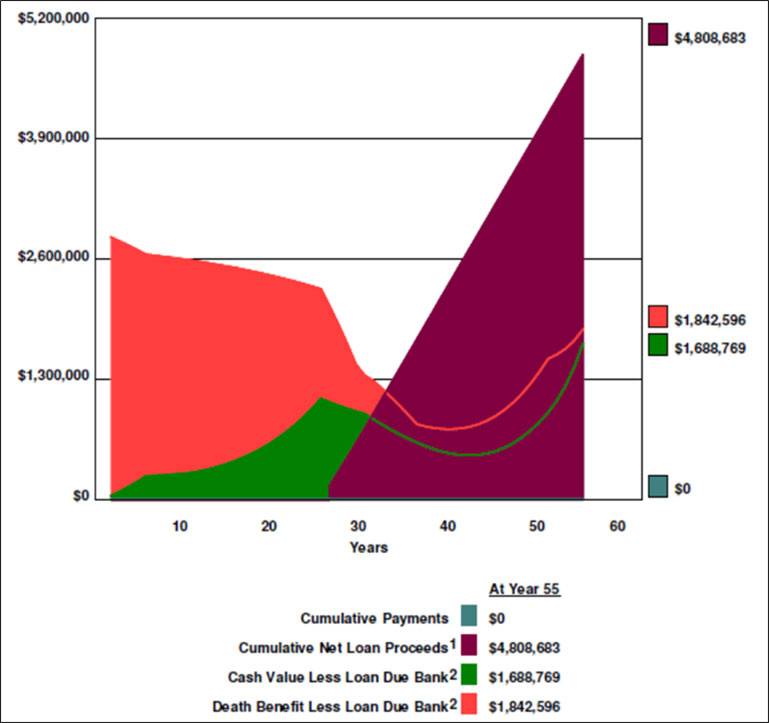

Hawthorne Construction has decided that part of his new benefit plan will include a leveraged executive bonus plan funded with $2,875,000 of indexed universal life (IUL). The policy is max-funded with five level premiums of $100,000 funded with deductible bonuses by the company paid to Alex. Alex will offset the resulting income tax liability on each bonus by way of a bank loan secured against the IUL.

|

There is more than sufficient cash value in the early years of the IUL to allow Alex to accrue the loan interest with the bank rather than pay it out-of-pocket. Including accrued loan interest, the cumulative loan never exceeds 50% of the policy’s illustrated cash surrender value during the first 10 policy years making it a relatively easy bank loan to negotiate. Alex intends to use a participating policy loan at the beginning of year 11 to repay the bank loan. |

|

Using the bank loan to fund the income tax eliminates the need for a more expensive variation of an executive bonus plan in which the company “grosses up” the annual bonus to provide the funds for the premiums and the income tax on the bonus.

The goal of the compensation package is to induce Alex to remain with the company for at least 10 years -- and, optimistically, until retirement.

Below is a graphic of the results:

| Image 1 |

| Costs and Benefits of |

| Income Tax Financing of the |

| Leveraged Executive Bonus Plan |

1For retirement cash flow.

2The cumulative loan due the bank is repaid in year 11 by way of a policy loan.

This is an impressive executive benefit! No out-of-pocket cost for Alex coupled with $4.8 million in after tax retirement cash flow, and all provided by Hawthorne Construction for an after tax cost of $65,000 a year for five years.

Click here to review this leveraged executive bonus plan from the InsMark Premium Financing System. (Pages 8 and 9 show the Summary numbers.)

Alex and Ana’s Retirement Plan

The leveraged executive bonus plan provides a significant benefit for Alex and his family; however, its value can be most appreciated if it is integrated into their overall retirement plan.

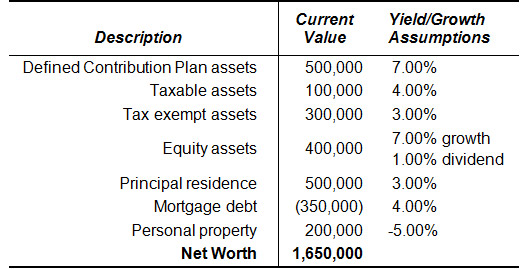

Starting at age 65, Alex and Ana’s current retirement goal is to provide $200,000 a year in after tax, spendable cash flow with a 3.00% inflation adjustment.

