(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using Wealthy and Wise®.)

In Blog #123, I examined the astonishing difference between purchasing permanent insurance vs. buy term and investing the difference for my good friends, Tom and Courtney Johnson, ages 40 and 35. The comparison involved $1,000,000 of indexed universal Life (“IUL”) with premiums of $40,000 a year for five years vs. $1,000,000 of 25-year level term with premiums of $970 a year for 25 years.

My conversation continues with this response from Tom, “Wow! The numbers look terrific. But that $40,000 premium for five years is a little steep for the cash value plan, the term is only $970 for 25 years.”

Remember, the premise in Blog #123 is that the analysis only makes sense for those who have the cash flow to buy whatever form of life insurance they want. Tom agrees he has the cash flow, but still, the difference in premiums is tempting.

My response, “There are two sources for the premiums for either policy: 1) paid from your current after tax income or 2) paid from your asset base so there is no out-of-pocket cost for premiums.”

“How does using our asset base work?” asks Courtney.

Case Study

Wealthy and Wise Analysis

As California residents, Tom and Courtney are in a combined state and federal income tax bracket of 45%.

Below is their current net worth including anticipated growth:

| $ 90,000 | Tom’s IRA Assets 1@ 7.00% |

| 125,000 | Courtney’s IRA Assets 1@ 4.00% |

| 200,000 | Taxable Assets @ 4.00% |

| 800,000 | Equity Assets 2 @ 7.00% growth; 2.00% dividend |

| 500,000 | Residence 3@ 5.00% growth |

| (350,000) | Mortgage on Residence @ 4.00% |

| 250,000 | Vacation Home @ 4.00% |

| 150,000 | Personal Property @ -6.00% |

| 500,000 | Courtney’s Travel Agency 4@ 4.00% |

| $ 2,265,000 | Net Worth |

|

1 Continuing annual pre-retirement contributions to the IRAs are planned at $5,500 a year (increasing by 3.00%) for both Tom and Courtney through ages 65/60.

2 Continuing annual contributions to their equity assets are planned at $25,000 through ages 65/60.

3 At retirement, they plan to sell their home, invest the after tax proceeds in equities, and retire in their vacation home.

4 At retirement, Courtney plans to sell the travel agency and invest the after tax proceeds in equities.

Click here for comments on the fee and tax drag assumptions used for the equity account. (See Blog #100 for a discussion of the “mysterious” management fees associated with mutual funds from an article published in Forbes.) Click here for comments regarding yields and Monte Carlo simulations. |

