(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

|

Editor’s Note: Blog #111 is a revision of Blog #84 by taking into account the impact of the new regulations impacting Indexed Universal Life (“IUL”). It examines powerful comparisons between IUL and “term and invest the difference” using both an equity account and a Keogh plan as the alternative investment. The results may surprise you. Your self-employed prospects/clients are often eligible for Keogh contributions well in excess of IRA limitations. As is generally the case, when you compare cash value life insurance to any tax deferred retirement plan like a Keogh or IRA or 401(k), the life policy is typically the winner by a large margin. |

Last week in Blog #110, I presented a life insurance analysis for Laura Lake Johnson, age 35, a very successful landscape painter living in Carmel, CA. Laura is single with a four-year-old daughter, Caroline. As a self-employed artist, retirement planning is solely Laura’s responsibility. In Blog #110, Laura was considering $1,000,000 of level death benefit coverage using IUL that provides her with substantial after tax retirement cash flow. For a reason described below, the IUL illustration in Blog #111 has an increasing death benefit during pre-retirement years; level thereafter.

Due to new regulations, Blog #111 uses an illustrated rate for the IUL of 6.85%.

| Laura’s Proposed IUL Policy |

| Increasing Death Benefit for 30 Years; Level Thereafter |

| Illustrated at 6.50% |

| Five Annual Premiums ($23,802 each) |

$119,010 |

|---|---|

| Initial Death Benefit | $1,000,000 |

| Cumulative After Tax Policy Loans for Retirement Cash Flow from Age 65 - 95 |

$2,088,194 |

| Cash Value at Age 95 Pre-Tax Equivalent Rate of Return at Age 95 |

$668,971 11.51% |

| Death Benefit at Age 95 Pre-Tax Equivalent Rate of Return at Age 95 |

$719,682 11.53% |

| This Table assumes the non-guaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. |

Click here to review the IUL illustration.

Laura mailed the illustration to her CPA. A few days later, he asked her an interesting question: “Why pay almost $24,000 for something you could get for under $700?” (He is referring to a $680 annual premium for $1,000,000 of 30-year, level term insurance.) He added, “Do you think you might be better off investing the difference in a good mutual fund?”

The CPA has surfaced “buy term and invest the difference”, and in response for this analysis, I am using IUL with an increasing death benefit. When comparing cash value life insurance to level term insurance (30-year term in this case) and a side fund, it is generally better to use a cash value policy with an increasing death benefit; otherwise, the term and its side fund combination will have an overall death benefit advantage until the term expires.

The following graphic summarizes the results of comparing the IUL to term insurance coupled with an equity account with a growth rate of 6.85%. The indexes available for IUL generally don’t credit a dividend. The current S&P 500 dividend yield is 1.99% so let’s round that to a 2.00% dividend and add that to the equity account growth rate for a gross yield of 8.85%, 200 basis points greater than the IUL. The identical after tax retirement cash flow from the IUL is illustrated being withdrawn from the equity account until it collapses.

| InsMark Illustration System |

| Indexed Universal Life |

| vs. |

| Term Insurance and an Equity Account |

| *This graphic assumes the non-guaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable; however, the ratio of the comparison should remain relatively stable given equal interest and growth assumptions. |

The equity account is consumed by Laura’s age 77 shortchanging her by $1,414,407 in after tax retirement cash flow over the years illustrated compared to the IUL.

What caused the reduced growth of the equity account? Four factors: 1) tax on capital gains caused by withdrawals; 2) tax on dividends; 3) portfolio turnover; and 4) management fees.

Click here to review the detailed comparison reports. As you can see from the Matching Interest Rate report on Page 4, it requires growth of 11.51% for the equity account (including the assumed 2.00% dividend) to match the living results of the IUL over the years illustrated. (This is 466 basis points higher than the assumed yield of 6.85% of the IUL.)

“This is an impressive analysis,” says the CPA upon reviewing the new numbers, “but as we have discussed in the past, Laura, you are eligible to participate in a Keogh plan at a very high level. Let’s have your adviser analyze the impact of contributing to a Keogh for five years coupled with the term insurance.”