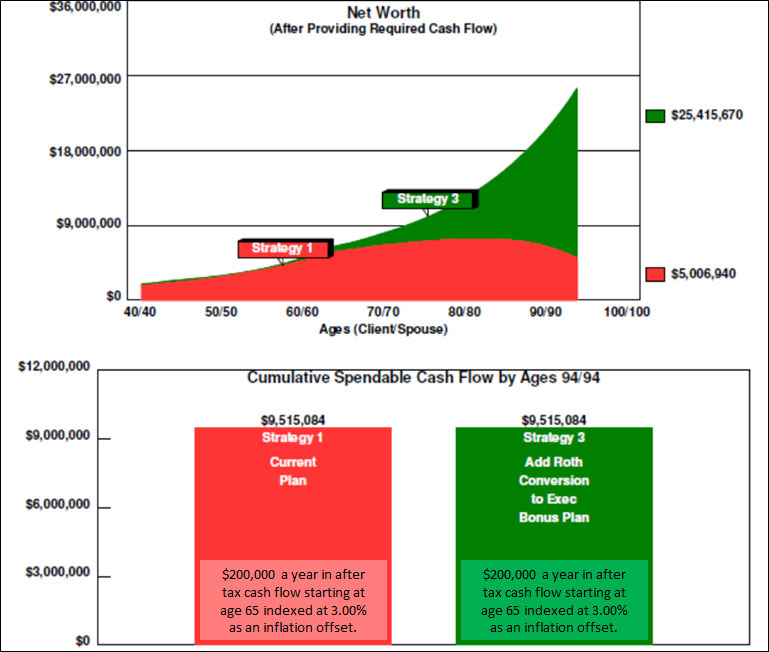

Below is a summary of their current net worth:

Net Worth

Alex and Ana Demas

Click here for comments on Monte Carlo simulations.

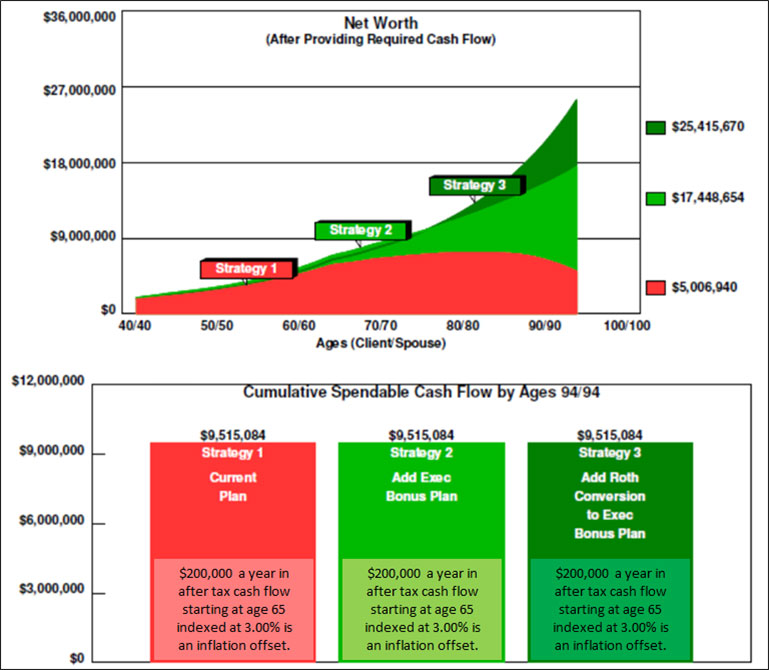

Let’s first compare their current retirement plan (Strategy 1) with Strategy 2, a variation that includes values from Alex’s leveraged executive bonus plan described above.

| Image 2 |

| Net Worth Comparison |

| (Strategy 1 vs. Strategy 2) |

The bonus plan increases their long-range net worth by almost 250% while maintaining their desired retirement cash flow. There are no additional out-of-pocket costs required from Alex and Ana.

Click here for instructions on importing data from our Premium Financing System into Wealthy and Wise.