|

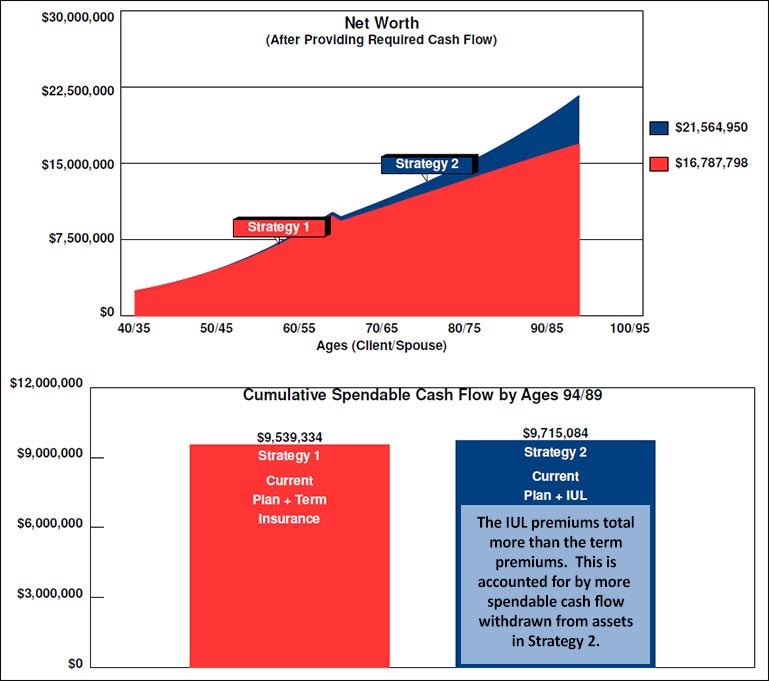

Starting at their ages 65 and 60, Tom and Courtney want $200,000 in annual after tax retirement cash flow indexed at 3.00% as a cost of living adjustment. Below is a graphic showing their long-range net worth after providing for this cash flow. Strategy 1 includes $970 annually for 25 years for the $1,000,000 term insurance paid by way of asset withdrawal. Strategy 2 includes $40,000 a year for five years for the IUL also paid by way of asset withdrawal.

Unlike Blog #123, I did not use loans on the IUL for retirement cash flow as it is more efficient for the Johnsons to use other assets for this purpose in Strategy 2. Click here to view the illustration for the IUL.

| Net Worth |

| Strategy 1 vs. Strategy 2 |

| Image 1 |

Including the IUL cash values, Strategy 2 produces an increase in net worth of almost $4.8 million over Strategy 1 with the term insurance.

Click here to view the Wealthy and Wise presentation that supports this evaluation.

Strategy 3

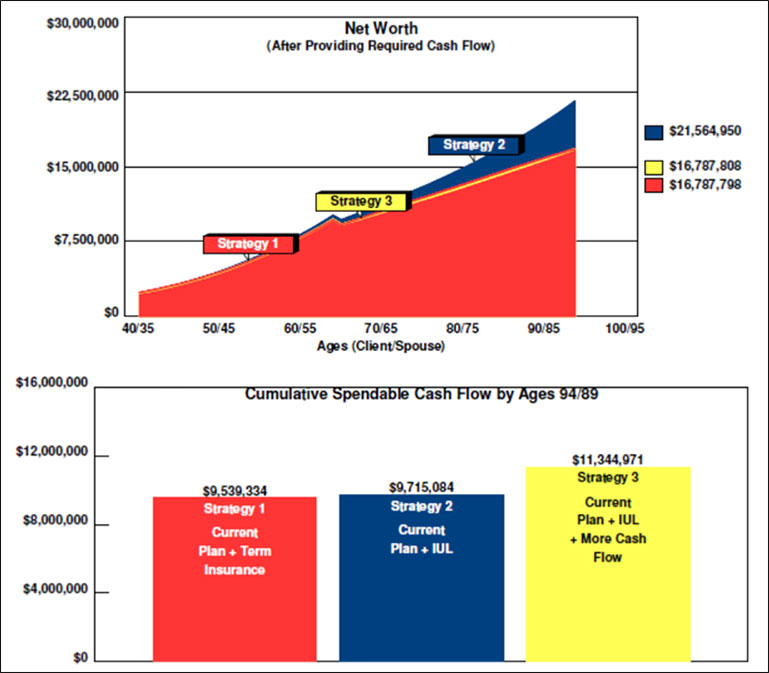

A question you will often hear from clients at this point is, “We’re not so much interested in accumulating more net worth. Can that increase be used to boost our retirement cash flow?” Wealthy and Wise has an easy way for you to calculate this adjustment. I instructed the System to increase cash flow to the point that the long-range net worth drops back to the same level as Strategy 1 (as close as possible based on available liquid assets). This becomes Strategy 3, and below is a graphic of the results.

| Net Worth |

| Strategy 1 vs. Strategy 2 vs. Strategy 3 |

| Image 2 |

Cash flow in Strategy 3 has increased by over $1.6 million by dropping long-range net worth to within $10 of Strategy 1. Normally, you would have to “fuss with assumptions” for an hour or so to come close to this solution. It took Wealthy and Wise about one second for the calculation. For more information on using this vital feature, review Purpose of the Cash Flow Calculator.

Click here to view the Wealthy and Wise presentation that supports this evaluation. Details of Strategy 3 start on Page 89. (Details of Strategy 1 and Strategy 2 are the same as reflected in Image 1.)