Keogh/Term Plan Analysis

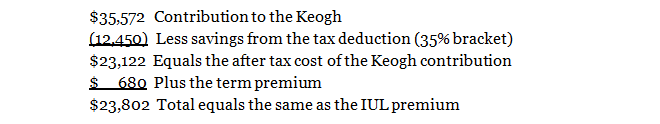

Since Laura will deduct the contribution to the Keogh but not the term premiums, the following calculation logic is assumed:

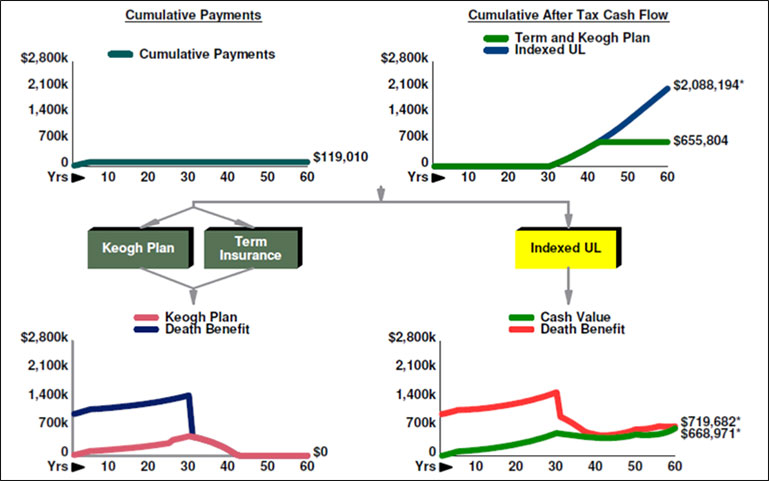

The following graphic summarizes the results of comparing the IUL to term insurance coupled with the Keogh earning a tax deferred yield of 6.85%.

| InsMark Illustration System |

| Indexed Universal Life |

| vs. |

| Term Insurance and a Keogh Plan |

| *This graphic assumes the non-guaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable; however, the ratio of the comparison should remain relatively stable given equal interest and yield assumptions. |

The Keogh collapses at Laura’s age 77 shortchanging her by $1,432,390 in after tax retirement cash flow compared to the IUL.

What caused the reduced growth of the Keogh? All withdrawals from the Keogh are taxable which means they must be grossed-up to match the after tax participating loans from the IUL. It’s simply no contest!

Click here to review the detailed comparison reports. As you can see from the Matching Interest Rate report on Page 4, it requires growth of 8.92% (207 basis points higher than the assumed yield of 6.85% of the IUL) for the Keogh to match the living results of the IUL over the years illustrated.

Note: Small withdrawals are illustrated from the Keogh in years 6 through 30 to provide Laura with the $680 for the after tax cost of the term premiums (including a factor for the 10% penalty tax through her age 59). (See the Term and Keogh Plan Detail report on Page 10 of the illustration.)

Additional Advantages of IUL vs. Keogh/Term

The IUL has four additional advantages:

- If the market turns negative, there is no market risk to the policy owner;

- There is no 10% penalty tax associated for distributions prior to age 59½;

- There are no required minimum distributions during retirement;

- There is a substantial tax free life insurance death benefit available during retirement.

| Summary of the Alternatives |

| (1) | (2) | (3) | |

| Equity Account | Keogh/Term | Indexed UL | |

| Cum. After Tax Payments | $119,010 | $119,010* | $119,010 |

| Cum. After Tax Cash Flow (Age 65 - 95) | $673,787 | $655,804 | $2,088,194 |

| Residual Cash Value at Age 95 | $0 | $0 | $668,971 |

| Overall Living Value to Laura | $673,787 | $655,804 | $2,757,165** |

| *After a 35% income tax deduction on the five Keogh contributions. |

| **309% greater than the Equity Account; 320% greater than the Keogh/Term. |

Conclusion

So -- is there ever a reason for spending almost $24,000 for something you can get for under $700? You bet there is!

Other Policy Forms

This comparison works equally well using other forms of cash value life insurance such as whole life, universal life, and variable universal life provided corresponding adjustments are made to the yield/growth of the equity and Keogh accounts that reflect levels of risk assumption corresponding to the type of policy selected.

Other Tax Deferred Retirement Plans

This type of comparison also works well with other Tax Deferred Retirement Plans such as an IRA or 401(k) -- provided only dollars in excess of those contributed by the employer are used for the life insurance.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing

To license the InsMark Illustration System, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275) or go to insmark.com. Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or (925) 543-0513.

Testimonials:

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer?, Top of the Table, International Forum, Pasadena, CA

“InsMark is the Picasso of the financial services world ? their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Power Producer?, Overland Park, KS

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Power Producer?, Grafton, WI

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.