(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the Premium Financing System and Wealthy and Wise®.)

|

Editor’s Note: Clients with significant illiquid assets will appreciate the use of premium financing featured in this Blog. |

Lee and Denise Hamilton are ages 55 and 47 respectively. They are real estate developers with a current emphasis on apartment complexes, and their inventory has a current value of $9 million. By their joint life expectancy of 40 years, they project their commercial real estate values to be worth almost $135 million assuming annual growth averaging 7.00%. They have indicated that the cash flow from their properties is sufficient for them to maintain their desired lifestyle.

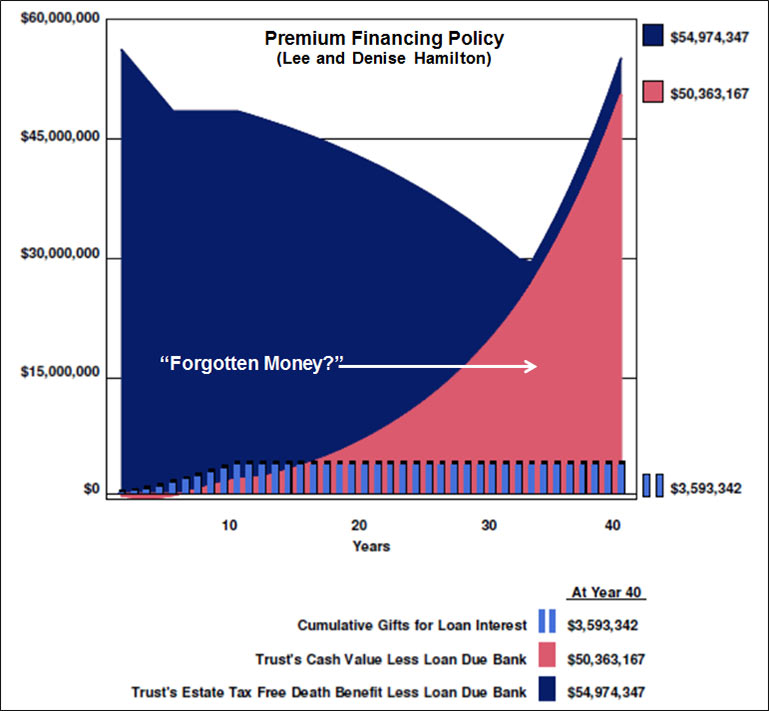

Problem: If they sell the properties prior to death, the capital gains will be severe. In addition, the net proceeds from the sale will still result in significant death taxes. If they don’t sell the properties prior to death, capital gains taxes are avoided, but the death taxes will still be severe. This is further compounded by a severe lack of liquidity for such tax bills.

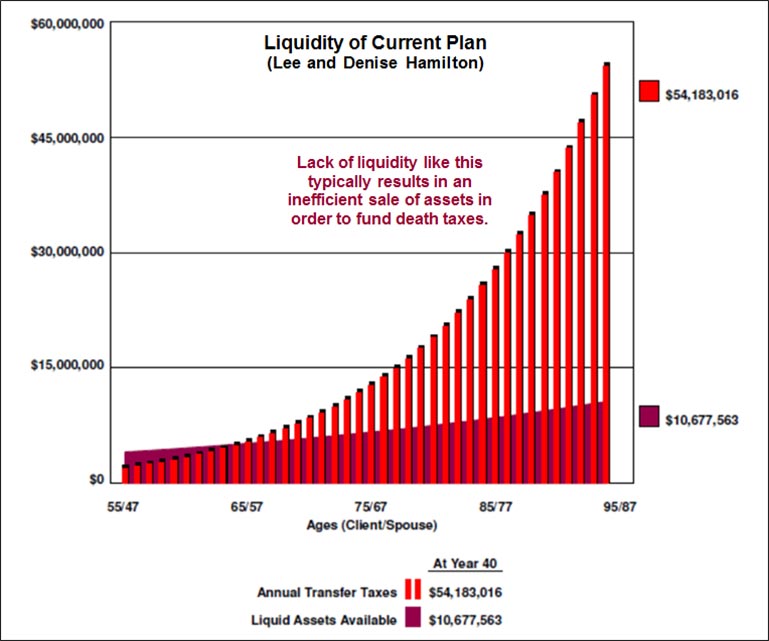

Let’s look at two liquidity evaluations for the Hamiltons from InsMark’s Wealthy and Wise®, both of which include a provision for federal and state death taxes. The first one assumes the Hamiltons’ status quo, i.e., no additional planning.

