(Click here for Blog Archive)

(Click here for Blog Index)

(Presentations in this blog were created using the InsMark Illustration System.)

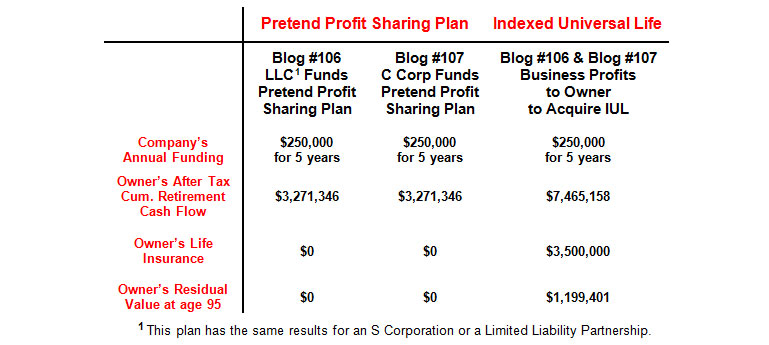

In Blog #106 and Blog #107, we discussed a deductible “pretend” Profit Sharing Plan funded by way of business profits compared to a distribution of the same amount to the business owner with the after tax proceeds used to purchase Indexed Universal Life (“IUL”). The former results in taxable retirement cash flow; the latter produces tax free retirement cash flow. If you have not read Blogs #106 and #107, please do so; otherwise the continuing analysis in this Blog will make little sense to you.

Here are the results of Blogs #106 and #107:

Unlike C Corporations, there are very few benefit arrangements that provide leverage for principals of S Corporations, Limited Liability Companies, and Limited Liability Partnerships. Due to the financial muscle of Indexed Universal Life (“IUL”), as you have seen in Blogs #106 and #107 (and the above table), IUL outperforms a hypothetical Profit Sharing Plan that discriminates totally in favor of the owner(s) of any business entity.

What might be the typical objections to the IUL solution?

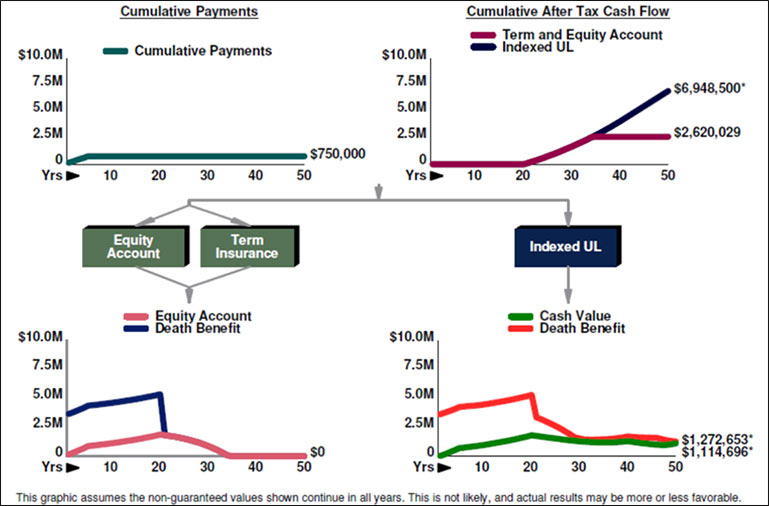

Objection #1: “The distributions required to make the comparison work don't have to be used to buy life insurance. If you want the insurance, why not use term insurance and an equity side fund?”

I researched the lowest super-preferred rate for $3,500,000 of 20-year term insurance for a male, age 45, and found $3,725 offered by Ohio National. So let’s use that in the comparison. The IUL is illustrated at 7.50%, so we’ll assume a growth rate for the equity side fund of the same 7.50%. The indexes available for IUL generally don’t credit a dividend. The current S&P 500 dividend yield is 1.99% so let’s round that to a 2.00% dividend and add that to the equity side fund for a total yield of 9.50%, 200 basis points greater than the IUL.

Since the equity side fund will provide for an increasing benefit on top of the level 20-year term insurance, I changed the death benefit option on the IUL to face amount plus cash value for the first 20 years.

Indexed Universal Life vs. Term Insurance and an Equity Side Fund

The graphic below summarizes the comparison.

Even with 200 basis points greater yield, the equity side fund collapses at age 79. It would have to earn 12.50% (including the 2.00% dividend) to equal the results of the IUL.