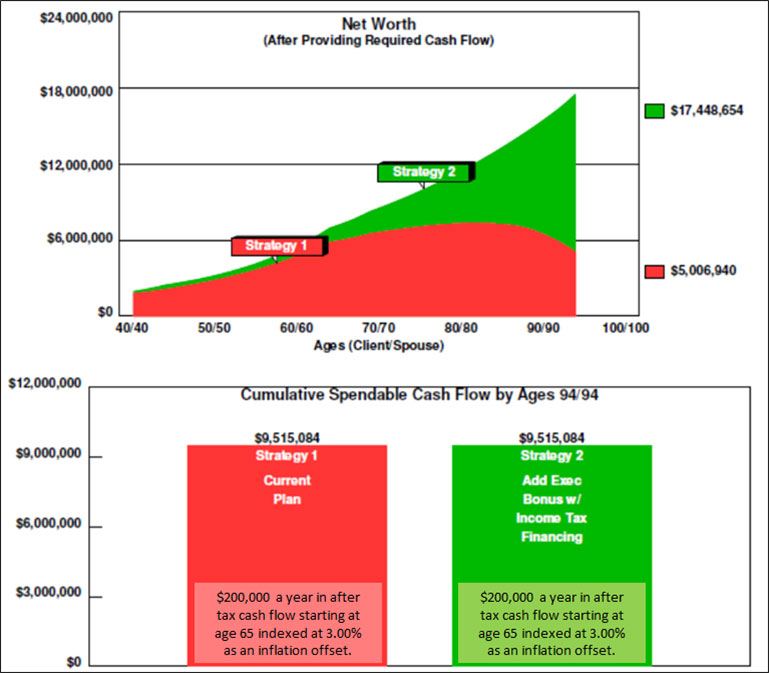

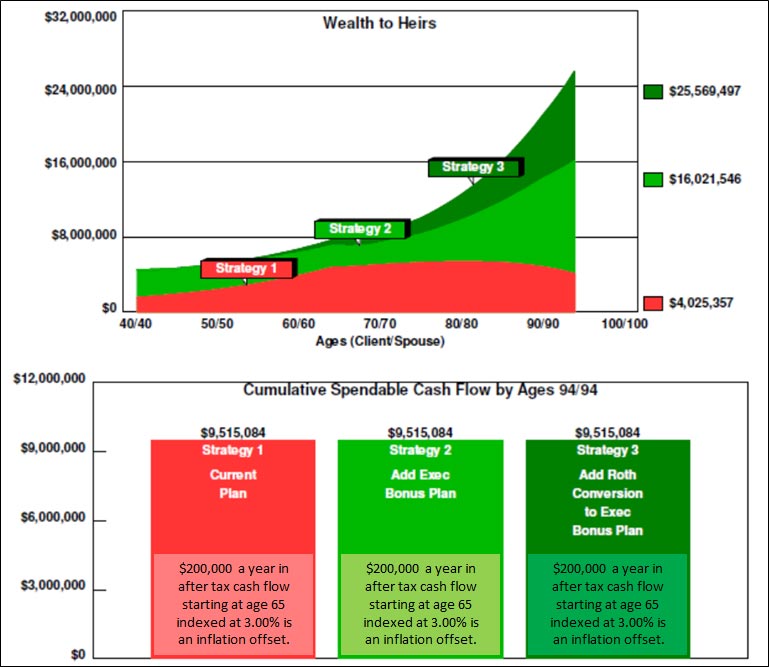

Let’s next add a Roth conversion (Strategy 3) into the mix producing the following result:

| Image 3 |

| Net Worth Comparison |

| (Strategy 1 vs. Strategy 3) |

The long-range net worth has increased over Strategy 1 by slightly over 500%.

We converted the Roth in $50,000 annual increments and withdrew the resulting income tax from their asset base (which is reflected in their net worth) -- so again there are no additional out-of-pocket costs required from Alex and Ana.