Image 1

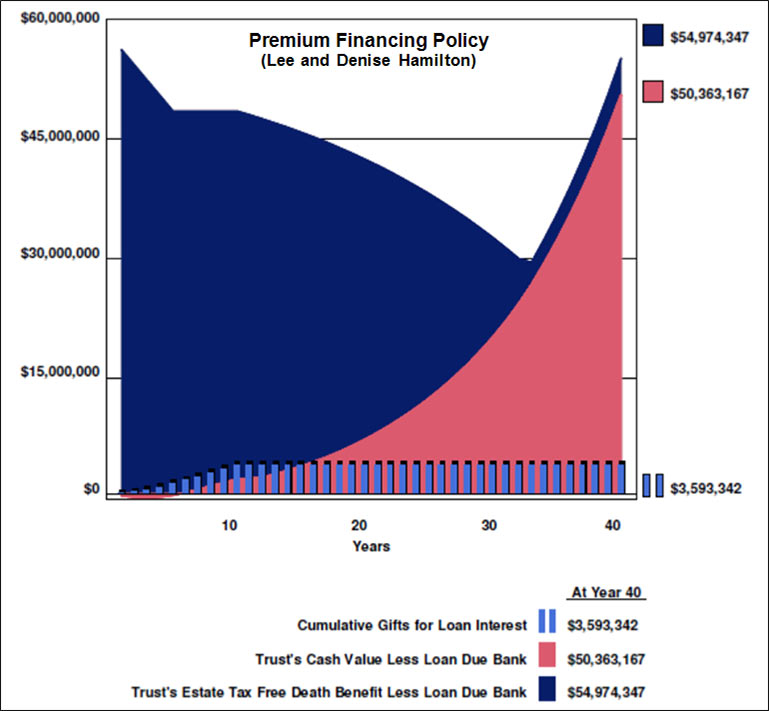

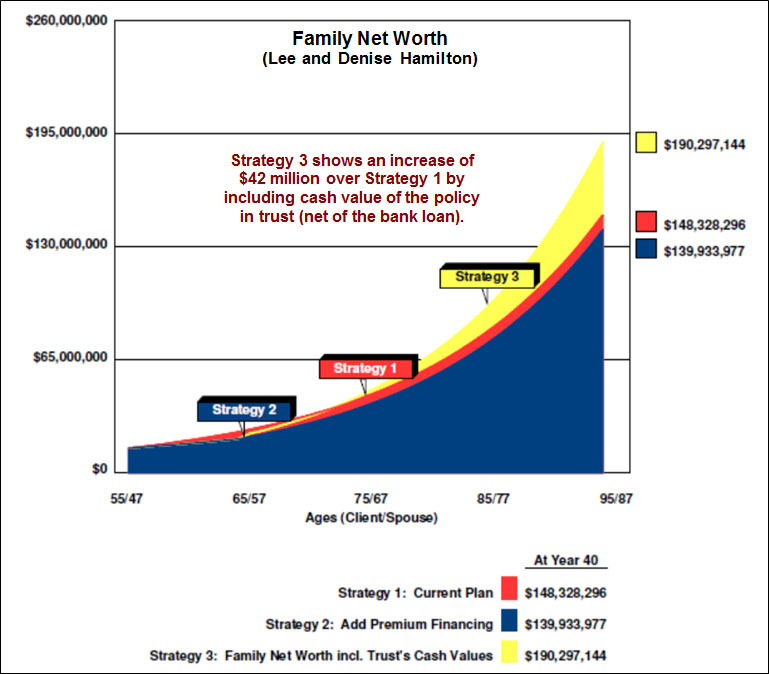

The second liquidity graphic below shows the effect of $58 million of indexed survivor universal life (“ISUL”) covering the Hamiltons owned by an irrevocable, grantor, life insurance trust. We used a level death benefit policy because the plan needed the TEFRA pushup of death benefit in the later years.

