(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System and Life Plan System.)

|

Editor’s Note: Blog #110 involves a revision of Blog #83: Chrystal Clear Alternatives, in which the presentation for Laura Lake Johnson is changed to illustrate the effect of the new regulations pertaining to Indexed Universal Life scheduled for implementation in September 2015. Analysis of the regulations indicates two main features:

Please understand that these restrictions apply only to illustrations of IUL. The performance of in-force IUL will not be restricted in a similar manner. Apparently, participating whole life insurance issued by the mutual life insurance companies has taken a serious beating from IUL, and the new regulations were promoted by them as a competitive move. The IUL carriers appear to have responded forcefully as the results shown below are remarkable. |

Laura Lake Johnson, age 35, is a successful landscape painter specializing in seascapes in watercolor and oil. She has a four-year-old daughter, Caroline.

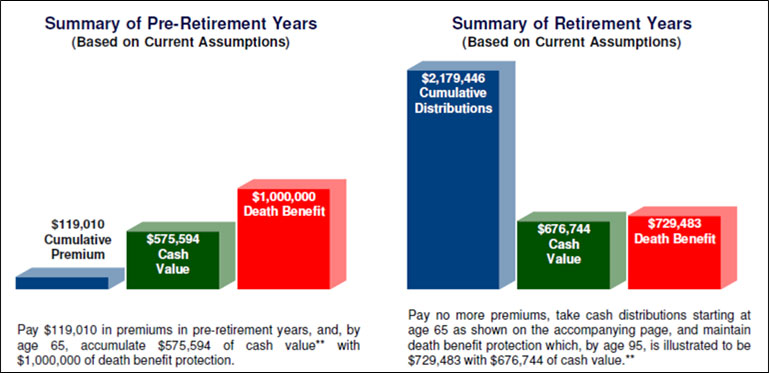

As a self-employed artist, retirement planning is solely Laura’s responsibility, and she is reviewing a ledger for a max-funded Indexed Universal Life (“IUL”) policy illustrated at 6.85%. It includes a substantial $1,000,000 death benefit to help care for Caroline should anything happen to Laura. It also illustrates $2,179,446 of total, after tax, retirement cash flow for Laura from her age 65 to age 95. Premiums are scheduled at $23,802 annually for five years.

Note: In all the examples in this Blog, Laura’s after tax retirement cash flow from the IUL policy consists of participating policy loans in which policy cash values securing loans continue to participate in the credited interest rate.

As is typically the case, her Basic Illustration from the insurance company is 20+ pages long, and although it includes very valuable information, it is an appalling presentation piece. What can you add to this tedious document that not only brightens the presentation but makes it more easily understood by Laura?

Illustration of Values is one of the most straightforward reports from the InsMark Illustration System. By including it as a forerunner to the Basic Illustration, communication to Laura can be significantly improved.

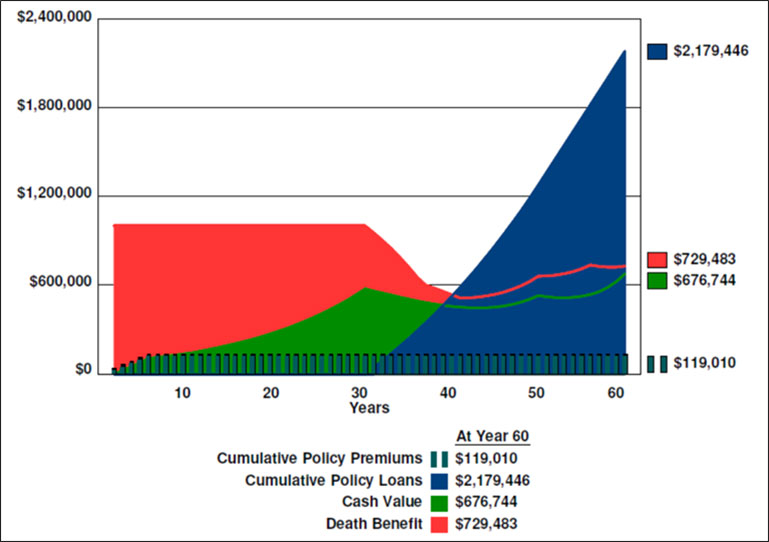

Below is the key graphic from Laura’s Illustration of Values:

Illustration of Values

Click here to review the entire illustration from Illustration of Values.

Do you want it even simpler? The most uncomplicated of all reports is Life Plan from the InsMark Illustration System.

Below is the key graphic from Laura’s Life Plan illustration:

Life Plan

Click here to review the entire illustration from Life Plan.

A Little More Complex

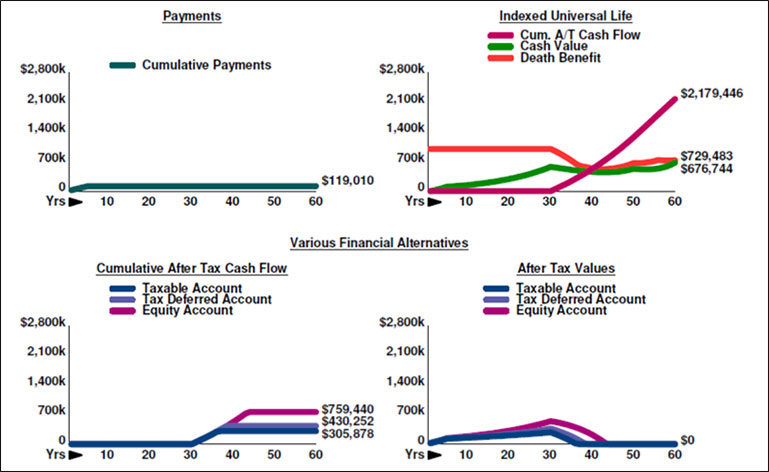

For those who prefer comparing alternative investments to the values of the life insurance, using our popular Various Financial Alternatives from the InsMark Illustration System produces a compelling, although more complex, presentation. You can choose from 21 different alternative investments or customize your own.