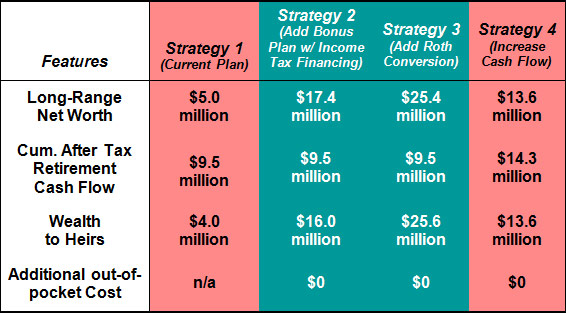

Below is the comparison of all three Strategies:

| Image 4 |

| Net Worth Comparison |

| (Strategy 1 vs. Strategy 2 vs. Strategy 3) |

Wealth to heirs is also significantly impacted by Strategies 2 and 3.

| Image 5 |

| Wealth to Heirs Comparison |

| (Strategy 1 vs. Strategy 2 vs. Strategy 3 |

Note: Another reason to convert to a Roth is the impact of inherited Roth values for heirs. In the forthcoming Blog #129 (Part 3 of this series), I’ll discuss how this will impact Alex and Ana’s daughter, Lexie.

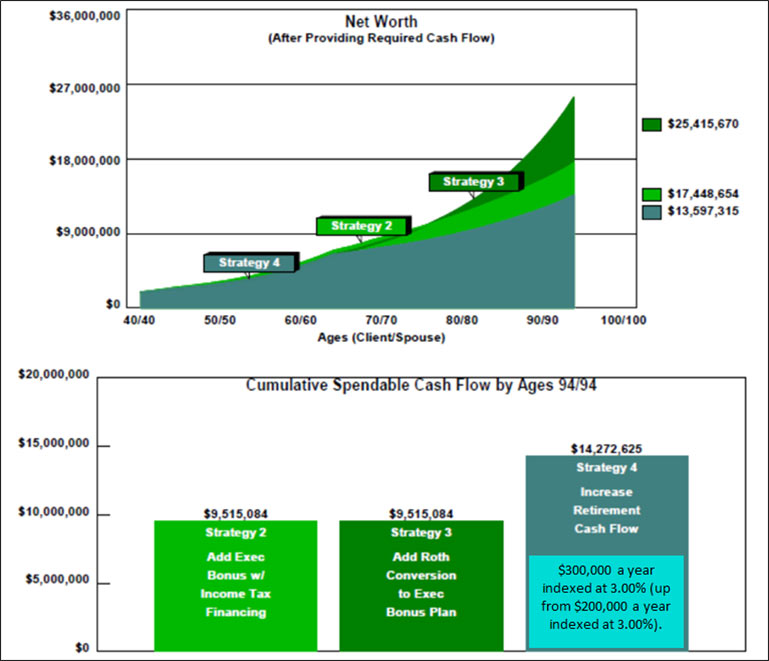

The large increase in Alex and Ana’s net worth raises an inevitable question: How about less net worth and more tax free, retirement cash flow? Below are the results of Strategy 4 if we increase Alex and Ana’s retirement cash flow by 50% (up by $100,000 a year also indexed by 3.00%).

| Image 6 |

| Net Worth Comparison |

| (Strategy 2 vs. Strategy 3 vs. Strategy 4) |

Note: We deliberately dropped Strategy 1 (Current Plan) as it is the least efficient plan. To review its results, see Images 4 and 5.

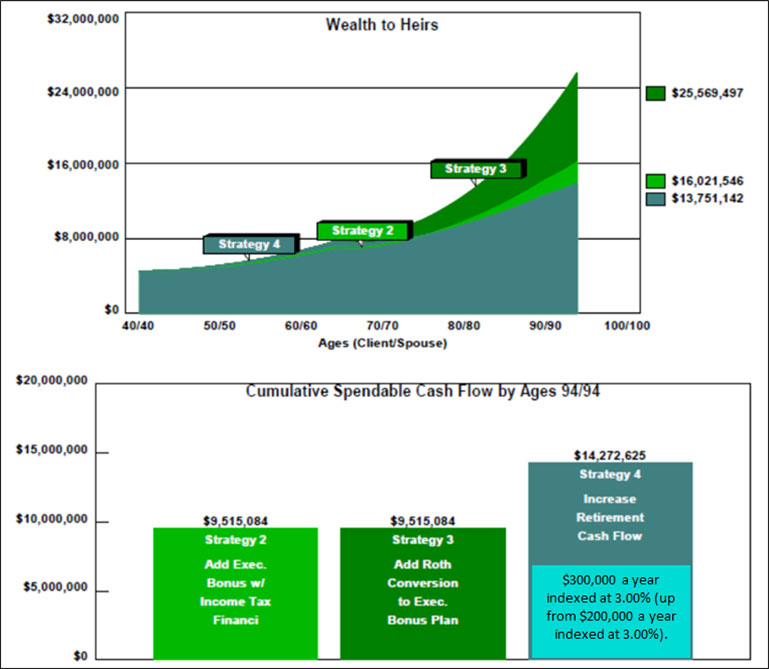

Below is the wealth to heirs analysis:

| Image 7 |

| Wealth to Heirs Comparison |

| (Strategy 2 vs. Strategy 3 vs. Strategy 4) |

Click here to review the 125 pages of reports from Wealthy and Wise that make up the numbers in Image 6 and Image 7. This is a large number of reports; however, with a Wealthy and Wise evaluation, I recommend that you have all the reports for a given case with you when you are visiting with a client or client’s attorney or CPA. Wealthy and Wise backs up every number shown, and you never know which report you’ll need to answer the inevitable question, “Where did this number come from?” That’s why I provided all of them to you in this Blog. Tip: The name of each strategy appears at the bottom right of each detailed report.

Most Wealthy and Wise users select a few key illustrations for the main report and put the balance in an Appendix. More elaborate report organization can be accomplished (Table of Contents and Section pages) through use of this prompt which I used that is available at the bottom right of the Main Workbook Window.

Summary of the Four Strategies

Conclusion

By integrating the leveraged executive bonus plan within the retirement plan, Alex and Ana’s appreciation of the executive benefit should increase exponentially. Hawthorne Contracting should get considerable additional credit (and loyalty) for being the sponsor of the plan that adds so much to their overall wealth.

Indexed universal life insurance is one of the stars of this Blog. This reminds me once again of Bill Boersma’s comment in his article in the December 2014 issue of Trusts & Estates in which he discusses life insurance as an asset class: “I can only wonder if another asset with the same qualities would be implemented more frequently if it wasn’t called life insurance.”

Prospecting

Candidates for a leveraged executive bonus plan are simple to identify if you pose the following question to an owner of a business:

“Do you have any non-owner executives or minority shareholders who are so valuable to your business that you will do whatever is economically reasonable to induce them to stay with you?”

The impact of integrating executive benefits into an overall wealth plan should be of great interest to companies that offer such benefits as the perception of the value is increased significantly.

Documentation

Special documents are needed to support a Leveraged Executive Bonus Plan. They typically consist of a standard executive bonus arrangement supplemented by an Endorsement of Policy Ownership Rights which precluding the executive from accessing any of the policy values for a predetermined number of years (or until a certain event occurs such as retirement).

The Endorsement is registered with the issuing insurance company and, as a result, the executive is unable to take any action on the policy other than that allowed by the Endorsement. One of life’s frustrating experiences for an employer involves an executive who starts a competing business using funds from an employer’s benefit plan that were designed to provide retirement cash flow. The Endorsement can eliminate this occurrence.

Comprehensive specimen documents for all aspects of an Executive Bonus Plan are available in Version 21.0 (and higher) of InsMark’s Cloud-Based Documents On A Disk™ in the Key Employee Benefit Plans section. These documents, coupled with the bank financing documents, are what make up a Leveraged Executive Bonus Plan.

Note: InsMark’s Leveraged Deferred Compensation System has a module that creates a different source of leverage whereby the employer makes the loan for the income tax liability on the bonus. This variation is often applicable for smaller cases where bank financing is unavailable. In general, I believe the bank-financed arrangement produces superior results.

Licensing InsMark Systems

To license the Premium Financing System or Wealthy and Wise or Cloud-Based Documents On A Disk, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“Standard bank financing illustrations produce much in the way of great data, but it takes the InsMark Premium Financing System to really present compelling numbers; however, the integration of that data into InsMark’s comparative modules like Various Financial Alternatives and Wealthy and Wise is really what makes premium financing sizzle.”

Chris Jacob, CFP, SFI-Cadeau, St. Louis, MO, InsMark Platinum Power Producer?

“As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using bank loans to solve their financial needs. Because of this, I was able to close three large financed cases easier and faster than ever before. As always, InsMark has delivered again. I encourage all who use bank financing as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.”

William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer?

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP?, CAP?, RFC?, International Forum Member, InsMark Platinum Power Producer?, Encino, CA

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.