Image 2

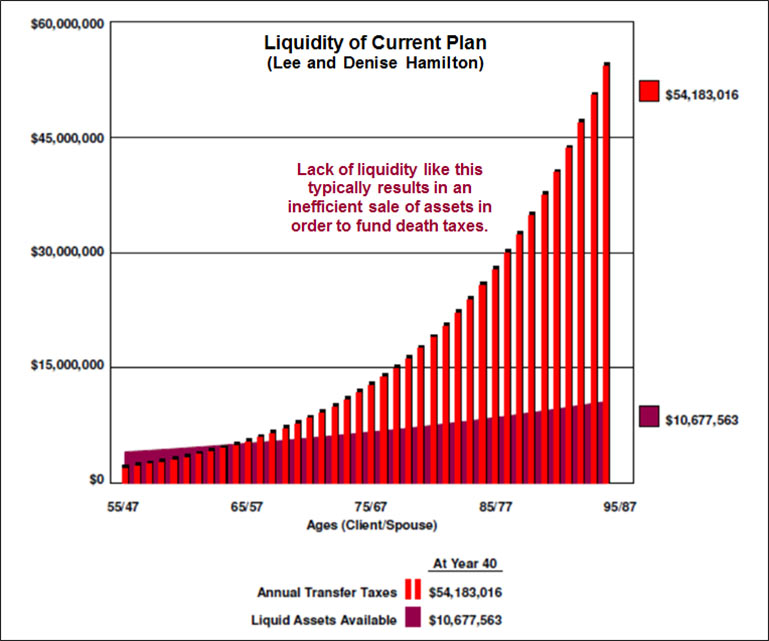

With the Hamiltons’ liquidity currently limited to $4 million in a tax exempt account, premium financing is a very efficient way to fund the life insurance. Premiums are $1,937,112 annually for five years funded with bank loans. The alternative of cramming five premiums of $1,937,112 each through to the trust by way of gifts would use up a huge percentage of the Hamiltons’ combined estate tax exemption, not a good strategy if it can be avoided.

Below is a graphic from our Premium Financing System showing the cumulative gifts to the trust and the trust’s policy values net of the bank loan:

Image 3

Click here to view the complete premium financing illustration. Loan interest is illustrated as 4.00% gradually increasing to 5.00% over the 10 years of the bank loan -- reflecting potential interest rate hikes. The bank loan is repaid at the beginning of year 11 using a policy loan.

Impact of Premium Financing on Overall Wealth

Wealthy and Wise Analysis

The value of any financial transaction can best be measured by comparing it to the status quo, i.e., do-it vs. don’t-do-it. This is particularly true for those considering premium financing. The numbers almost always look impressive -- but compared to what? Clients always make their best decisions in a comparative environment.

