(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

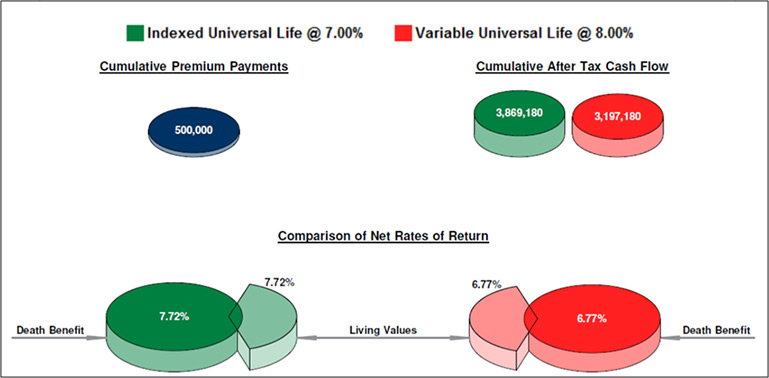

The InsMark Compare™ illustrations in Blog #117 have generated questions among some readers as to how Indexed Universal Life at 7.00% can outperform Variable Universal Life at 8.00% -- particularly in later durations.

Blog #117 compares Whole Life, Universal Life, Indexed Universal Life, and Variable Universal Life. Let’s review just the Indexed Universal Life vs. Variable Universal Life to address the questions. The following graphic illustrates the issues:

| Summary Analysis of Net Rates of Returns at Age 100 |

Click here to review the entire illustration comparing IUL with VUL.

Problem: How can IUL have a long-range, net rate of return of 7.72% which is in excess of the 7.00% rate credited to the policy?

Solution: Interest rate arbitrage -- the difference between the interest paid and the interest earned.

The 7.72% net return is caused by the arbitrage created by participating policy loans. This is one of the unique characteristics of IUL in which the cumulative loans on the policy continue to participate in the credited index rate less the loan interest charged. Such arbitrage does not occur with loans on a VUL policy (or any other policy generally available).

There is, however, a potential risk associated with participating loans involving an extended term of years in which the credited rate of the selected index is less than the loan interest rate charged. This will cause a drag on policy performance during later durations when policy loans represent a substantial percentage of policy cash values. This is best handled if the carrier has a guaranteed loan interest rate.

Riskier IULs are those with large policy loans in which the loan interest rate is tied to a floating index such as one of Moody’s bond indexes. While this may guarantee the source of the loan interest rate, it does guarantee a cap at a reasonable rate. Assuming a policy owner intends to access policy values by way of substantial loans, it makes sense to acquire IUL with acceptable cap on loan interest rates. I understand why an issuing life insurance company might not want to offer such a cap, but under these circumstances, a prospective client is well-advised to purchase IUL from a company that provides it.

For a more detailed study of these issues with some powerful examples, see my Blog #52: Participating Loans vs. Fixed Loans.

Conclusion

The best long-range illustrated rate of return is not the only consideration.

- A client may decide that VUL’s edge at shorter durations is preferable;

- A client might prefer IUL at any duration due to the 0% floor on performance (1% to 2% with some companies) during years if an index goes negative;

- A client might prefer the upside possibilities of VUL unencumbered by a cap on an index;

- A client might prefer the guarantees of a Whole Life chassis.

Note: Many of you are rightly concerned about the potential tax bomb in a life insurance policy with large policy loans that can accidentally be triggered by a careless policyowner. See my Blog #51: Avoiding the Tax Bomb in Life Insurance for my analysis of this issue.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials:

“InsMark has increased my production by 10 fold. It clearly communicates to the client the best financial scenario to take.”

Gary Sipos, M.B.A., A.I.F.? InsMark Platinum Power Producer?, Sipos Insurance Services, Freehold, NJ

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer?, Grafton, WI

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Make certain you have the appropriate state and federal licenses if you include variable universal life in the product type comparison in an InsMark Compare™ illustration.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.