For Laura, we compared IUL illustrated at 6.85% with a Taxable Account and a Tax Deferred Account, both at 6.85%, and assumed a growth rate for the Equity Account of the same 6.85%. The indexes available for IUL generally don’t credit a dividend. The current S&P 500 dividend yield is 1.99% so let’s round that to a 2.00% dividend and add that to the Equity Account growth rate for a total yield of 8.85%, 200 basis points greater than the IUL.

We matched the after tax cash flow from the IUL with after cash flow from each of the alternatives. (None but the IUL lasted for the entire duration of the illustration.)

Below is the key graphic from Laura’s Various Financial Alternatives illustration:

Various Financial Alternatives

Click here to review the entire illustration from Various Financial Alternatives.

It is remarkable that the best alternative shown against the IUL is the Equity Account which terminates at Laura’s age 78 -- way too early for retirement cash flow to cease. Long-range the IUL produces almost 3 times as much after tax retirement cash flow even though the Equity Account is illustrated at 200 basis points more yield.

The Equity Account requires a yield of 11.36% (including the 2.00% dividend) to match the results of the IUL illustrated at 6.85%. See Page 4 of the Various Financial Alternatives Illustration for details.

Note: At first glance, the account values for the Tax Deferred Account in Column 3b on Pages 2 and 3 may look too low. Be sure to review Pages 10 and 11 for clarification.

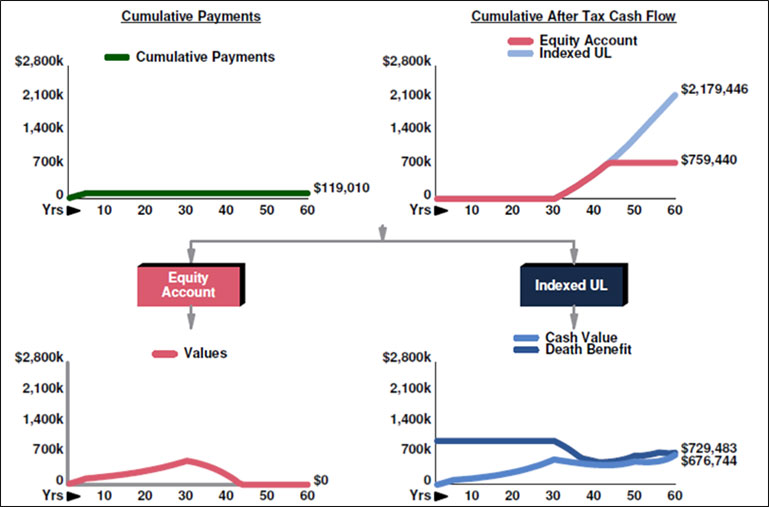

You may find the illustration from Various Financial Alternatives too busy with numbers. In this event, I recommend Other Investments vs. Your Policy from the InsMark Illustration System which compares the life policy to your selection of just one of the alternative investments. We selected the Equity Account with the same assumptions used in Various Financial Alternatives.

Below is the key graphic from Laura’s Other Investments vs. Your Policy illustration:

Equity Account vs. Indexed Universal Life

Click here to view the entire illustration from Other Investments vs. Your Policy.

Combination Illustrations

A good combination of illustrations couples Life Plan (for simplicity) with Various Financial Alternatives (for comparisons). Click here to view it.

You can print combinations of illustrations by using the icon below that appears on the lower right of the Main Workbook Window. (Be sure you have all the illustrations for the combination you want in the same workbook.)

Conclusion

While InsMark has plenty of advanced illustration capacity, our comparative Supplemental Illustration formatting is what has made us so popular to so many. I hope it proves useful to you.

I am not suggesting that you ignore Laura’s multiple-page Basic Illustration from the insurance company -- only that you disregard it as your primary presentation tool. It is complex because it serves too many masters: actuarial, legal, compliance, you -- and finally, Laura.

Please understand that the purpose of InsMark is to augment the carrier’s Basic Illustration; however, our Supplemental Illustrations are not valid without this footnote (or some carrier-approved variation of it) appearing at the bottom of our numerical data:

This illustration assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. This illustration is not valid unless accompanied by a basic illustration from the issuing life insurance company.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Testimonials:

“The reason I use InsMark products is because they are so good at explaining financial concepts to all three parties: 1) the producer trying to explain the idea; 2) the computer technician trying to illustrate it; 3) the customer trying to understand it.”

Rich Linsday, CLU, AEP, ChFC, InsMark Power Producer?, Top of the Table, International Forum, Pasadena, CA

“InsMark is the Picasso of the financial services world – their marketing savvy never fails to amaze me.”

Doug Peete, Past President, Top of the Table, InsMark Power Producer?, Overland Park, KS

“The InsMark software is indispensable to my entire planning process because it enables me to show my clients that inaction has a price tag. I can’t afford to go without it!”

David McKnight, Author of The Power of Zero, InsMark Power Producer?, Grafton, WI

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.