|

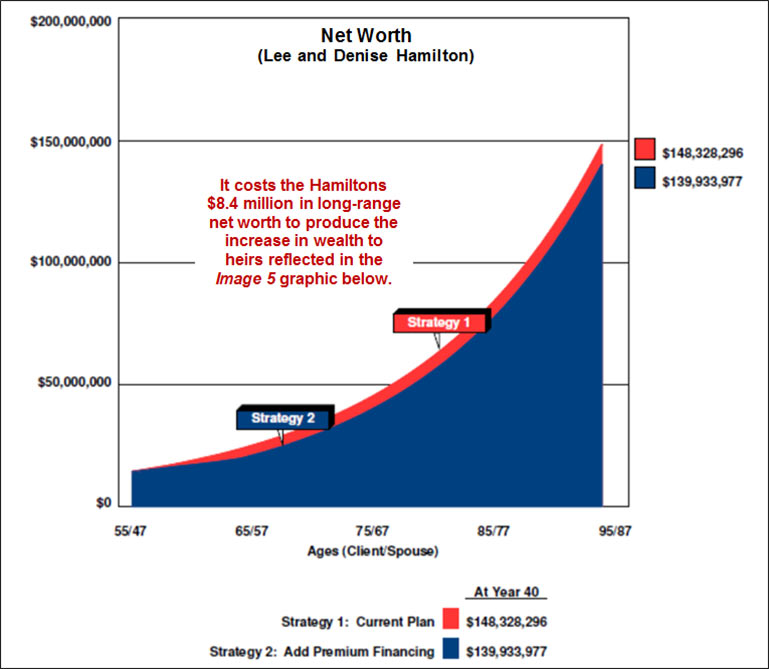

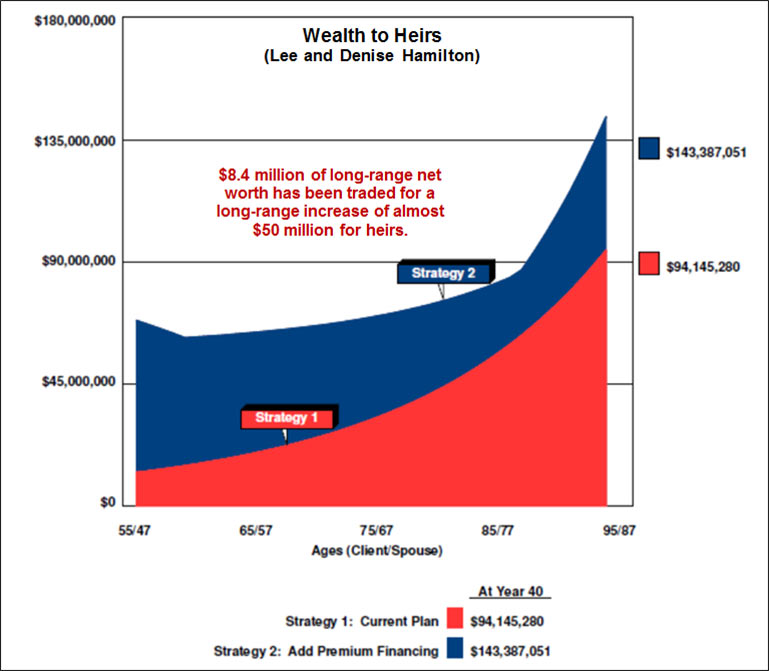

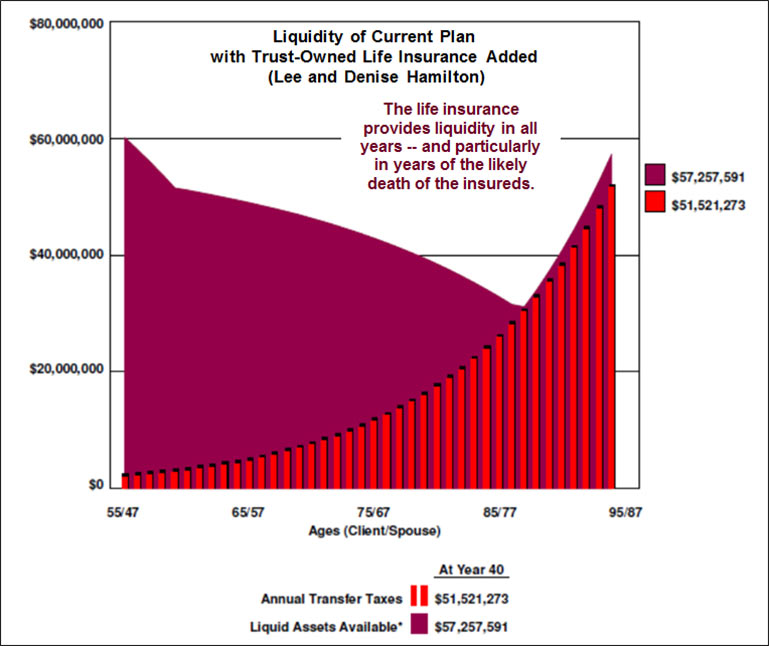

Below are the results of the comparison for both net worth and wealth to heirs. Strategy 1 is their current plan. Strategy 2 includes the imported premium financing numbers. The loan interest for the premium financing is funded with withdrawals from their $4 million tax exempt account |

|

|

Image 4

Image 5

The “Forgotten Money”

Have we overlooked anything? What about the cash value of the policy in the trust (net of the outstanding bank loan which is repaid at the beginning of year 11)? So far, the cash value of the trust-owned policy has not appeared as a component of net worth, and it is clearly part of their family’s wealth prior to the deaths of Lee and Denise.

Copy of Image 3

Once the loan has been repaid to the bank at the beginning of year 11 (in this case), the trust’s policy cash values can fund distributions to beneficiaries, and many commentators believe the trust can loan money to the Hamiltons using what is known as a Wrap Trust, a term that has been copyrighted by James G. Blase, JD, LLM, of St. Louis, Missouri, as the Wealth, Retirement, and Asset Protection (WRAP) Trust.

