(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System, Leveraged Compensation System and Cloud-Based Documents On A Disk™.)

|

Editor’s Note: This Blog requires some familiarity with Blog #114. Click here to review it if you need a refresher. |

Last week in Blog #114, we examined a Leveraged Deferred Compensation plan for Arthur Lee who is being recruited as Chief Executive Officer of Ryder Manufacturing Co., Inc. (“Ryder”), a successful, privately-owned C corporation. This week in Blog #115, we’ll evaluate if term insurance could be a better alternative than the indexed universal life (“IUL”) featured in Blog #114.

Leveraged Deferred Compensation involves Arthur reducing his compensation by $250,000 a year for five years. In his 45% marginal income tax bracket, this reduction costs him $137,500 a year for five years for a total of $687,500. In return, Ryder loans Arthur $250,000 a year for five years ($1,250,000) which he uses to fund a personally-owned $5.7 million IUL policy illustrated at 6.85%. The policy is collaterally assigned to Ryder as security for the loans.

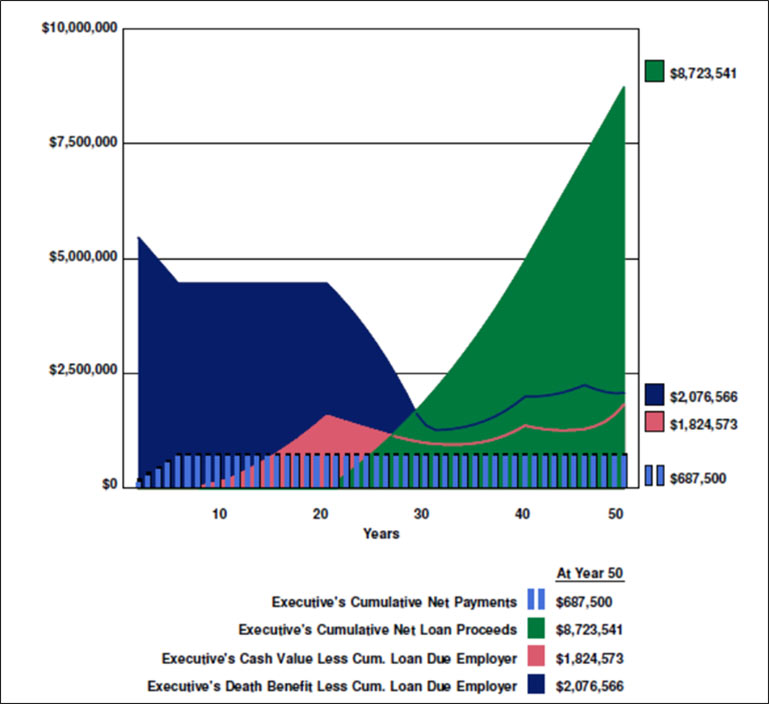

Arthur is scheduled to begin participating policy loans in year 21. The first loan is planned at $1,400,000, of which $1,250,000 will be used to repay the outstanding split dollar loans due Ryder; the remaining $150,000 provides cash flow for Arthur during his first retirement year. In subsequent retirement years, gradually increasing loans are scheduled which level out at $377,000 at age 85. By age 95, they total $8,723,541 in cumulative spendable cash flow for Arthur. At that point, Arthur’s residual net cash value is $1,824,573 surrounded by a net death benefit of $2,076,566 for his heirs.

The plan is appealing to both Arthur and Ryder; however, one of Ryder’s financial advisers wants to see if “term and invest the difference” will perform better for Arthur if it is substituted for the Indexed Universal Life (“IUL”).

Below is a graphic of Arthur’s costs and benefits of the Leveraged Deferred Compensation plan:

Click here to review the year-by-year numbers.

Term Insurance as an Alternative

You never know when term insurance will surface, so my recommendation to you is that you always prepare a “permanent vs. term” comparison for each presentation. You may not need it, but if you do, you’ll be glad you have it.

Think about this: you may want to present it whether term insurance is brought up or not. Why bring it up if it is apparently not an issue? Because it may surface from an adviser when you are not present, and having it previously presented allows your prospect(s) to be proactive about the alternative. Instead of “I’ll look into it,” they can say, “Term insurance was already evaluated; the results do not favor it, and here are the calculations.”