Note: Most clients who have several types of asset have no idea of how to establish when to use what dollars from which asset for retirement cash flow. In preparing the data for Strategy 1, Strategy 2, and Strategy 3, I used the principles of what we call Good Logic vs. Bad Logic?, details of which are highlighted in an eight-minute video on this vitally important subject. Once you see it (particularly the first four minutes), you may not want to prepare a retirement plan any other way.

Strategy 4

An inevitable question occurs: “What if we reduce net worth even further?”

My question to Tom and Courtney would then be, “How much of a reduction would be acceptable?”

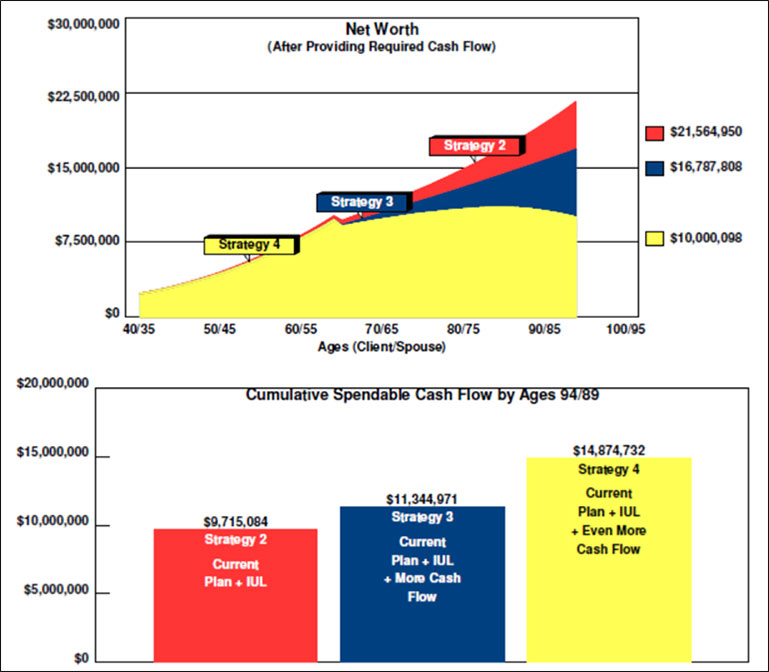

Assume they decide that $10 million of long-range net worth is adequate. Using similar logic as Strategy 3, Wealthy and Wise determines with Strategy 4 that with long-range net worth of $10 million, they can increase their retirement cash flow considerably. View the comparative results below. (Consideration of term insurance is long gone, so I deleted it from this comparison).

| Net Worth |

| Strategy 2 vs. Strategy 3 vs. Strategy 4 |

| Image 3 |

Click here to view the Wealthy and Wise presentation that supports this evaluation. Details of Strategy 4 start on Page 89.

Strategy 4 produces an cumulative increase in after tax, retirement cash flow in excess of $3.5 million. See Columns (1), (2), and (3) on Pages 5 and 6 (starting in year 26 on Page 5) for a year-by-year comparison of retirement cash flow of the three Strategies. In every one of those years, Strategy 4 is 154% of Strategy 2 and 131% of Strategy 3.

Note: With Strategy 4, I used participating loans on the IUL to assist with the increased retirement cash flow. Click here to view the IUL illustration.

Conclusion

This Blog, coupled with Blog #123, should surely put the final nails in the coffin of the Siren Song of “Buy Term and Invest the Difference”.

Final Thought #1

In all four Strategies, premiums for the life insurance are withdrawn from assets, not paid from Tom and Courtney’s pre-retirement cash flow. I know that many of my readers are comfortable selling the retirement cash flow features of IUL using a stand-alone illustration that is not integrated with a client’s other assets. Clients typically consider the premium for these plans to be an expense. Changing to a Wealthy and Wise analysis creates a new learning curve because your presentation changes to asset transfer. Believe this: the wealthier a client, the easier it is to convince him or her of the power of integrating IUL into their portfolio of assets with this type of analysis. With allocations from current assets as the source of premiums as shown in this Blog, it becomes a case of “comparing assets and cash flow if you do it -- with what happens when you don’t”. That is a completely different presentation, and it can have compelling results for you

The payoff? You will develop much higher average compensation per case and a client locked into your planning expertise, not just as an IUL policyholder. Tended carefully, you will likely have this client for life.