Click here to read a report on the subject of Wrap Trusts that also includes an unusual use of limited powerholders to provide grantor access to funds in the trust.

|

Below is a reflection of the Hamiltons’ net worth in which the cash value of the trust’s policy is included in a category called “Family Net Worth”. This is not double counting of cash values since only the policy death benefit appears in the reports and graphics for wealth to heirs. Adding these values to Family Net Worth has no bearing on the wealth to heirs since, on the death of the second-to-die insured, this aspect of Family Net Worth disappears and is replaced by the tax free life insurance death benefit. |

|

|

Image 6

Click here to review the Wealthy and Wise reports backing up the numbers in this graphic along with those of all the Strategies covered in this Blog.

Note: Wealthy and Wise calculations typically include a provision for the Hamiltons’ desired cash flow throughout the analysis; however, as noted at the beginning of this Blog, they have indicated that the cash flow from their properties is sufficient for them to maintain their desired lifestyle. As a result, this Wealthy and Wise analysis ignores this Desired Cash Flow category as well as offsetting Expected Cash Flow entries.

Underwriting a $58 Million Life Insurance Policy

A $58 million policy is not easily issued for clients with a current net worth of $13.6 million. To do so, a careful review of the need for this level of coverage must be submitted with the application. For the Hamiltons, the critical component would be a comprehensive analysis of the potential long-range death tax liability they are likely to experience as shown in this Wealthy and Wise evaluation -- emphasized by Images #1 and #2 which are shown again below. These images need to be backed up by the detailed reports in the entire Wealthy and Wise analysis.

Copy of Image 1

Copy of Image 2

Conclusion

Premium financing can be an irresistible way for wealthy clients to increase wealth to heirs as well as provide tax free liquidity for death taxes at precisely the point when the need for liquidity occurs.

State Death Taxes

We recently included an enhancement to Wealthy and Wise to help you estimate state death taxes. You can review the state death tax prompts in Wealthy and Wise when you edit or create a new scenario. The prompts are located at the bottom of the Estate and Gift Transfer Taxes, State Death Taxes located on the Illustration Details tab. If you don’t find them there, you need to update your Wealthy and Wise. Click on InsMark Live Update near the bottom of the drop down menu under Help on the main toolbar. When the Live Update menu appears, select Wealthy and Wise and click Update.

This tax is a deduction against the taxable estate (not a credit), and its results are included on the Wealth Transfer Summary and Transfer Tax Detail reports. If you include state death taxes, a footnote with details of the tax assumptions you used appears on the bottom of the Transfer Tax Detail report.

Any state estate tax and/or state inheritance (collectively “death tax”) that appears on the Wealth Transfer Summary and Transfer Tax Details report in Wealthy and Wise is an estimate by the user and is not specifically based on the precise tax rates and/or exemptions of a particular state. These rates change with some frequency, so be certain your clients consult with their legal and tax advisers for precise state death tax calculations.

Click here for a state-by-state analysis of the state death tax rates from Forbes magazine.

Accrued Loan Interest

On trust-owned premium financing plans, our system can illustrate loan interest gifted to the trust or accrued by the trust (or some of each). It can also illustrate gifts for a portion of the early policy premiums thus reducing the bank loan when providing collateral outside the policy is problematic.

Retirement Cash Flow

To review how our Premium Financing System can be used to illustrate a personally-owned policy designed to enhance retirement cash flow, see Blog #96.

Licensing InsMark Systems

To license the Premium Financing System or Wealthy and Wise or Cloud-Based Documents On A Disk, visit us online or contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or (925) 543-0513.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials

“Standard premium financing illustrations produce much in the way of great data, but it takes the InsMark Premium Financing System to really present compelling numbers; however, the integration of that data into InsMark’s comparative modules like Various Financial Alternatives and Wealthy and Wise is really what makes premium financing sizzle.”

Chris Jacob, CFP, SFI-Cadeau, St. Louis, MO, InsMark Platinum Power Producer?

“As with all of the InsMark software, InsMark’s Premium Financing System has proven to be an indispensable addition to my ability to show my clients the advantages in using a “Financed Premium” concept to solve their financial needs. Because of this, I was able to close three large financed premium cases easier and faster than ever before. As always, InsMark has delivered again. I encourage all who use Premium Finance as a solution to their clients’ needs to purchase this system. The cost of the system is not an expense, but rather an investment in your business.”

William Moates, Jr., Trilennium Financial Alliance LLC, Fort Smith, AR, InsMark Platinum Power Producer?

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP?, CAP?, RFC?, International Forum Member, InsMark Platinum Power Producer?, Encino, CA

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.