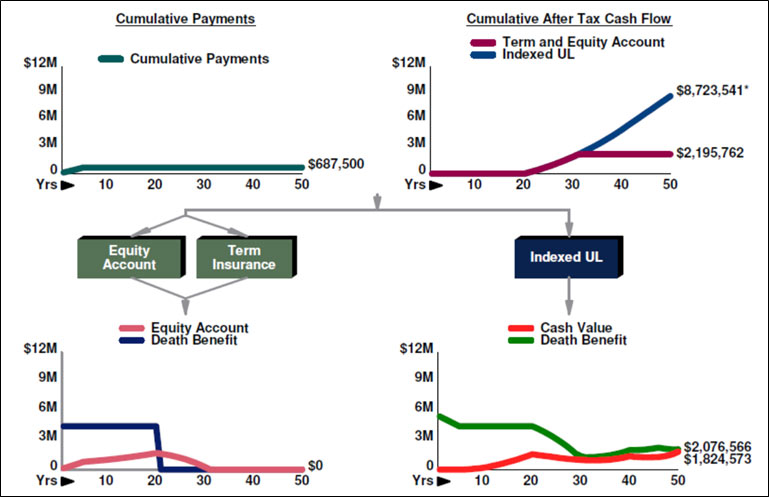

The IUL in Blog #114 has a face amount of $5,700,000. I am using only $4,450,000 of 20-year term insurance in the comparison since, due the split dollar arrangement of the Leveraged Compensation Plan, the net death benefit to Arthur’s family drops to $4,450,000 by year 5. Thus, for the first four years, the IUL has more death benefit, a marginal advantage due to the short duration.

The best rate I could surface for $4,450,000 of 20-year term is $4,700 (male, age 45, preferred plus). I used the same contribution level as the Leveraged Deferred Compensation ($137,500 for five years). For the comparison, I used an equity account with a yield of 6.85% (same as the IUL) plus a 2.00% dividend for a total yield of 8.85%.

Of course, there is no legal way to “split dollar” term insurance and an equity account; however, even if you could, the dismal results of a “buy term and invest the difference” evaluation vs. Arthur’s personal costs and benefits of his Leveraged Deferred Compensation plan are significant. Below is a graphic of the comparison from the InsMark Illustration System:

Click here to review the entire term comparison report.

In his 45% marginal income tax bracket, the $250,000 compensation adjustment costs Arthur $137,500 a year for five years for a total of $687,500. I used the same deposit pattern for the equity account and the term insurance. Arthur is scheduled to begin participating policy loans from the IUL starting at the beginning of year 21, and I matched this after tax cash flow with the same after tax cash flow from the equity account. Unfortunately, the equity account collapses in year 32 at age 76 as you can see on Page 3 of the report while the IUL is still performing at age 95 with $1,824,573 of residual cash value remaining surrounded by a net death benefit of $2,076,566 for his heirs.

In order to compete with Arthur’s share of the IUL, the equity account in this comparison would have to earn 11.18% plus the 2.00% dividend for a total yield of 13.18%, 633% basis points higher than the IUL.

Conclusion

I have made this comparison in my Blog using small, medium, and large cash value life insurance policies. “Buy term and invest the difference” simply does not compete with 21st century cash value life insurance. There is no economic theory that explains why a bad idea is acceptable just because you hear it frequently. If you have the cash flow to buy what you want, cash value life insurance is the only logical choice.

I am reminded once again of Bill Boersma’s comment in his article in the December 2014 issue of Trusts & Estates in which he discusses life insurance as an asset class: “I can only wonder if another asset with the same qualities would be implemented more frequently if it wasn’t called life insurance.”

Suitability of the Leveraged Compensation Plan

- For owner-executives of C corporations: Yes.

- For non-owner executives of any business entity (C corporation, S corporation, Limited Liability Company, Partnership, and Limited Liability Partnership): Yes.

- For executives of Tax Exempt Organizations: Yes.

Note: See Blog #40 for an example. - For an independent consultant to any business entity (C corporation, S corporation, Limited Liability Company, Partnership, Limited Liability Partnership, and Tax exempt Organization): Yes.

- For officers and directors of a publicly-owned corporation: No.

Note: This is due to the Sarbanes-Oxley Act of 2002 which precludes use of loan-funded plans for such individuals. - For managers and independent consultants of publicly-owned corporations: Yes.

- For executives of governmental organizations: Yes

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Note: The System Workbook file for Arthur’s Leveraged Deferred Compensation is available in Blog #114 for those licensed for InsMark’s Leveraged Compensation System.

Testimonials:

“InsMark’s Checkmate? Selling strategy of permanent vs. term is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

“InsMark is the Picasso of the financial services world ? their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Silver Power Producer?, Overland Park, KS

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Gold Power Producer?, Grafton, WI

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.