If you are an experienced user with Wealthy and Wise, putting a case together like this will be relatively straightforward. (See below to obtain the electronic Workbook I used to prepare the data for all the Strategies in this Blog.)

That’s the good news. The bad news for some is that you have to gather all of your client’s financial data for this type of analysis. Many of my readers are used to doing this. For those of you who are not so comfortable with it, how do you feel about asking a prospective client to reveal details of financial data? Clearly, you have to earn a prospective client’s trust to do that. My suggestion for the best way to gain that confidence is to share examples of how this concept works for others -- this Blog, for example, or the Wealthy and Wise reports associated with it.

Note: A Fact Finder is available in Wealthy and Wise to guide you in your data gathering (see Tools on the main menu bar). Many of our licensees tell me they think the Fact Finder is best filled out with the client(s) present and involved in the process.

At first glance the Fact Finder may look intimidating, but on most pages, you will be entering data in only a few of the listed categories. To acquaint yourself with it, try filling one out for your own situation.

Final Thought #2

As their income increases, Tom and Courtney will likely want to increase the projected amount of spendable, retirement cash flow at retirement, and here is the point: They will need you to bring their plan up-to-date every year, and this means you not only have opportunities for additional planning strategies, you also have the opportunity to charge an annual monitoring fee for each review. This is easier to negotiate if you charge a fee for the initial study. Look what you can accomplish for clients like the Johnsons. Isn’t this worth a good-sized fee?

Blog #97 is a good resource if you are contemplating charging monitoring fees. Blog #98 includes a monitoring fee analysis in a Wealthy and Wise study. The fees are coupled with a premium financing case, but the logic involved fits any planning case. Review Blog #98 for the ease in which monitoring fees can be included in an evaluation

Note: Before charging monitoring fees, be sure to check your compliance rules and regulations.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials:

“If you don’t get the client to distinguish cash flow from net worth, you won’t make the case sale. In my experience, Wealthy and Wise is the only system that recognizes this important estate planning component.”

Stephen Rothschild, CLU, ChFC, CRC, RFC, International Forum Member, Saint Louis, MO

“InsMark has created without question the best suite of software for our industry that has ever existed. I personally have been using their software for almost 30 years, and it changed my career. This unique and user friendly software will add many thousands to your income for as long as you’re in business. InsMark makes me look good, and it will you as well.”

Simon Singer, CFP?, CAP?, RFC?, International Forum Member, InsMark Platinum Power Producer?, Encino, CA

“I am writing to give you a ringing endorsement for the Wealthy and Wise System. As you know, I am a LEAP practitioner. The Wealthy and Wise software has helped me supplement my LEAP skills in the over age 60 client base. I have been paid for many cases using Wealthy and Wise as support, the smallest of which was $27,000, the largest was $363,000. With those type of commissions, you would have to be nuts not to buy it.”

Vincent M. D'Addona, CLU, ChFC, MSFS, AEP, InsMark Platinum Power Producer?, New York City, NY

“InsMark helps us help our clients understand their money and their choices. I always learn something new that changes what we do and how we can do it more efficiently. That translates to a better bottom line for us and for our clients. It’s making more money for everyone -- just by pushing InsMark buttons on the computer.”

Kay Corbin, CLU, ChFC, InsMark Platinum Power Producer?, Phoenix, AZ

“Major cases we are developing have all moved along successfully because of the sublime simplicity and communication capability of Wealthy and Wise. I guarantee that the proper use of this tool will dramatically raise the professional and personal self-image of any associate who dares to take the time to understand it . . .”

Phillip Barnhill, CLU, InsMark Gold Power Producer?, Minneapolis, MN

Important Note #1: The hypothetical life insurance illustration associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: This information is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.