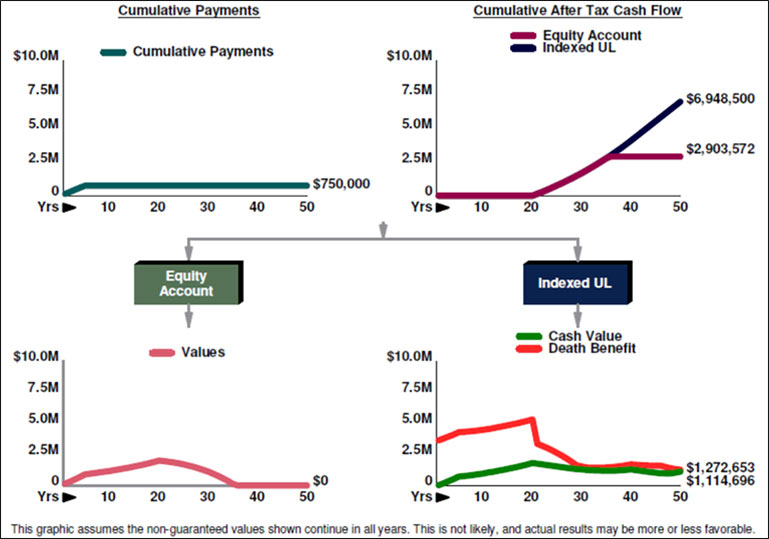

Objection #2: “Maybe you should skip the life insurance.”

OK, let’s compare the IUL to just an equity account with the same assumptions.

Click here to review both illustrations, one with term insurance; the other without. For consistency purposes, we used an increasing death benefit IUL for both.

Even with 200 basis points greater yield, the equity account collapses at age 80. It would have to earn 12.20% (including the 2.00% dividend) to equal the results of the IUL.

Note: Robert McNamara, age 45, is the insured in Blog #106; Tony Harmon, age 45, is the insured in Blog #107. The IUL illustrated for both is identical, so I used “Robert McNamara or Tony Harmon” as the insured in both illustrations.

Additional Advantages

The IUL has several additional advantages:

- Unlike either equity alternative, if the selected market index for the IUL drops, there is no loss to the policy owner;

- Against term and an equity side fund, it provides a life insurance death benefit during retirement years;

- Against just an equity account, it also provides $3,500,000 in life insurance death benefits during pre-retirement years.

InsMark’s Digital Workbook Files

If you would like some help creating customized versions of the presentations in this Blog for your clients, watch the video below on how to download and use InsMark’s Digital Workbook Files.

Digital Workbook Files For This Blog

Download all workbook files for all blogs

|

Note: If you are viewing this on a cell phone or tablet, the downloaded Workbook file won’t launch in your InsMark System. Please forward the Workbook where you can launch it on your PC where your InsMark System(s) are installed. |

Licensing InsMark Systems

To license any of the InsMark Systems, contact Julie Nayeri at julien@insmark.com or 888-InsMark (467-6275). Institutional inquiries should be directed to David Grant, Senior Vice President ? Sales, at dag@insmark.com or (925) 543-0513.

Testimonials

“I really thought I knew all the sales techniques that affect my business, but I do now, thanks to InsMark.”

Sam Keck, MBA, CLU, CFP, LUTCF, InsMark Platinum Power Producer?, Financial Planner, Denver, CO

“InsMark’s Checkmate? Selling strategy is still one of the most compelling tools to bring a client to a definitive decision, based on their best case alternatives!!! Solid mathematical comparisons that prove the validity of our insurance solution!!!”

Frank Dunaway, III, CLU, Legacy Advisory Services, Carthage, MO

“InsMark provides incredible tools to give clients a visual of how they can optimize their wealth. It’s great for deciding which road to go down.”

Jim Heafner, MBA, CFP, Heafner Financial Solutions, Inc., Charlotte, NC

Important Note #1: The hypothetical life insurance illustrations associated with this Blog assumes the nonguaranteed values shown continue in all years. This is not likely, and actual results may be more or less favorable. Actual illustrations are not valid unless accompanied by a basic illustration from the issuing life insurance company.

Important Note #2: Many of you are rightly concerned about the potential tax bomb in life insurance that can accidentally be triggered by a careless policyowner. Click here to read Blog #51: Avoiding the Tax Bomb in Life Insurance.

Important Note #3: The information in this Blog is for educational purposes only. In all cases, the approval of a client’s legal and tax advisers must be secured regarding the implementation or modification of any planning technique as well as the applicability and consequences of new cases, rulings, or legislation upon existing or impending plans.