(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

Consider asking a client this question:

“Assuming you have the cash flow to buy whatever kind of life insurance you want, if you could acquire $500,000 of term insurance for $1.00, would that be a good deal?”

That’s not $1.00 per thousand, that’s $1 a year. And it’s not a good deal for your client.

We all know that cash value life insurance can almost always compete with term provided the following factors are considered:

- The time frame for the insurance need;

- The available cash flow;

- The alternative uses for the cash flow;

- The income tax considerations.

But how about term for $1.00. Let’s see . . .

Case Study

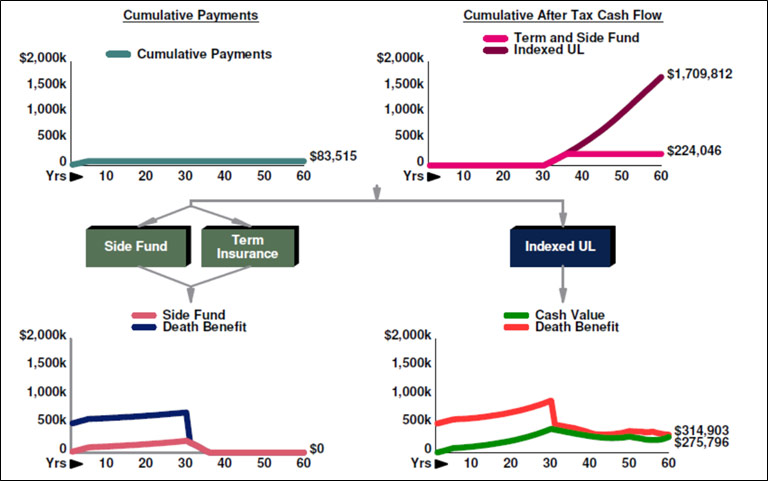

Cliff Havers, age 35, wants to acquire $500,000 of life insurance. Here is the comparison he is reviewing:

- $500,000 of indexed universal life (IUL) with five scheduled premiums of $16,703 illustrated at 7.00%. After tax policy cash flow is scheduled starting at age 65.

- $500,000 of 30-year level term with annual premiums of $1.001 coupled with a taxable side fund2 at 7.00% for the difference in premiums. (Cliff is in a 30% marginal income tax bracket). After tax cash flow from the taxable account is scheduled to match the cash flow from the IUL for as long as possible.

- 1 The best “real” rate I could find was $450.

- 2 Management fee of 1.50%.

- See Blog #100 for a discussion of “mysterious” management fees from an article published in Forbes.

| Indexed Universal Life vs. 30-Year Level Term Insurance and a Side Fund |

| Image #1 |

Click here to see the detailed numbers. The term insurance expires at age 65; the side fund collapses at age 70. The IUL does not expire, and the difference in its retirement cash flow of almost $1.5 million is enormous (over 7.6 times as much as the term/side fund combination).

The side fund would have to earn 13.32% in order to match the IUL, 6.32% more than the IUL’s 7.00% interest assumption.

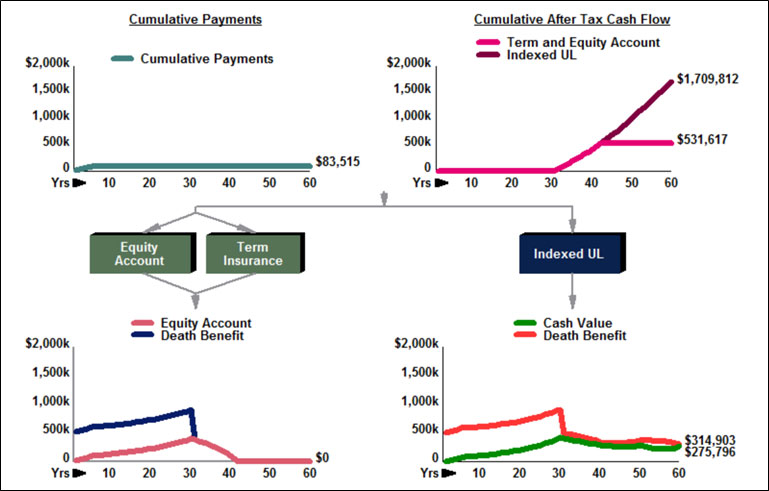

I also ran the comparison using the term insurance at $1.00 coupled with an equity account with 7.00% growth and a 2.00% dividend as shown in the graphic below. Fee and tax drag assumptions are conservative:

- 25% short-term capital gains; 75% long-term capital gains;

- 30% marginal income tax bracket;

- 25% capital gains tax;

- 25% dividend tax;

- 25% portfolio turnover;

- 1.50% management fee.

| Mortality costs retard the growth of IUL. When you include the costs associated with owning an equity account, the IUL easily outperforms it. |

|

After tax cash flow from the equity account is scheduled to match the cash flow from the IUL for as long as possible.

| Indexed Universal Life vs. 30-Year Level Term Insurance and an Equity Account |

| Image #2 |

Click here to see the detailed numbers. The term insurance expires at age 65; the equity account collapses at age 76. The IUL does not expire, and the difference in its retirement cash flow is almost $1.2 million (over 3.2 times as much as the term/equity combination).

The equity account requires growth of 9.46% plus the dividend of 2.00% for a total yield of 11.46% in order to match the IUL, 4.46% more than the IUL’s 7.00% interest assumption.

Note: The performance of the IUL gets an additional nudge due to the arbitrage associated with its participating policy loans. See Blog #52 for a discussion of participating vs. fixed policy loans.

Conclusion

If you can outperform term insurance for $1.00, term doesn’t stand a chance -- so long as the cash flow exists to buy want you want.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials:

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer?, Grafton, WI

“InsMark is the Picasso of the financial services world ? their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer?, Overland Park, KS

?“InsMark’s Checkmate? Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.